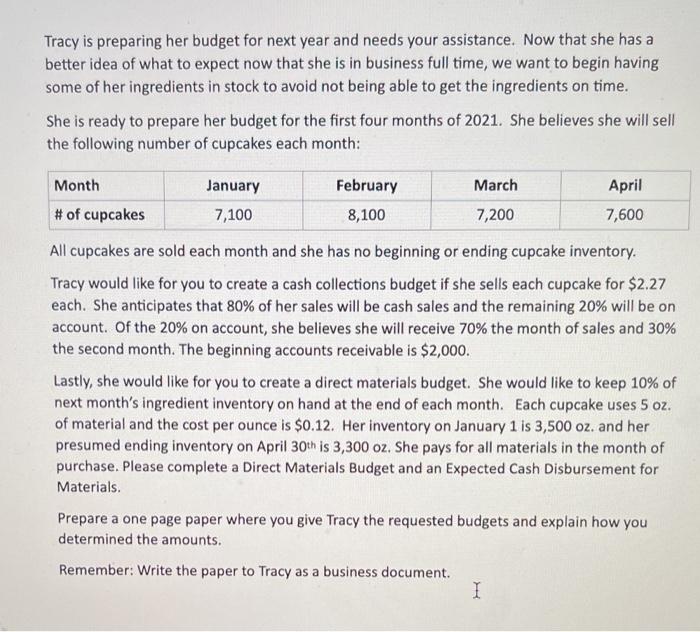

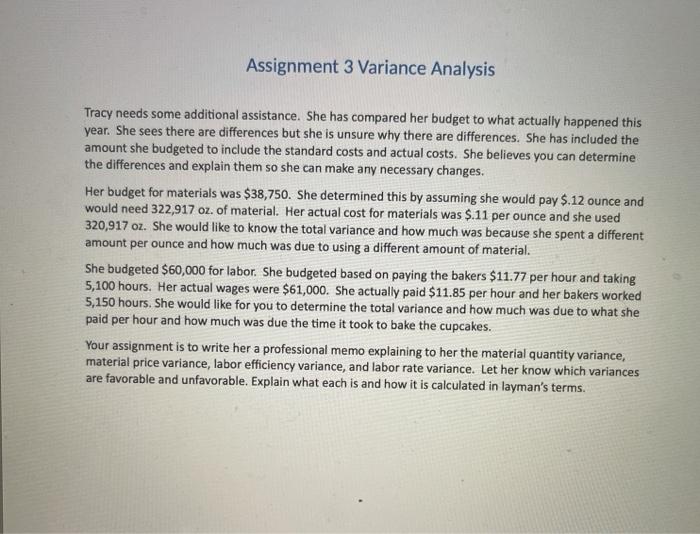

Tracy is preparing her budget for next year and needs your assistance. Now that she has a better idea of what to expect now that she is in business full time, we want to begin having some of her ingredients in stock to avoid not being able to get the ingredients on time. She is ready to prepare her budget for the first four months of 2021. She believes she will sell the following number of cupcakes each month: Month March January 7,100 February 8,100 April 7,600 # of cupcakes 7,200 All cupcakes are sold each month and she has no beginning or ending cupcake inventory. Tracy would like for you to create a cash collections budget if she sells each cupcake for $2.27 each. She anticipates that 80% of her sales will be cash sales and the remaining 20% will be on account. Of the 20% on account, she believes she will receive 70% the month of sales and 30% the second month. The beginning accounts receivable is $2,000. Lastly, she would like for you to create a direct materials budget. She would like to keep 10% of next month's ingredient inventory on hand at the end of each month. Each cupcake uses 5 oz. of material and the cost per ounce is $0.12. Her inventory on January 1 is 3,500 oz. and her presumed ending inventory on April 30th is 3,300 oz. She pays for all materials in the month of purchase. Please complete a Direct Materials Budget and an Expected Cash Disbursement for Materials. Prepare a one page paper where you give Tracy the requested budgets and explain how you determined the amounts. Remember: Write the paper to Tracy as a business document. I Assignment 3 Variance Analysis Tracy needs some additional assistance. She has compared her budget to what actually happened this year. She sees there are differences but she is unsure why there are differences. She has included the amount she budgeted to include the standard costs and actual costs. She believes you can determine the differences and explain them so she can make any necessary changes. Her budget for materials was $38,750. She determined this by assuming she would pay $.12 ounce and would need 322,917 oz. of material. Her actual cost for materials was $.11 per ounce and she used 320,917 oz. She would like to know the total variance and how much was because she spent a different amount per ounce and how much was due to using a different amount of material. She budgeted $60,000 for labor. She budgeted based on paying the bakers $11.77 per hour and taking 5,100 hours. Her actual wages were $61,000. She actually paid $11.85 per hour and her bakers worked 5,150 hours. She would like for you to determine the total variance and how much was due to what she paid per hour and how much was due the time it took to bake the cupcakes. Your assignment is to write her a professional memo explaining to her the material quantity variance, material price variance, labor efficiency variance, and labor rate variance. Let her know which variances are favorable and unfavorable. Explain what each is and how it is calculated in layman's terms