Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Traders ltd. Is a limited company who specializes in investments. They wish to invest in either one of the following 10-year projects with the

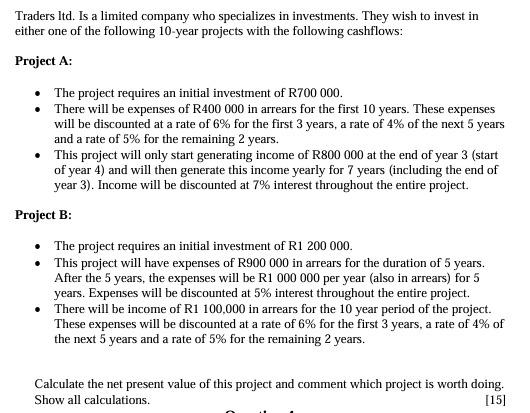

Traders ltd. Is a limited company who specializes in investments. They wish to invest in either one of the following 10-year projects with the following cashflows: Project A: The project requires an initial investment of R700 000. There will be expenses of R400 000 in arrears for the first 10 years. These expenses will be discounted at a rate of 6% for the first 3 years, a rate of 4% of the next 5 years and a rate of 5% for the remaining 2 years. This project will only start generating income of R800 000 at the end of year 3 (start of year 4) and will then generate this income yearly for 7 years (including the end of year 3). Income will be discounted at 7% interest throughout the entire project. Project B: The project requires an initial investment of R1 200 000. This project will have expenses of R900 000 in arrears for the duration of 5 years. After the 5 years, the expenses will be R1 000 000 per year (also in arrears) for 5 years. Expenses will be discounted at 5% interest throughout the entire project. There will be income of R1 100,000 in arrears for the 10 year period of the project. These expenses will be discounted at a rate of 6% for the first 3 years, a rate of 4% of the next 5 years and a rate of 5% for the remaining 2 years. Calculate the net present value of this project and comment which project is worth doing. Show all calculations. [15]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the image you sent it appears to be a depiction of a passage about different economic systems Heres a breakdown of the key concepts Economic ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started