Answered step by step

Verified Expert Solution

Question

1 Approved Answer

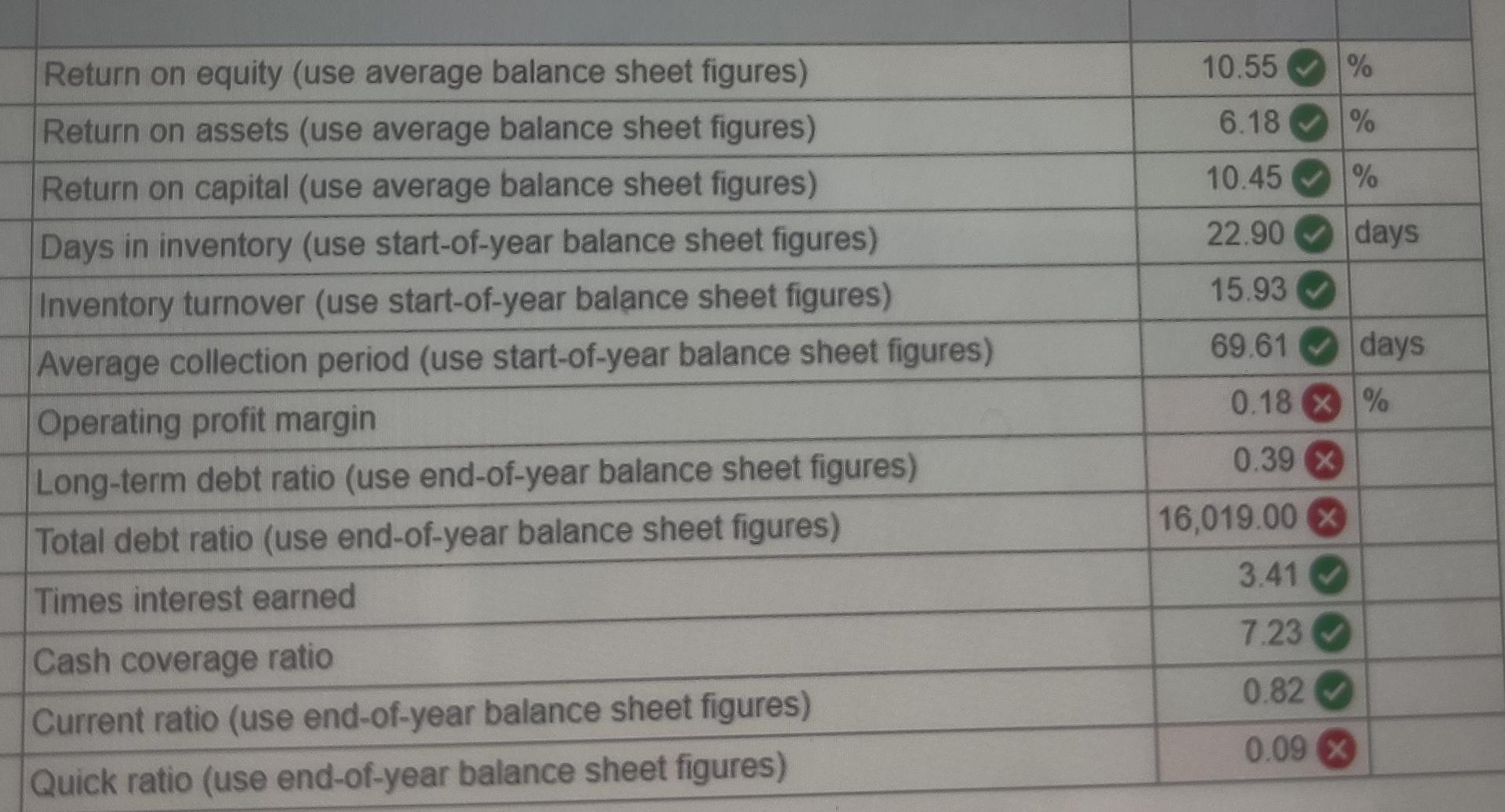

10.55 % 6.18 % 10.45 % 22.90 days 15.93 Return on equity (use average balance sheet figures) Return on assets (use average balance sheet figures)

