Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Transactions Opening balance Jerry Seinfeld is a director of Technical Smart Solutions Pty Ltd, an Australian resident private company, with a corporate tax rate

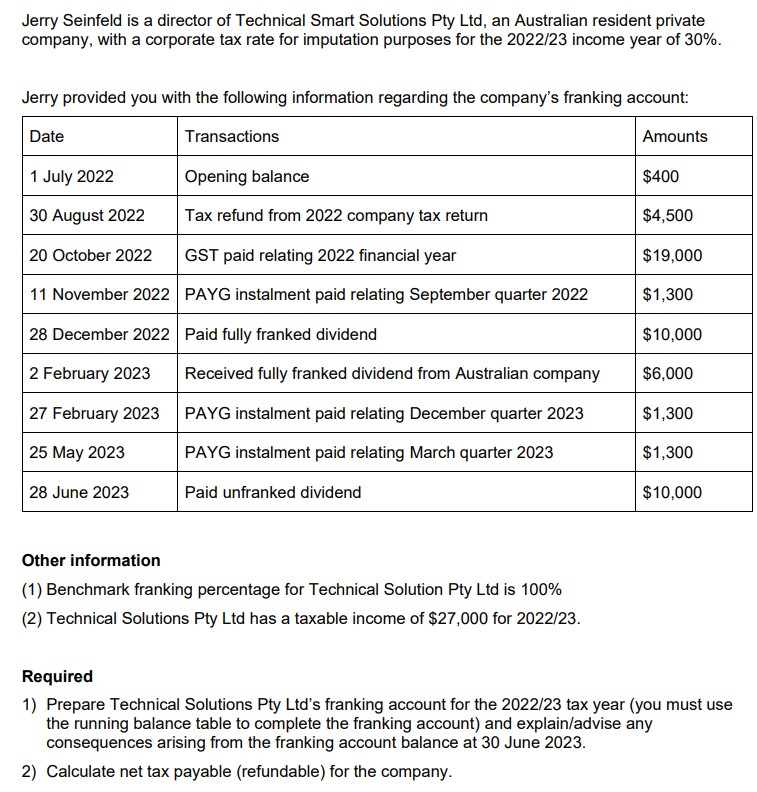

Transactions Opening balance Jerry Seinfeld is a director of Technical Smart Solutions Pty Ltd, an Australian resident private company, with a corporate tax rate for imputation purposes for the 2022/23 income year of 30%. Jerry provided you with the following information regarding the company's franking account: Date 1 July 2022 Amounts $400 30 August 2022 Tax refund from 2022 company tax return $4,500 20 October 2022 GST paid relating 2022 financial year $19,000 11 November 2022 PAYG instalment paid relating September quarter 2022 28 December 2022 Paid fully franked dividend $1,300 $10,000 2 February 2023 Received fully franked dividend from Australian company $6,000 27 February 2023 PAYG instalment paid relating December quarter 2023 $1,300 25 May 2023 PAYG instalment paid relating March quarter 2023 $1,300 28 June 2023 Paid unfranked dividend $10,000 Other information (1) Benchmark franking percentage for Technical Solution Pty Ltd is 100% (2) Technical Solutions Pty Ltd has a taxable income of $27,000 for 2022/23. Required 1) Prepare Technical Solutions Pty Ltd's franking account for the 2022/23 tax year (you must use the running balance table to complete the franking account) and explain/advise any consequences arising from the franking account balance at 30 June 2023. 2) Calculate net tax payable (refundable) for the company.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started