Question

TradeWell Limited is a privately-owned corporation that manufactures and sells steel coils. The mission of TradeWell is to produce steel coils of the highest quality.

TradeWell Limited is a privately-owned corporation that manufactures and sells steel coils. The mission of TradeWell is to produce steel coils of the highest quality. TradeWell's vision is to become the leading manufacturer of steel coils across Canada. TradeWell was founded in 1995 by Michael Stevens. Michael was the main contributor to TradeWell's growth. Unfortunately, during 2023 Michael's health began to fail and he was forced to reduce his involvement. On January 5, 2024, Michael passed away at the age of 74. Michael's child inherited 100% of the shares of TradeWell and is now acting as the new CEO. Michael's child is a real estate agent and has no experience in running TradeWell. Michael's child is constantly worried about the profitability of the company and would like it to succeed.

Michael established a competent Board of Directors in 2005, which have met semi-annually since inception to advise on business operations. The Board has taken a more active role in representing TradeWell since Michael's passing.

The current Chair of the board is Anthony Carpenter who retired as the Engagement Partner of TradeWell Limited two years ago from TradeWell's public accountant SC LLP.

Today is January 25, 2024, You, CPA are employed by SC LLP as an In Charge Auditor. You have just left a meeting with your Engagement Manager who debriefed you on key topics of the file. Both yourself and the Engagement Manager have been on the TradeWell file for multiple years and have experience with the client. Please refer to Appendix I for your written notes.

Your engagement manager has requested the following:

1. Discuss the implications of changing from a review to an audit. What will you need to consider? Please use specific case facts. (2 Marks).

2. Assess the overall risk of the engagement using case facts and conclude on the overall risk level of the file. (Hint: Discuss Inherent Risks, Controls Risks, Detection Risks and Overall Risk. To reach "discuss" always state why your point increases or decreases risk). (4 Marks)

3. As the auditor, list out any control deficiencies identified within the case. In your response please state the Weakness, Implication and your Recommendation for Management. (9 Marks)

4. Calculate materiality and performance materiality. When calculating materiality include a qualitative discussion on the users as well as how you determined your base for materiality along with why you selected the percentages for materiality and performance materiality. (4 Marks)

5. What procedure should you complete over inventory to obtain evidence over existence as at December 31, 2023. (2 Marks)

Appendix I - Notes from your meeting with the Engagement Manager

TradeWell is a private company with a December 31st year-end, they never required an audit and only required a review of the financial statements. However, in the current year TradeWell's lender, Chartwell Bank, has requested an audit to be completed by February 9, 2024. TradeWell has a loan from Chartwell Bank. To remain compliant with their loan they need to maintain a debt-to-equity ratio of less than 2:1. The Engagement Manager has noted that we do not have comfort over the opening balances from an audit perspective. We need to consider how this will impact our audit fees.

Prior to Michael's illness he was very involved in the business. However, due to his declining health he hired Sebastian Bull, TradeWell's financial controller. Sebastian was hired during fiscal 2022. Even though Sebastian has been working at TradeWell for over a year he does not have a formal accounting designation. There is an accounting clerk that supports Sebastian in his role.

TradeWell has two production staff who are both authorized to issue purchase orders for materials, without approval. TradeWell uses a number of suppliers but does not have a pre-approved vendor list.

Any cheque payments made require one signature which is signed by the accounting clerk. The accounting clerk then mails the signed cheques to the suppliers and prepares the required accounting entries.

Each month the accounting clerk prepares a bank reconciliation that is available for review upon Sebastian's request, however, Sebastian does not mandate his review.

From a sales perspective, orders are submitted through a secure website. This website is integrated with TradeWell's financial system. The customers have a unique login and profile. Their profile specifies a credit limit and term of sale. All terms are populated by Sebastian who is the only individual with access. All credit terms are tracked within the system.

Since we have only completed reviews in the past we have never audited the inventory balance. It is now January 25, 2024. The Engagement Manager has asked you to write a specific procedure on how you will obtain audit evidence over the existence of inventory.

Based on your Engagement Manager's discussion with Sebastian and preliminary review of the financials there have been instances where repairs & maintenance were capitalized erroneously. Your Engagement Manager feels there may be additional errors throughout the preliminary financial statements.

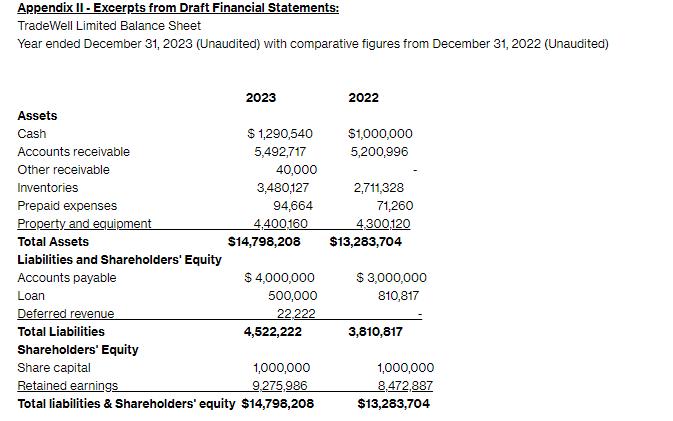

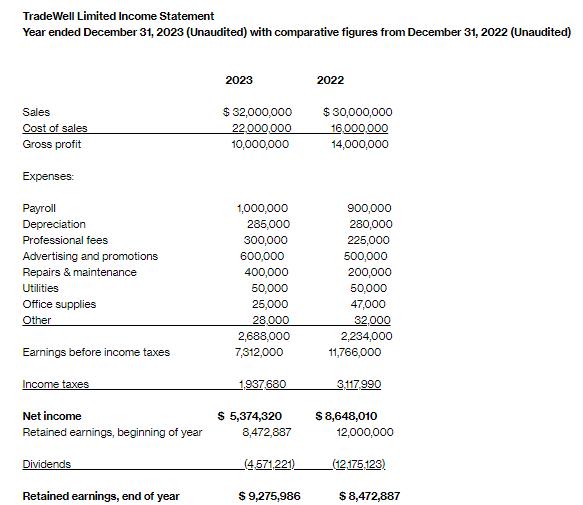

Your Engagement Manager has also provided the preliminary draft of the financial statements as at December 31, 2023 in Appendix II.

Submission Instructions

All course work submitted will require students in the course to complete and submit the academic integrity checklist. Please download the academic integrity checklist (PDF - opens in a new tab) and have one group member upload it under "Academic Integrity Checklist" tab at the top.

NOTE: Assignments will be considered incomplete if they do not include the required academic integrity checklist.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started