Answered step by step

Verified Expert Solution

Question

1 Approved Answer

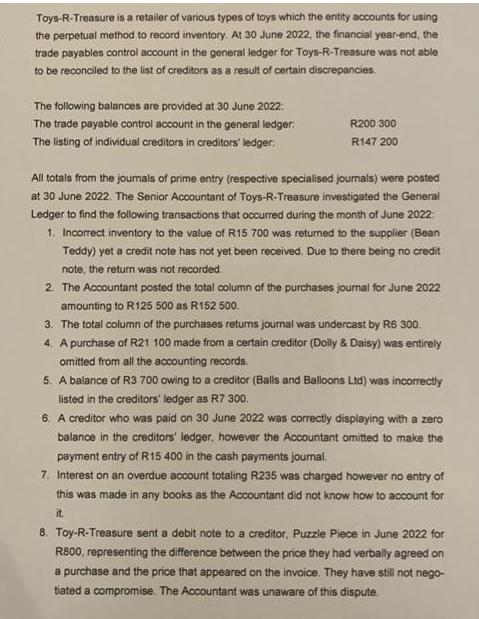

Toys-R-Treasure is a retailer of various types of toys which the entity accounts for using the perpetual method to record inventory. At 30 June

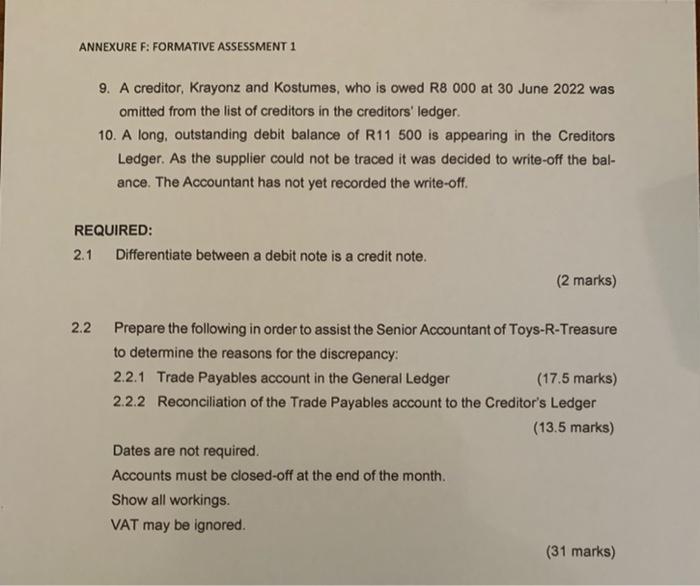

Toys-R-Treasure is a retailer of various types of toys which the entity accounts for using the perpetual method to record inventory. At 30 June 2022, the financial year-end, the trade payables control account in the general ledger for Toys-R-Treasure was not able to be reconciled to the list of creditors as a result of certain discrepancies The following balances are provided at 30 June 2022: The trade payable control account in the general ledger The listing of individual creditors in creditors' ledger: R200 300 R147 200 All totals from the journals of prime entry (respective specialised journals) were posted at 30 June 2022. The Senior Accountant of Toys-R-Treasure investigated the General Ledger to find the following transactions that occurred during the month of June 2022: 1. Incorrect inventory to the value of R15 700 was returned to the supplier (Bean Teddy) yet a credit note has not yet been received. Due to there being no credit note, the return was not recorded. 2. The Accountant posted the total column of the purchases journal for June 2022 amounting to R125 500 as R152 500. 3. The total column of the purchases retums journal was undercast by R6 300. 4. A purchase of R21 100 made from a certain creditor (Dolly & Daisy) was entirely omitted from all the accounting records. 5. A balance of R3 700 owing to a creditor (Balls and Balloons Ltd) was incorrectly listed in the creditors' ledger as R7 300. 6. A creditor who was paid on 30 June 2022 was correctly displaying with a zero balance in the creditors' ledger, however the Accountant omitted to make the payment entry of R15 400 in the cash payments journal. 7. Interest on an overdue account totaling R235 was charged however no entry of this was made in any books as the Accountant did not know how to account for it. 8. Toy-R-Treasure sent a debit note to a creditor, Puzzle Piece in June 2022 for R800, representing the difference between the price they had verbally agreed on a purchase and the price that appeared on the invoice. They have still not nego- tiated a compromise. The Accountant was unaware of this dispute, ANNEXURE F: FORMATIVE ASSESSMENT 1 9. A creditor, Krayonz and Kostumes, who is owed R8 000 at 30 June 2022 was omitted from the list of creditors in the creditors' ledger. 10. A long, outstanding debit balance of R11 500 is appearing in the Creditors Ledger. As the supplier could not be traced it was decided to write-off the bal- ance. The Accountant has not yet recorded the write-off. REQUIRED: 2.1 Differentiate between a debit note is a credit note. (2 marks) 2.2 Prepare the following in order to assist the Senior Accountant of Toys-R-Treasure to determine the reasons for the discrepancy: 2.2.1 Trade Payables account in the General Ledger (17.5 marks) 2.2.2 Reconciliation of the Trade Payables account to the Creditor's Ledger (13.5 marks) Dates are not required. Accounts must be closed-off at the end of the month. Show all workings. VAT may be ignored. (31 marks)

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Lets address the requirements step by step 21 Differentiate between a debit note and a credit note Debit Note A debit note is a document issued by a buyer to a seller indicating the buyers intention t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started