Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Toto company invested in Far company in 1/1/2019 and paid 45,000$ in excess of underlying book value, in that time the book value of

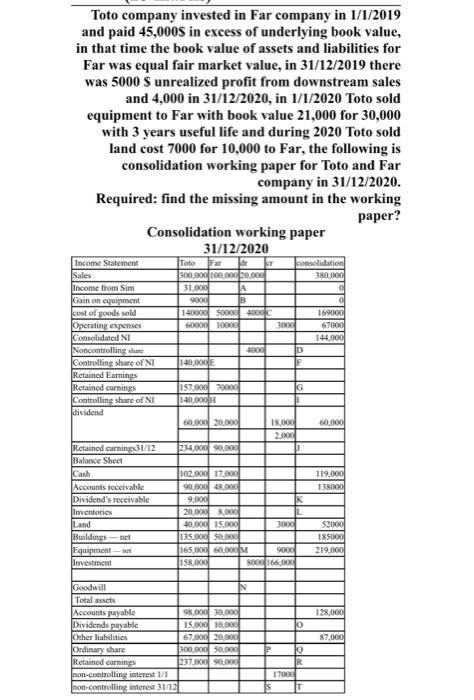

Toto company invested in Far company in 1/1/2019 and paid 45,000$ in excess of underlying book value, in that time the book value of assets and liabilities for Far was equal fair market value, in 31/12/2019 there was 5000 S unrealized profit from downstream sales and 4,000 in 31/12/2020, in 1/1/2020 Toto sold equipment to Far with book value 21,000 for 30,000 with 3 years useful life and during 2020 Toto sold land cost 7000 for 10,000 to Far, the following is consolidation working paper for Toto and Far company in 31/12/2020. Required: find the missing amount in the working paper? Income Statement Sales Income from Sim Gain on equipment cost of goods sold Operating expenses Consolidated NI Noncontrolling shuane Controlling share of NI Consolidation working paper 31/12/2020 de kr Retained Earnings Retained earnings Controlling share of NI dividend Retained earnings31/12 Balance Sheet Cash Accounts receivable Dividend's receivable Inventories Land Buildings-net Equipment-net Investment Goodwill Total assets Accounts payable Dividends payable Other liabilities Ordinary share Retained earnings non-controlling interest 1/1 non-controlling interest 31/12 Toto Far 300,000 100.000 20,000 31,000 9000 140000 50000 4000 C 60000 10000 140,000 E 157,000 70000 140,000 60,000 20,000 234,000 90,000 102,000 17,000 90,000 45.000 9,000 A B 20,000 8,000 40,000 15,000 135.000 50,000 165,000 60,000 M 158,000 300,000 50,000 237,000 90,000 4000 98,000 30,000 15,000 10,000 67,000 20,000 N 3000 18,000 2,000 P 9000 8000 166,000 3000 consolidation 380,000 D E IL G 17000 K 10 Q IR 169000 67000 144,000 60,000 119,000 138000 52000 185000 219,000 128,000 87,000

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started