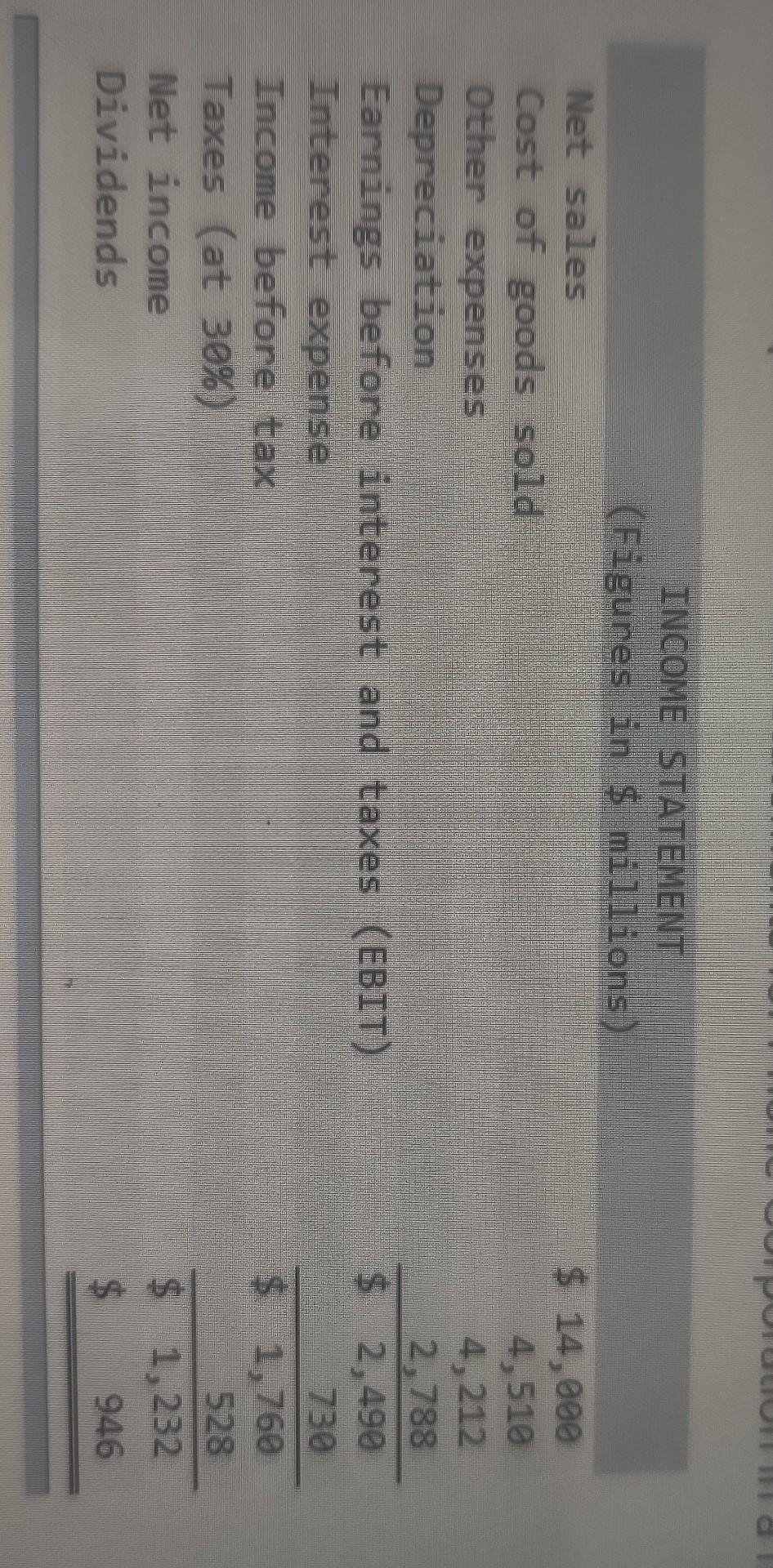

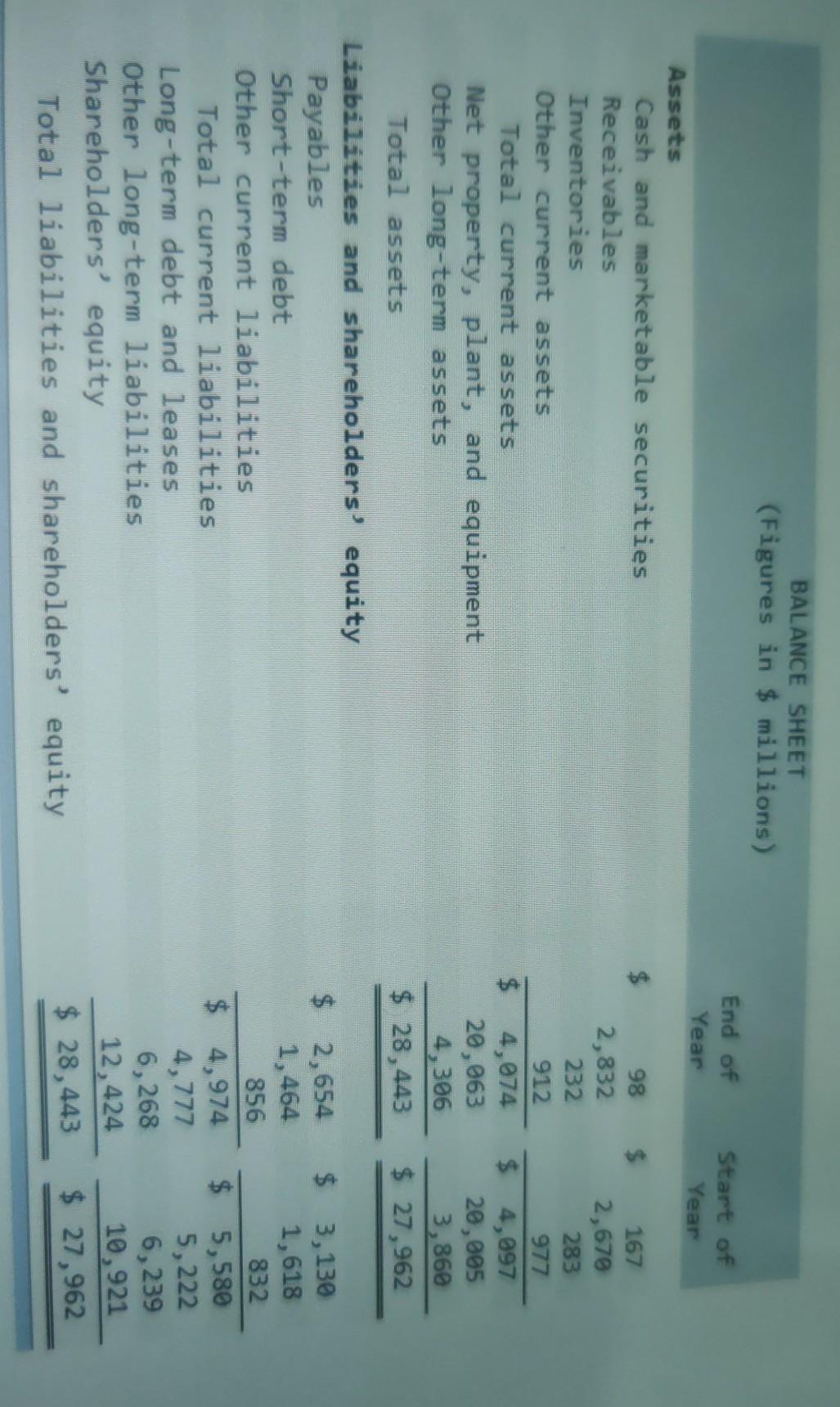

10.55 % 6.18 % 10.45 % 22.90 days 15.93 Return on equity (use average balance sheet figures) Return on assets (use average balance sheet figures) Return on capital (use average balance sheet figures) Days in inventory (use start-of-year balance sheet figures) Inventory turnover (use start-of-year balance sheet figures) Average collection period (use start-of-year balance sheet figures) Operating profit margin Long-term debt ratio (use end-of-year balance sheet figures) Total debt ratio (use end-of-year balance sheet figures) Times interest earned 69.61 days 0.18 X % 0.39 X 16,019.00 X 3.41 7.23 0.82 Cash coverage ratio Current ratio (use end-of-year balance sheet figures) Quick ratio (use end-of-year balance sheet figures) 0.09 X INCOME STATEMENT (Figures in $ millions) Net sales Cost of goods sold Other expenses Depreciation Earnings before interest and taxes (EBIT) Interest expense Income before tax Taxes (at 30%) Net income Dividends $ 14,000 4,510 4,212 2,788 $ 2,490 730 $ 1,760 528 $ 1,232 $ 946 BALANCE SHEET (Figures in $ millions) End of Year Start of Year 98 2,832 232 912 4,074 20,963 4,306 $ 28,443 167 2,670 283 977 $ 4,097 20,005 3,860 $ 27,962 Assets Cash and marketable securities Receivables Inventories Other current assets Total current assets Net property, plant, and equipment Other long-term assets Total assets Liabilities and shareholders' equity Payables Short-term debt Other current liabilities Total current liabilities Long-term debt and leases Other long-term liabilities Shareholders' equity Total liabilities and shareholders' equity $ 2,654 1,464 856 $ 4,974 4,777 6,268 12,424 $ 28,443 $ 3,130 1,618 832 $ 5,580 5,222 6,239 10,921 $ 27,962

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started