Question

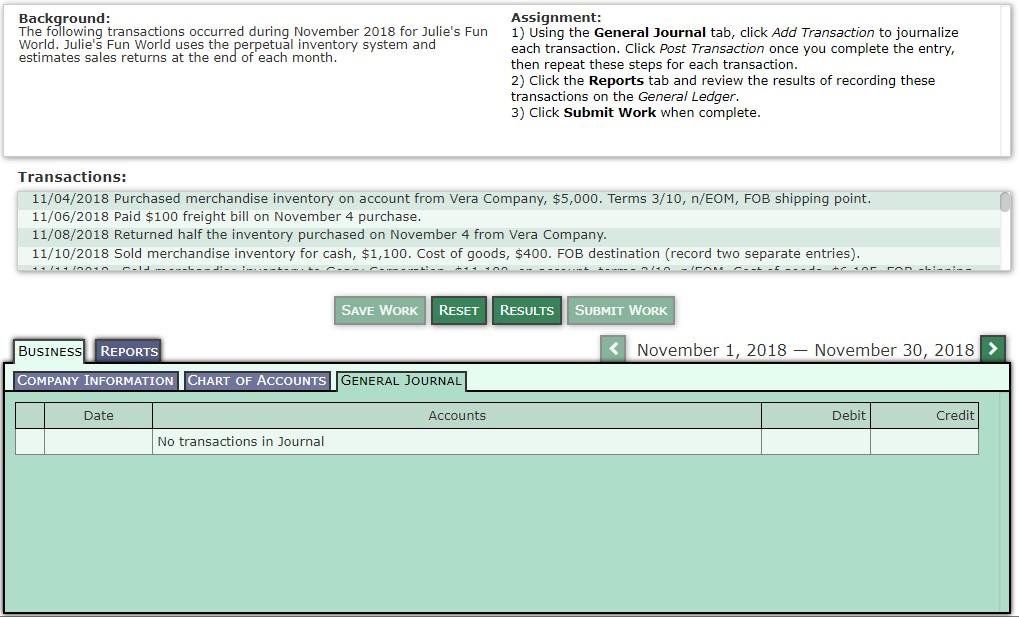

Transactions: 11/04/2018 Purchased merchandise inventory on account from Vera Company, $5,000. Terms 3/10, n/EOM, FOB shipping point. 11/06/2018 Paid $100 freight bill on November 4

Transactions:

11/04/2018

Purchased merchandise inventory on account from Vera Company, $5,000. Terms 3/10, n/EOM, FOB shipping point.

11/06/2018

Paid $100 freight bill on November 4 purchase.

11/08/2018

Returned half the inventory purchased on November 4 from Vera Company.

11/10/2018

Sold merchandise inventory for cash, $1,100. Cost of goods, $400. FOB destination (record two separate entries).

11/11/2018

Sold merchandise inventory to Geary Corporation, $11,100, on account, terms 2/10, n/EOM. Cost of goods, $6,105. FOB shipping point (record two separate entries).

11/12/2018

Paid freight bill of $20 on November 10 sale.

11/13/2018

Sold merchandise inventory to Caldwell Company, $9,500, on account, terms of n/45. Cost of goods, $5,225. FOB shipping point (record two separate entries).

11/14/2018

Paid the amount owed on account from November 4, less the return and discount.

11/17/2018

Received defective inventory as a sales return from the November 13 sale, $500. Cost of goods, $275 (record two separate entries).

11/18/2018

Purchased inventory of $3,600 on account from Rainman Corporation. Payment terms were 2/10, n/30. FOB destination.

11/20/2018

Received cash from Geary Corporation, less discount.

11/26/2018

Paid amount owed on account from November 18, less discount.

11/28/2018

Received cash from Caldwell Company, less return.

11/29/2018

Purchased inventory from Sandra Corporation for cash, $12,300, FOB shipping point.

11/29/2018

Paid freight costs to the shipping company for the purchase from Sandra Corporation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started