Question

TPI Inc., a manufacturer of computer storage devices, is planning to go public at the end of 2007. Future growth will be financed by TPI's

TPI Inc., a manufacturer of computer storage devices, is planning to go public at the end of 2007. Future growth will be financed by TPI's internally generated CF and the additional borrowing made possible by the expected increase in the company debt capacity. The company has put together the following projections:

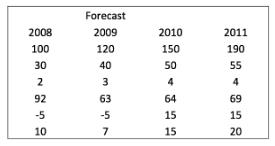

Consider the following 4-year projections for TPI.:

TPI's corporate tax rate is 38%. Its cost of equity is estimated accounting for risk and its relatively small size (its beta is 2.0, Treasury bond yield is 4.5%, equity premium is 4.4%, and micro-cap size premium is 3.9%.) TPI has issued 10 million shares to its present owners and plans to issue 5 million new shares in the IPO, bringing the total number of shares outstanding to 15 million

TPI starts with $200 million net debt at year-end 2007, increase debt to $300 million at year-end 2008, $400 million at year-end 2009, $500 million at year-end 2010, and finally attains a 40% debt ratio at year-end 2011 ($550 million). The cost of debt is 8%.

After 2011, EBIT are expected to grow at 5%

a. Estimate the APV of TPI Inc as of year-end 2007.

b. Estimate the value of TPI's share of common equity.

c. Compute the forward P/E multiple implied by your valuation at the beginning of 2008

2008 100 30 2 92 -5 10 Forecast 2009 120 40 3357 63 -5 2010 150 50 64 15 15 2011 190 55 4 69 15 20

Step by Step Solution

3.40 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

a To estimate the APV of TPI Inc as of yearend 2007 we need to calculate the value of the companys equity and debt separately and then add them togeth...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started