Trader Joe's Case

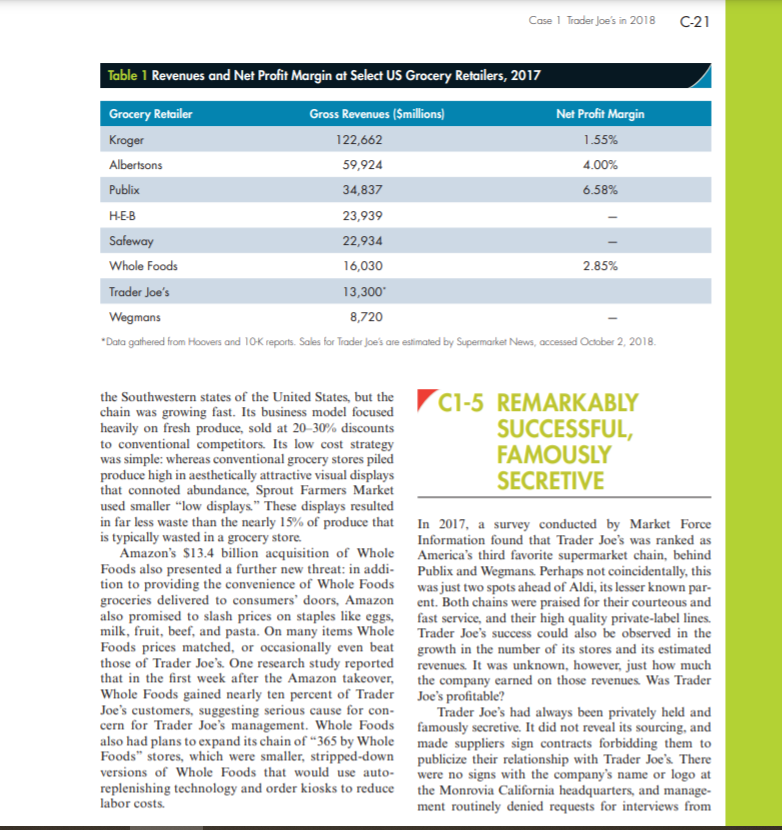

\fCase 1 Trader Joe's in 2018 C-19 Figure 1 Examples of Trader Joe's hormones. It also announced in 2007 that it would Branded Items discontinue stocking most products from China due to concerns about inadequate monitoring of food safety. The carefully curated product line turned out to have big economic advantages: Selling a narrower selection of high-volume products helped to drive down supply costs because each item was bought in higher volumes, enabling Trader Joe's to negotia ate deep discounts. At the same time, managing a narrower product line lowered inventory carrying costs, and stocking only items that turned quickly boosted sales per square foot. Trader Joe's stores sell roughly $1,750 per square foot-more than double that of Whole Foods. As a result, many Trader Joe's is very selective about the products analysts speculated that Trader Joe's was sig- it stocks. Trader Joe's biggest R&D expense is for nificantly more profitable than a typical grocery its top buyers to travel the world looking for new retailer (actual profits were unknown as Trader trend-setting items, such as the wildly successful Joe's was a privately held company and did not Trader Joe's cookie butter, which is a gooey Belgian share its income figures). spread known as "Speculoos" in its home coun- try. The company does not charge slotting fees to suppliers to get on the shelves-instead it makes them compete to demonstrate they can sell in high C1-2 LOGISTICS AND enough volumes, and at low enough prices, to keep MARKETING their spots. Trader Joe's routinely discontinues prod- ucts that fail to deliver on these dimensions, cutting the 10% worst performers to make room for new Most Trader Joe's store locations were leased, and items. Customers do not seem to mind the narrower about two-thirds operated out of existing build- selection-in fact, analysts speculated that custom- ings rather than being newly built. The stores ers actually felt better about their choices when ranged from 8,000-15,000 square feet, and were there were fewer options. Trader Joe's had cultivated typically opened in non-prime locations (though a reputation of choosing products very carefully, its Manhattan stores were notable exceptions). which in turn, inspired customer faith in the compa- From its inception, Coulombe recognized that ny's offerings. As articulated by a former employee, the stores would fare better in communities that "If they're going to get behind only one jar of Greek had adventurous and educated people, and thus olives, then they're sure as heck going to make sure he targeted college towns and other educated it's the most fabulous jar of Greek olives they can communities. find for the price." Rather than working with national or regional Trader Joe's also took a fairly strict stance on is- distributors, Trader Joe's purchased directly from the sues pertaining to the environment, humane practices, manufacturers, which then shipped their products and food safety. For example, products sold under the straight to Trader Joe's distribution centers. This pro- Trader Joe's brand name could not contain artificial cess streamlined the distribution process and reduced colors, flavors, preservatives, or genetically modi- costs, but also limited where, and how fast, Trader fied ingredients; Trader Joe's eggs could only come Joe's was able to expand. For example, it took Trader from cage-free hens; and Trader Joe's dairy products Joe's longer to enter states like Texas or Florida had to come from cows that were not given artificial (despite entreaties from customers in those locations\f\f\f