Answered step by step

Verified Expert Solution

Question

1 Approved Answer

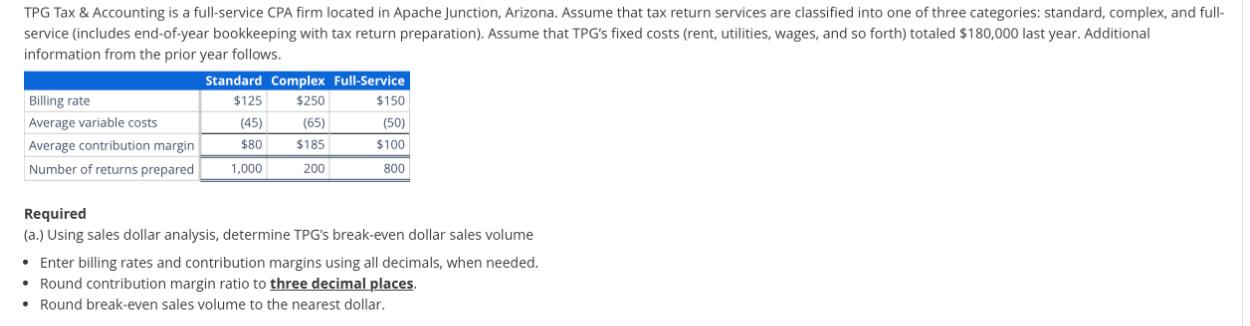

TPG Tax & Accounting is a full-service CPA firm located in Apache Junction, Arizona. Assume that tax return services are classified into one of

TPG Tax & Accounting is a full-service CPA firm located in Apache Junction, Arizona. Assume that tax return services are classified into one of three categories: standard, complex, and full- service (includes end-of-year bookkeeping with tax return preparation). Assume that TPG's fixed costs (rent, utilities, wages, and so forth) totaled $180,000 last year. Additional information from the prior year follows. Standard Complex Full-Service Billing rate $125 $250 $150 Average variable costs (45) (65) (50) Average contribution margin $80 $185 $100 Number of returns prepared 1,000 200 800 Required (a.) Using sales dollar analysis, determine TPG's break-even dollar sales volume Enter billing rates and contribution margins using all decimals, when needed. Round contribution margin ratio to three decimal places. Round break-even sales volume to the nearest dollar.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started