Question

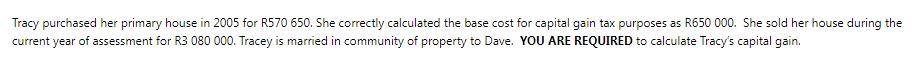

Tracy purchased her primary house in 2005 for R570 650. She correctly calculated the base cost for capital gain tax purposes as R650 000.

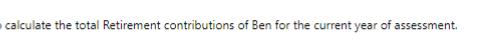

Tracy purchased her primary house in 2005 for R570 650. She correctly calculated the base cost for capital gain tax purposes as R650 000. She sold her house during the current year of assessment for R3 080 000. Tracey is married in community of property to Dave. YOU ARE REQUIRED to calculate Tracy's capital gain. calculate the total Retirement contributions of Ben for the current year of assessment. Ben Glead is 52 years old. He provided you with the following information: Provident fund contributions of R280 000 Pension fund contributions of R176 000 Previously disallowed portion carried over of R85 000 Medical aid contribution of R33 000 Retirement annuity contributions of R150 000

Step by Step Solution

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

to calculate Tracys capital gain 1 Determine the ca...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Introduction To Federal Income Taxation In Canada

Authors: Robert E. Beam, Stanley N. Laiken, James J. Barnett

33rd Edition

1554965020, 978-1554965021

Students also viewed these Law questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App