Trail balance is provided underneath

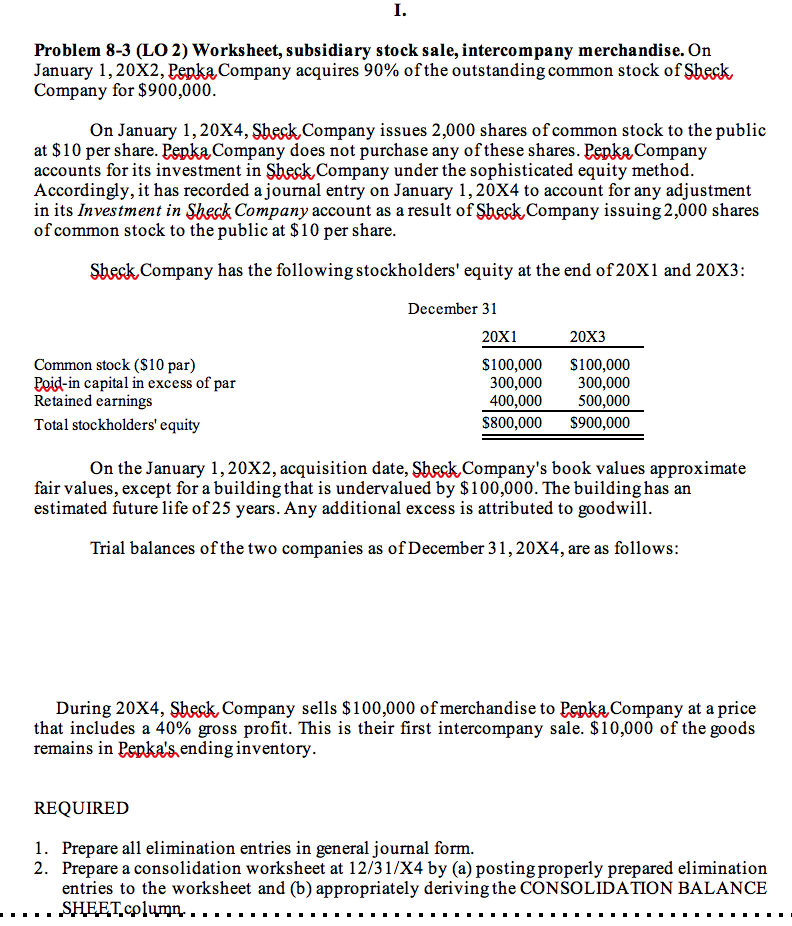

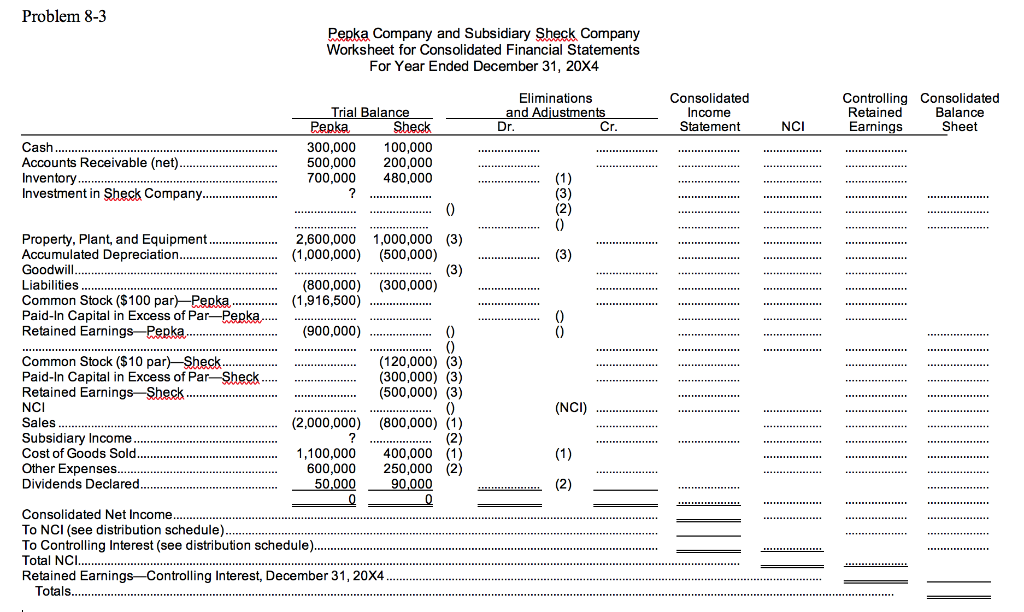

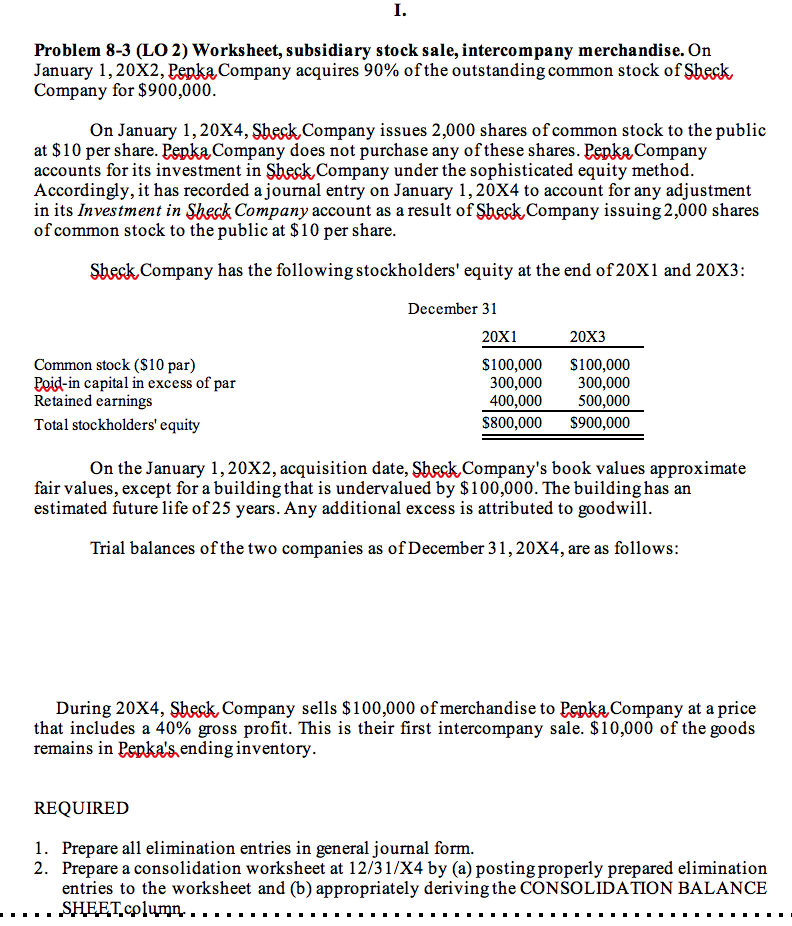

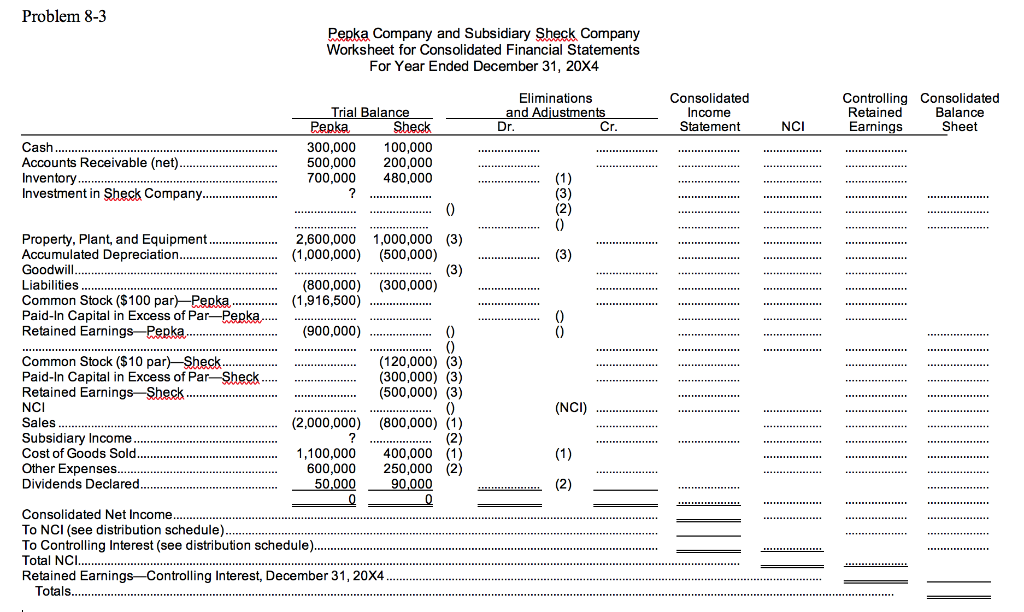

I. Problem 8-3 (LO2) Worksheet, subsidiary stock sale, intercompany merchandise. On January 1, 20X2, Pepka Company acquires 90% of the outstanding common stock of Sbeck Company for $900,000. On January 1, 20X4, Sheck Company issues 2,000 shares of common stock to the public at $10 per share. Pepka Company does not purchase any of these shares. Pepka Company accounts for its investment in Sheck Company under the sophisticated equity method. Accordingly, it has recorded a journal entry on January 1, 20X4 to account for any adjustment in its Investment in Sheck Company account as a result of Sheck Company issuing 2,000 shares of common stock to the public at $10 per share. Sheck Company has the following stockholders' equity at the end of 20X1 and 20X3: 20x3 Common stock ($10 par) Poid-in capital in excess of par Retained earnings Total stockholders' equity December 31 20X1 $100,000 300,000 400,000 $800,000 $100,000 300,000 500,000 $900,000 On the January 1, 20X2, acquisition date, Sheck Company's book values approximate fair values, except for a building that is undervalued by $100,000. The building has an estimated future life of 25 years. Any additional excess is attributed to goodwill. Trial balances of the two companies as of December 31, 20X4, are as follows: During 20X4, Sheck, Company sells $100,000 of merchandise to Pepka Company at a price that includes a 40% gross profit. This is their first intercompany sale. $10,000 of the goods remains in Pepka's, ending inventory. REQUIRED 1. Prepare all elimination entries in general journal form. 2. Prepare a consolidation worksheet at 12/31/X4 by (a) posting properly prepared elimination entries to the worksheet and (b) appropriately deriving the CONSOLIDATION BALANCE SHEET.column... Problem 8-3 Pepka Company and Subsidiary Sheck Company Worksheet for Consolidated Financial Statements For Year Ended December 31, 20X4 Eliminations and Adjustments Dr Cr Consolidated Income Statement Controlling Consolidated Retained Balance Earnings Sheet NCI Cash........ Accounts Receivable (net) Inventory................. Investment in Sheck Company Trial Balance Pepka Sheck 300,000 100,000 500,000 200,000 700,000 480,000 (1 0 ena. (3) 2,600,000 1,000,000 (3) (1,000,000) (500,000) (3) (800,000) (300,000) (1,916,500) (900,000) Property, Plant, and Equipment Accumulated Depreciation.... Goodwill. Liabilities Common Stock ($100 par) Pepka Paid-In Capital in Excess of Par-Pepka Retained Earnings Pepka Common Stock ($10 par) Sheck Paid-In Capital in Excess of Par-Sheck..... Retained Earnings Sheck NCI Sales Subsidiary Income Cost of Goods Sold. Other Expenses Dividends Declared 0 0 (120,000) (3) (300,000) (3) (500,000) (3) 0 (800,000) (1) (2) 400,000 (1) 250,000 (2) 90,000 (NCI) (2,000,000 (1) 1,100,000 600,000 50.000 (2) Consolidated Net Income. To NCI (see distribution schedule). To Controlling Interest (see distribution schedule). Total NCI. Retained Earnings-Controlling Interest, December 31, 20X4 Totals... I. Problem 8-3 (LO2) Worksheet, subsidiary stock sale, intercompany merchandise. On January 1, 20X2, Pepka Company acquires 90% of the outstanding common stock of Sbeck Company for $900,000. On January 1, 20X4, Sheck Company issues 2,000 shares of common stock to the public at $10 per share. Pepka Company does not purchase any of these shares. Pepka Company accounts for its investment in Sheck Company under the sophisticated equity method. Accordingly, it has recorded a journal entry on January 1, 20X4 to account for any adjustment in its Investment in Sheck Company account as a result of Sheck Company issuing 2,000 shares of common stock to the public at $10 per share. Sheck Company has the following stockholders' equity at the end of 20X1 and 20X3: 20x3 Common stock ($10 par) Poid-in capital in excess of par Retained earnings Total stockholders' equity December 31 20X1 $100,000 300,000 400,000 $800,000 $100,000 