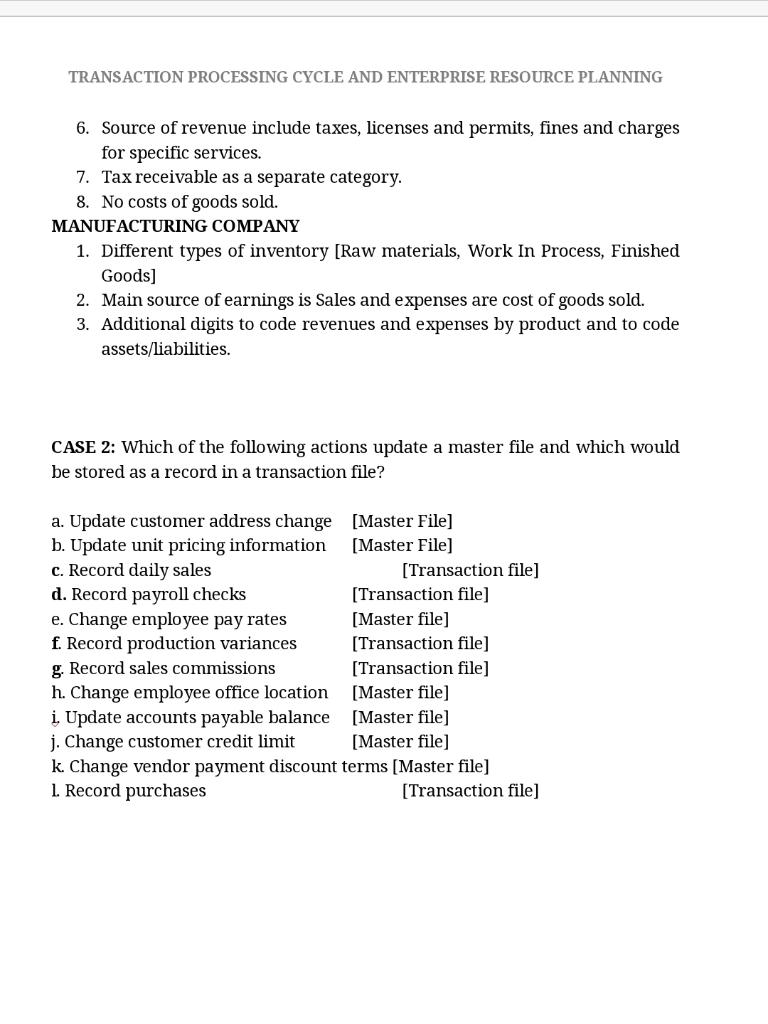

TRANSACTION PROCESSING CYCLE AND ENTERPRISE RESOURCE PLANNING CASE 1: The chart of accounts must be tailored to an organization's specific needs. Discuss how the chart of accounts for the following organizations would differ: a. University b. Bank C. Government unit d. Manufacturing company UNIVERSITY 1. No equity and summary drawing accounts. Instead have a fund balance section for each type of fund. 2. Several types of funds with a separate chart of accounts for each. The current fund is used for operating expenses but not capital expenditures. Loan funds are used to account for scholarship and loans. Endowment funds are used to account for resources obtained from specific donors. Plant funds are used for major capital expenditures. 3. Accounts Receivable is used for students who pay tuition in installment payments. 4. Tuition and fees are the main source of revenue. 5. Student loans are an asset and student deposit are a liability. BANK 1. Loans to customers would be an asset. [Current and Non-current] 2. No inventory. 3. Customer accounts would be liabilities. 4. No cost of goods sold. 5. Classification of revenue would be among loans, investments, service charges. GOVERNMENT UNITS 1. No equity or summary drawing accounts. Instead have fund balances. 2. Balance sheet shows two major categories: a. Assets b. Liabilities and fund balances. 3. Separate chart of account for each fund like General fund, Special revenue fund, capital project fund and debt service fund. 4. Revenue and expenditure accounts would be grouped by purpose (police, highways, education, health] 5. Encumbrance account. TRANSACTION PROCESSING CYCLE AND ENTERPRISE RESOURCE PLANNING 6. Source of revenue include taxes, licenses and permits, fines and charges for specific services. 7. Tax receivable as a separate category. 8. No costs of goods sold. MANUFACTURING COMPANY 1. Different types of inventory (Raw materials, Work In Process, Finished Goods] 2. Main source of earnings is Sales and expenses are cost of goods sold. 3. Additional digits to code revenues and expenses by product and to code assets/liabilities. CASE 2: Which of the following actions update a master file and which would be stored as a record in a transaction file? a. Update customer address change (Master File] b. Update unit pricing information [Master File] c. Record daily sales [Transaction file] d. Record payroll checks [Transaction file] e. Change employee pay rates [Master file] f. Record production variances [Transaction file] g. Record sales commissions [Transaction file] h. Change employee office location [Master file] i. Update accounts payable balance [Master file) j. Change customer credit limit [Master file] k. Change vendor payment discount terms (Master file) 1. Record purchases [Transaction file] TRANSACTION PROCESSING CYCLE AND ENTERPRISE RESOURCE PLANNING CASE 1: The chart of accounts must be tailored to an organization's specific needs. Discuss how the chart of accounts for the following organizations would differ: a. University b. Bank C. Government unit d. Manufacturing company UNIVERSITY 1. No equity and summary drawing accounts. Instead have a fund balance section for each type of fund. 2. Several types of funds with a separate chart of accounts for each. The current fund is used for operating expenses but not capital expenditures. Loan funds are used to account for scholarship and loans. Endowment funds are used to account for resources obtained from specific donors. Plant funds are used for major capital expenditures. 3. Accounts Receivable is used for students who pay tuition in installment payments. 4. Tuition and fees are the main source of revenue. 5. Student loans are an asset and student deposit are a liability. BANK 1. Loans to customers would be an asset. [Current and Non-current] 2. No inventory. 3. Customer accounts would be liabilities. 4. No cost of goods sold. 5. Classification of revenue would be among loans, investments, service charges. GOVERNMENT UNITS 1. No equity or summary drawing accounts. Instead have fund balances. 2. Balance sheet shows two major categories: a. Assets b. Liabilities and fund balances. 3. Separate chart of account for each fund like General fund, Special revenue fund, capital project fund and debt service fund. 4. Revenue and expenditure accounts would be grouped by purpose (police, highways, education, health] 5. Encumbrance account. TRANSACTION PROCESSING CYCLE AND ENTERPRISE RESOURCE PLANNING 6. Source of revenue include taxes, licenses and permits, fines and charges for specific services. 7. Tax receivable as a separate category. 8. No costs of goods sold. MANUFACTURING COMPANY 1. Different types of inventory (Raw materials, Work In Process, Finished Goods] 2. Main source of earnings is Sales and expenses are cost of goods sold. 3. Additional digits to code revenues and expenses by product and to code assets/liabilities. CASE 2: Which of the following actions update a master file and which would be stored as a record in a transaction file? a. Update customer address change (Master File] b. Update unit pricing information [Master File] c. Record daily sales [Transaction file] d. Record payroll checks [Transaction file] e. Change employee pay rates [Master file] f. Record production variances [Transaction file] g. Record sales commissions [Transaction file] h. Change employee office location [Master file] i. Update accounts payable balance [Master file) j. Change customer credit limit [Master file] k. Change vendor payment discount terms (Master file) 1. Record purchases [Transaction file]