Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Transaction Analysis and Journal Entries Pasta House Inc. was organized in January. During the year, the transactions below occurred: a. On January 14, Pasta

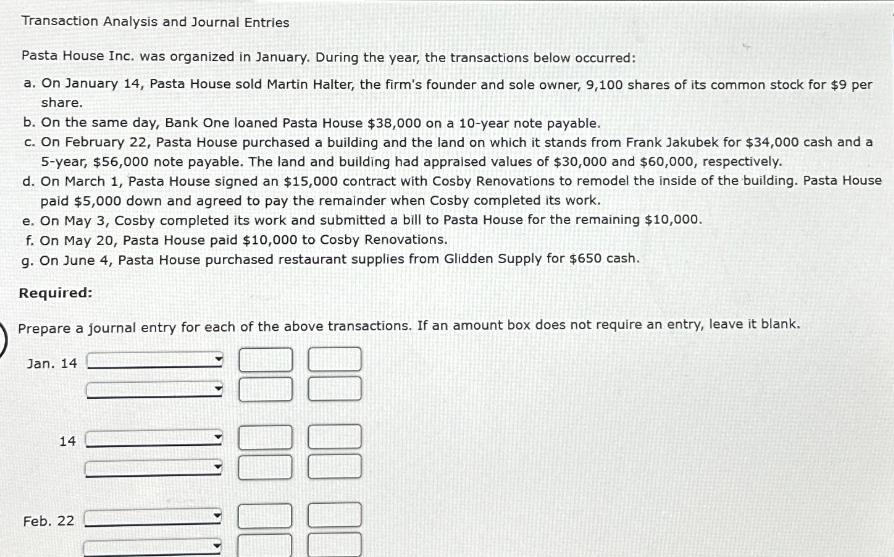

Transaction Analysis and Journal Entries Pasta House Inc. was organized in January. During the year, the transactions below occurred: a. On January 14, Pasta House sold Martin Halter, the firm's founder and sole owner, 9,100 shares of its common stock for $9 per share. b. On the same day, Bank One loaned Pasta House $38,000 on a 10-year note payable. c. On February 22, Pasta House purchased a building and the land on which it stands from Frank Jakubek for $34,000 cash and a 5-year, $56,000 note payable. The land and building had appraised values of $30,000 and $60,000, respectively. d. On March 1, Pasta House signed an $15,000 contract with Cosby Renovations to remodel the inside of the building. Pasta House paid $5,000 down and agreed to pay the remainder when Cosby completed its work. e. On May 3, Cosby completed its work and submitted a bill to Pasta House for the remaining $10,000. f. On May 20, Pasta House paid $10,000 to Cosby Renovations. g. On June 4, Pasta House purchased restaurant supplies from Glidden Supply for $650 cash. Required: Prepare a journal entry for each of the above transactions. If an amount box does not require an entry, leave it blank. Jan. 14 14 Feb. 22

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Journal Entries for Pasta House Inc Transactions a January 14 Stock Issuance Account Title Debit Cre...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started