Answered step by step

Verified Expert Solution

Question

1 Approved Answer

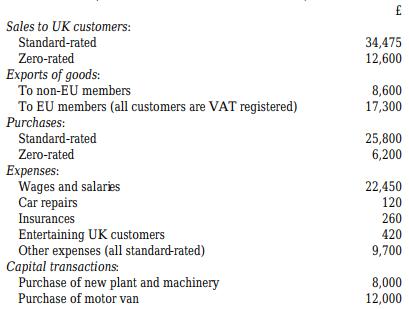

Tracey is a sole trader. She has the following transactions during the quarter to 31 December 2017 (all amounts shown are VAT-exclusive): Tracey drives a

Tracey is a sole trader. She has the following transactions during the quarter to 31 December 2017 (all amounts shown are VAT-exclusive):

Tracey drives a car with an emission rating of 16 4 g/km and reclaims input tax on all of the fuel used by this car, whether for business or private motoring . She does not keep detailed mileage records. Calculate the amount of VAT due for the quarter.

Sales to UK customers: Standard-rated 34,475 12,600 Zero-rated Exports of goods: To non-EU members To EU members (all customers are VAT registered) Purchases: 8,600 17,300 Standard-rated Zero-rated 25,800 6,200 Expenses: Wages and salaries Car repairs Insurances Entertaining UK customers Other expenses (all standard-rated) Capital transactions: Purchase of new plant and machinery Purchase of motor van 22,450 120 260 420 9,700 8,000 12,000

Step by Step Solution

★★★★★

3.52 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Computation of VAT due for the quarter Particulars Basic Amount VAT Total S...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started