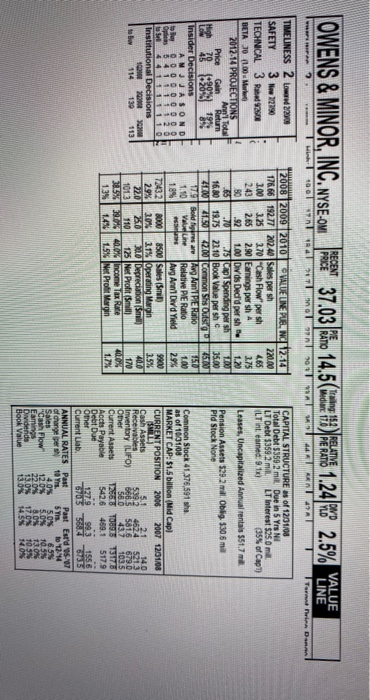

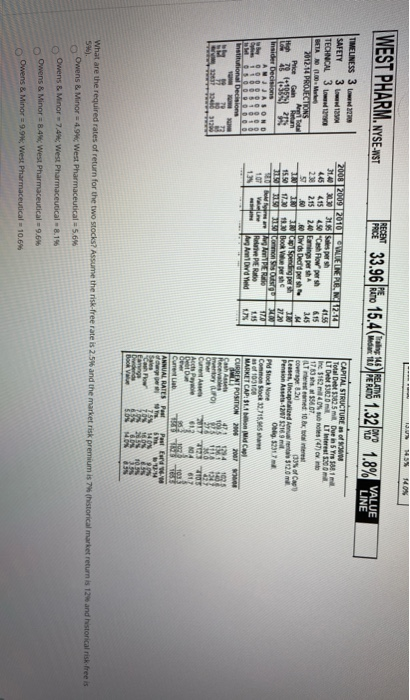

TOWENS & MINOR, INC. NYSE-OM RECENT 37.03 Rro 14.5(Modlin 1:2 PEATE 1.24 |: ) % 2.5% YAKE Twink WITH 59 RANTAU Tari DARA TIMELINESS 2 Lowww SAFETY 3 72290 TECHNICAL 3 Rated 9250 BETA 10 (0.00. Mare 2012524 PROJECTIONS Anal Total Price Gain Return High LOW 2! 1:289) 1903 Insider Decisions OND CAPITAL STRUCTURE as of 1201/08 Total Debt 53592 mill Due in 5 Yrs NI LT Debt 5359.2 mil LT Interest 5250 mill ILT int camned: 9.1x) (35% of Capt) Leases, Uncapitalized Annual rentals 551.7 mil Pension Assets $292 mil. Oblig. 5305 mil Pld Stock None 2008 2009 2010 VALUE UNE, NO 12-14 176.66 192.77 202.40 Sales persh 220.00 3.00 3.25 3.70 Cash Flow' per sh 4.68 243 2.65 2.90 Earnings per sh 3.75 80 .92 1.00 Dvds Decid per she 1.20 65 .70 75 Cap Spending persh 10 16.80 19.75 22.10 Book Value per sh 35.00 2100 21.50 2200 Common Shes Outsig 250 17.Soldiers ar Arg Ann'T PIERalio 750 Vaudine Relative PE Ratio 1.00 189 Avg Ann Did Yield 294 72432 8000 8500 Sales (Smil 2.9% 3.0% 3.1% Operating Marin 3.5% 220 20 220 Depreciation Small 4000 1013 110 125Net Profit Still 170 38%20% 400% Income Tax me 400% 1.3 14% 1.5% Ne Profil Mergin 110 9900 Institutional Decisions 10200 to be 114 130 113 oner 17% Common Stock 41.376,591 ha as of 10/31/08 MARKET CAP: $1.5 billion (Mid Cap) CURRENT POSITION 2006 2007 1201/08 SMILE Cash Assets 14.0 Receivables 539 45224 521,3 Inventory LFO) 566 5816 6790 5810 437 103.5 Current Assets 1256,8 TUBOS T3178 Accts Payable 5426 459.1 5179 Debt Due Other 155 Current Lab. ANNUAL RATES Past Past Estd 05-07 of cong 10 Yn. 6. to-14 Sales 40% 5.0 6.5% Cash Flow 12.05 1058 Eaming 22.0% 3.08 13.08 Dividends 15.0% 17.08 103 Book Value 13.0% 14.5% 14.05 50 NEON WEST PHARM. NYSE-WS CAT 33.96 kino 15.4( 19 PAR 1.32 1.8% VALUE LINE TIMEUNESS 3 SAFETY 3 TECHNICAL 3 BETANO (1.30. Make 2012:14 PROJECTIONS Price Ango Artan H 79 AN 213 138 Insider Decisions Gain 2008 2009 2010 LLEINERE, N1214 11.40 2007 Salespers 4155 445 415 Cash Flowers 815 23 2.15 240 Baringspers 57 0 145 Os Decor 14 IN IN Capoenders 78 15.50 17.30 11. Books 27.20 Courg TO TAMATPER 170 107 R PER 1.15 1 Ang weld 1% Institutional Decisions CAPITAL STRUCTURE us of Total Debt 25 mil Duelin 581 De 20 LT interest 30 Inc 162 millon 17 83 9107 ILT med 10 Best coverage: 82 3 of La Uncadrer 2.0 Pension Ansei-12070 Obi: 5237 PM Stock None Common Stock 1.715. of 1031.00 MARKET CAP: 1.1 MMC CURRENT POSITION 2006 2007 W M | Cam Rece wory FOI Oh Current Acts Pub Det O Current ANNUAL RATES Post Pul on ST ZON ON Co ZON Fang 10 SSION e de What are the required rates of return for the two stocks? Assume the risk-free rate is 2.5% and the market risk premium is 7% (historical market return is 12% and historical risk-free is Owens & Minor = 4.9 West Pharmaceutical = 5.6% Owens & Minor 7.44 West Pharmaceutical - 8.1% Owens & Minor = 8.4% West Pharmaceutical-9.66 Owens & Minor = 9.94; West Pharmaceutical 10.6%