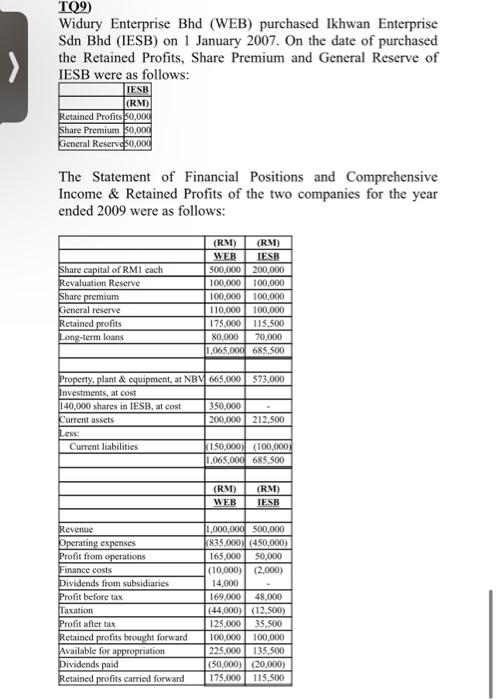

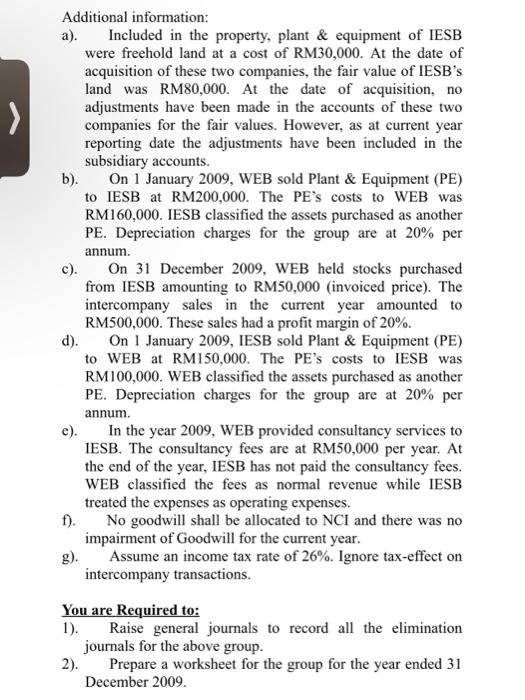

TQ9) Widury Enterprise Bhd (WEB) purchased Ikhwan Enterprise Sdn Bhd (IESB) on 1 January 2007. On the date of purchased the Retained Profits, Share Premium and General Reserve of IESB were as follows: The Statement of Financial Positions and Comprehensive Income \& Retained Profits of the two companies for the year ended 2009 were as follows: Additional information: a). Included in the property, plant \& equipment of IESB were freehold land at a cost of RM30,000. At the date of acquisition of these two companies, the fair value of IESB's land was RM80,000. At the date of acquisition, no adjustments have been made in the accounts of these two companies for the fair values. However, as at current year reporting date the adjustments have been included in the subsidiary accounts. b). On 1 January 2009, WEB sold Plant \& Equipment (PE) to IESB at RM200,000. The PE's costs to WEB was RM160,000. IESB classified the assets purchased as another PE. Depreciation charges for the group are at 20% per annum. c). On 31 December 2009, WEB held stocks purchased from IESB amounting to RM50,000 (invoiced price). The intercompany sales in the current year amounted to RM500,000. These sales had a profit margin of 20%. d). On 1 January 2009, IESB sold Plant \& Equipment (PE) to WEB at RM150,000. The PE's costs to IESB was RM 100,000 . WEB classified the assets purchased as another PE. Depreciation charges for the group are at 20% per annum. e). In the year 2009, WEB provided consultancy services to IESB. The consultancy fees are at RM50,000 per year. At the end of the year, IESB has not paid the consultancy fees. WEB classified the fees as normal revenue while IESB treated the expenses as operating expenses. f). No goodwill shall be allocated to NCI and there was no impairment of Goodwill for the current year. g). Assume an income tax rate of 26%. Ignore tax-effect on intercompany transactions. You are Required to: 1). Raise general journals to record all the elimination journals for the above group. 2). Prepare a worksheet for the group for the year ended 31 December 2009. TQ9) Widury Enterprise Bhd (WEB) purchased Ikhwan Enterprise Sdn Bhd (IESB) on 1 January 2007. On the date of purchased the Retained Profits, Share Premium and General Reserve of IESB were as follows: The Statement of Financial Positions and Comprehensive Income \& Retained Profits of the two companies for the year ended 2009 were as follows: Additional information: a). Included in the property, plant \& equipment of IESB were freehold land at a cost of RM30,000. At the date of acquisition of these two companies, the fair value of IESB's land was RM80,000. At the date of acquisition, no adjustments have been made in the accounts of these two companies for the fair values. However, as at current year reporting date the adjustments have been included in the subsidiary accounts. b). On 1 January 2009, WEB sold Plant \& Equipment (PE) to IESB at RM200,000. The PE's costs to WEB was RM160,000. IESB classified the assets purchased as another PE. Depreciation charges for the group are at 20% per annum. c). On 31 December 2009, WEB held stocks purchased from IESB amounting to RM50,000 (invoiced price). The intercompany sales in the current year amounted to RM500,000. These sales had a profit margin of 20%. d). On 1 January 2009, IESB sold Plant \& Equipment (PE) to WEB at RM150,000. The PE's costs to IESB was RM 100,000 . WEB classified the assets purchased as another PE. Depreciation charges for the group are at 20% per annum. e). In the year 2009, WEB provided consultancy services to IESB. The consultancy fees are at RM50,000 per year. At the end of the year, IESB has not paid the consultancy fees. WEB classified the fees as normal revenue while IESB treated the expenses as operating expenses. f). No goodwill shall be allocated to NCI and there was no impairment of Goodwill for the current year. g). Assume an income tax rate of 26%. Ignore tax-effect on intercompany transactions. You are Required to: 1). Raise general journals to record all the elimination journals for the above group. 2). Prepare a worksheet for the group for the year ended 31 December 2009