Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Transaction Description of transaction 0 1 . June 1 : Hudson Bloom invested $ 1 1 2 , 7 2 3 . 0 0 cash

Transaction Description of transaction

June : Hudson Bloom invested $ cash and computer equipment with a fair market value of $ in his new business, Byte of Accounting.

June : Check # was used to purchased computer equipment costing $ from zachary luhmann. The invoice number was

June : Check # was used to purchased office equipment costing $ from Office Express. The invoice number was

June : Check # was used to make a down payment of $ on additional computer equipment that was purchased from Royce Computers, invoice number The full price of the computer was $ A fiveyear note was executed by Byte for the balance.

June : Additional office equipment costing $ was purchased on credit from Discount Computer Corporation. The invoice number was

June : Unsatisfactory office equipment costing $ from invoice number was returned to Discount Computer for credit to be applied against the outstanding balance owed by Byte.

June : Check # was used to make a $ payment reducing the principal owed on the June purchase of computer equipment from Royce Computers.

June : Check # was used to purchase a oneyear insurance policy covering its computer equipment for $ from Seth's Insurance. The effective date of the policy was June and the invoice number was

June : A check in the amount of $ was received for services performed for Pitman Pictures.

June : Byte purchased a building and the land it is on for $ to house its repair facilities and to store computer equipment. The lot on which the building is located is valued at $ The balance of the cost is to be allocated to the building. Check # was used to make the down payment of $ A thirty year mortgage with an inital payement due on August st was established for the balance.

June : Check # for $ was paid for rent for June and July.

June : Received invoice number in the amount of $ from the local newspaper for advertising.

June : Accounts payable in the amount of $ were paid with Check #

June : Check # was used to purchase a fax machine for the office from Office Machines Express for $ The invoice number was

June : Billed various miscellaneous local customers $ for consulting services performed.

June : Check # was used to pay salaries of $ to equipment operators for the week ending June Ignore payroll taxes.

June : Received a bill for $ from Computer Parts and Repair Co for repairs to the computer equipment. The invoice number was

June : Check # was used to pay the advertising bill that was received on June

June : Purchased office supplies for $ from Staples on account. The invoice number was

June : Cash in the amount of $ was received on billings.

June : Billed $ to miscellaneous customers for services performed to June

June : Paid the bill received on June from Computer Parts and Repairs Co with Check #

June : Cash in the amount of $ was received for billings.

June : Check # was used to pay salaries of $ to equipment operators for the week ending June Ignore payroll taxes.

June : Received a bill for the amount of $ from O & G Oil and Gas Co The invoice number was

June : Check # was used to pay for airline tickets of $ to send the kids to Grandma Ellen for the July th holiday.

Adjusting Entries Round to two decimal places.

The rent payment made on June was for June and July. Expense the amount associated with one month's rent.

A physical inventory showed that only $ worth of office supplies remained on hand as of June

The annual interest rate on the mortgage payable was percent. Interest expense for onehalf month should be computed because the building and land were purchased and the liability incurred on June

Record a journal entry to reflect that one half month's insurance has expired.

A review of Bytes job worksheets show that there are unbilled revenues in the amount of $ for the period of June

The fixed assets have estimated useful lives as follows:

Building years

Computer Equipment years

Office Equipment years

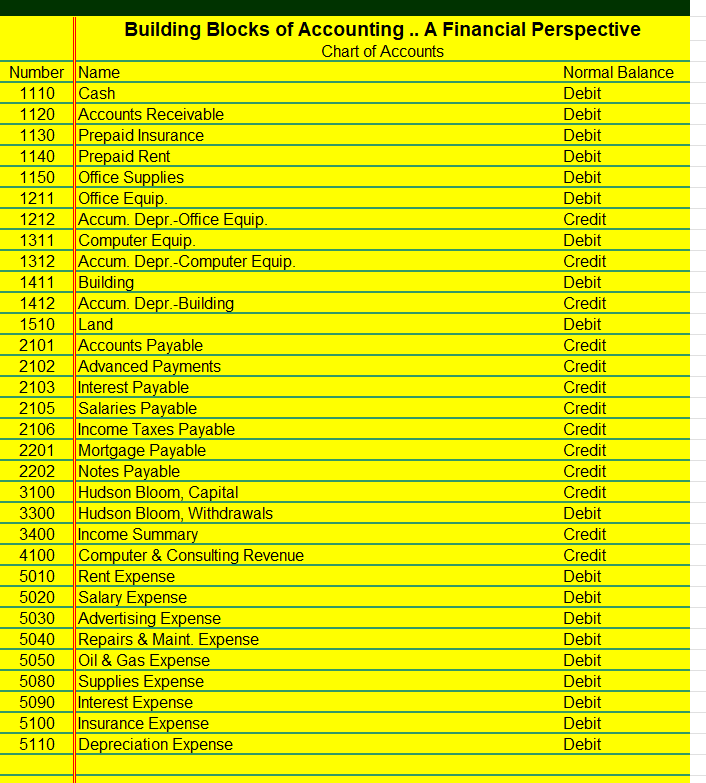

Use the straightline method of depreciation. Management has decided that assets purchased during a month are treated as if purchased on the first day of the month. The buildings scrap value is $ The office equipment has a scrap value of $Building Blocks of Accounting A Financial Perspective Chart of Acco

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started