Answered step by step

Verified Expert Solution

Question

1 Approved Answer

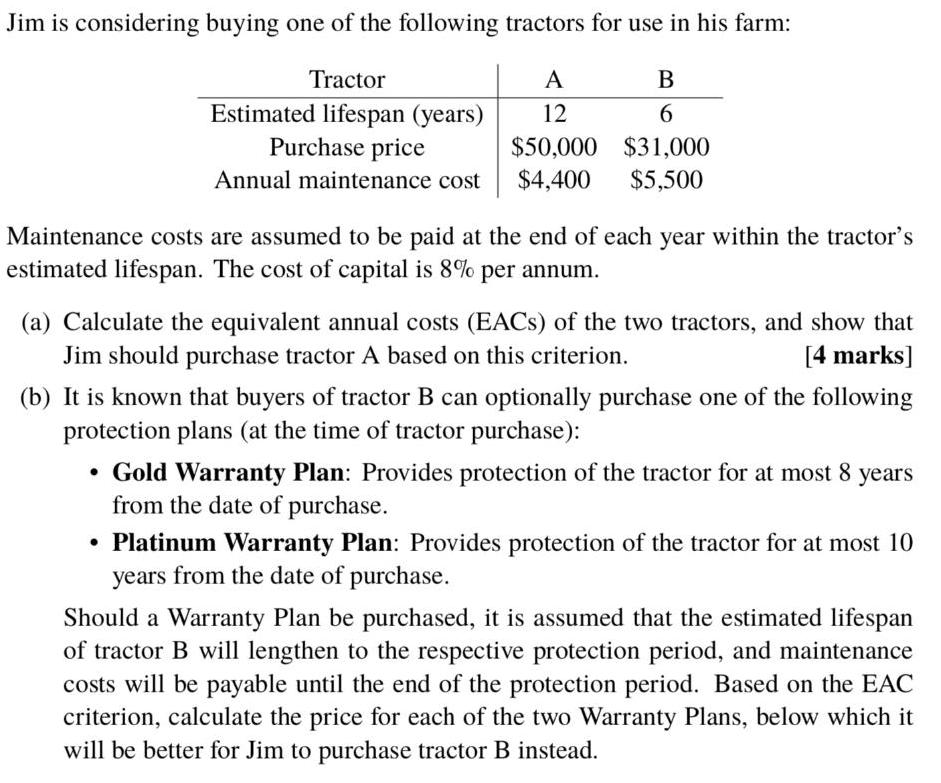

Jim is considering buying one of the following tractors for use in his farm: A B 12 6 $50,000 $31,000 $5,500 Tractor Estimated lifespan

Jim is considering buying one of the following tractors for use in his farm: A B 12 6 $50,000 $31,000 $5,500 Tractor Estimated lifespan (years) Purchase price Annual maintenance cost $4,400 Maintenance costs are assumed to be paid at the end of each year within the tractor's estimated lifespan. The cost of capital is 8% per annum. (a) Calculate the equivalent annual costs (EACs) of the two tractors, and show that Jim should purchase tractor A based on this criterion. [4 marks] (b) It is known that buyers of tractor B can optionally purchase one of the following protection plans (at the time of tractor purchase): Gold Warranty Plan: Provides protection of the tractor for at most 8 years from the date of purchase. Platinum Warranty Plan: Provides protection of the tractor for at most 10 years from the date of purchase. Should a Warranty Plan be purchased, it is assumed that the estimated lifespan of tractor B will lengthen to the respective protection period, and maintenance costs will be payable until the end of the protection period. Based on the EAC criterion, calculate the price for each of the two Warranty Plans, below which it will be better for Jim to purchase tractor B instead.

Step by Step Solution

★★★★★

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

A The equivalent annual cost E AC of a machine is the sum of all ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started