300,000 500,000 $900,000 On the January 1, 20X2, acquisition date, Sheck Company's book values approximate fair values, except for a building that is undervalued by $100,000. The building has an estimated future life of 25 years. Any additional excess is attributed to goodwill. Trial balances of the two companies as of December 31, 20X4, are as follows: During 20X4, Sheck, Company sells $100,000 of merchandise to Pepka Company at a price that includes a 40% gross profit. This is their first intercompany sale. $10,000 of the goods remains in Pepka's, ending inventory. REQUIRED 1. Prepare all elimination entries in general journal form. 2. Prepare a consolidation worksheet at 12/31/X4 by (a) posting properly prepared elimination entries to the worksheet and (b) appropriately deriving the CONSOLIDATION BALANCE SHEET.column... Problem 8-3 Pepka Company and Subsidiary Sheck Company Worksheet for Consolidated Financial Statements For Year Ended December 31, 20X4 Eliminations and Adjustments Dr Cr Consolidated Income Statement Controlling Consolidated Retained Balance Earnings Sheet NCI Cash........ Accounts Receivable (net) Inventory................. Investment in Sheck Company Trial Balance Pepka Sheck 300,000 100,000 500,000 200,000 700,000 480,000 (1 0 ena. (3) 2,600,000 1,000,000 (3) (1,000,000) (500,000) (3) (800,000) (300,000) (1,916,500) (900,000) Property, Plant, and Equipment Accumulated Depreciation.... Goodwill. Liabilities Common Stock ($100 par) Pepka Paid-In Capital in Excess of Par-Pepka Retained Earnings Pepka Common Stock ($10 par) Sheck Paid-In Capital in Excess of Par-Sheck..... Retained Earnings Sheck NCI Sales Subsidiary Income Cost of Goods Sold. Other Expenses Dividends Declared 0 0 (120,000) (3) (300,000) (3) (500,000) (3) 0 (800,000) (1) (2) 400,000 (1) 250,000 (2) 90,000 (NCI) (2,000,000 (1) 1,100,000 600,000 50.000 (2) Consolidated Net Income. To NCI (see distribution schedule). To Controlling Interest (see distribution schedule). Total NCI. Retained Earnings-Controlling Interest, December 31, 20X4 Totals