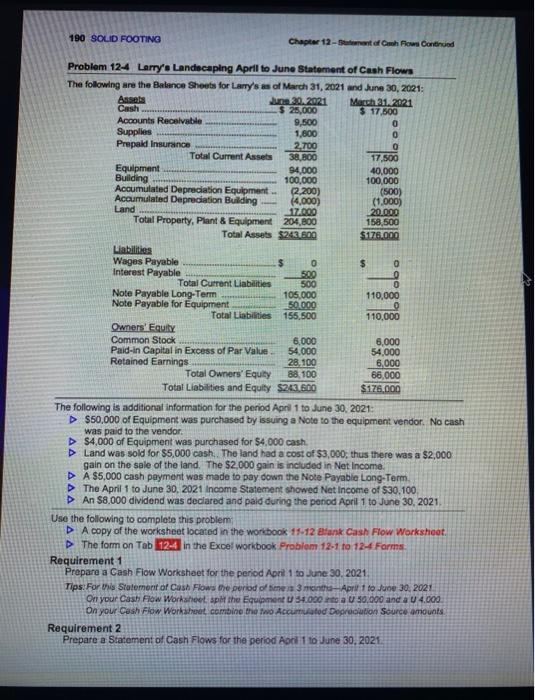

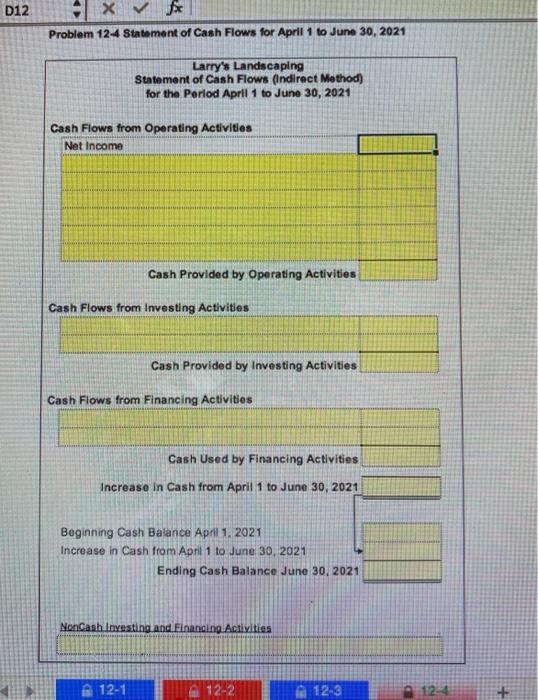

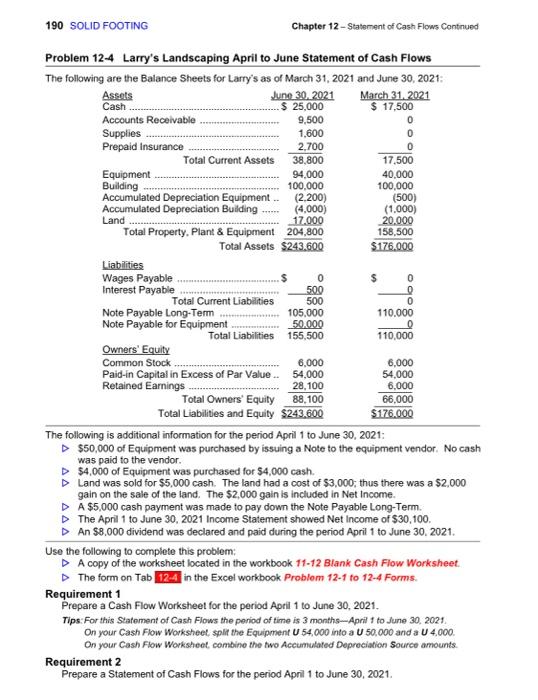

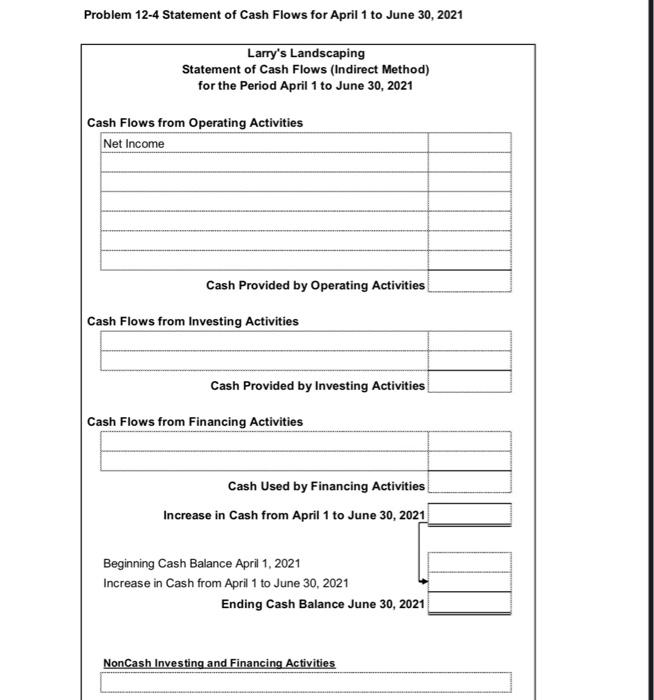

190 SOLID FOOTING Chapter 12 - Stochows Contre Problem 12-4 Larry's Landecaping April to June Statement of Cash Flows The following are the Balance Sheets for Larry's as of March 31, 2021 and June 30, 2021: Assets June 30, 2021 March 31, 2021 Cash $ 25,000 $17.500 Accounts Recalvabile 9,500 Supplies 1,600 0 Prepaid Insurance 2.700 0 Total Current Assets 38,800 17,500 Equipment 94,000 40.000 Building 100,000 100,000 Accumulated Depreciation Equipment 2.2003 (500) Acoumulated Depreciation Building (4,000) (1.000) Land 17,000 20.000 Total Property, Plant & Equipment 204,800 158,500 Total Assets $243.800 $175.000 Liabilities Wages Payable $ 0 $ 0 Interest Payable Total Current Liabilities 500 0 Note Payable Long-Term 105,000 110,000 Note Payable for Equipment 50.000 0 Total Liabilities 155,500 110,000 Owners' Equity Common Stock 6.000 6,000 Paid-in Capital in Excess of Par Value 54,000 54.000 Retained Earnings 28,100 6,000 Total Owners' Equity 88 100 66,000 Total Liabilities and Equity $243 00 $175.000 The following is additional information for the period April 1 to June 30, 2021 $50,000 of Equipment was purchased by issuing a Note to the equipment vendor. No cash was paid to the vendor $4,000 of Equipment was purchased for $4.000 cash Land was sold for $5,000 cash. The land had a cost of $3,000, thus there was a $2,000 gain on the sale of the land. The $2,000 gain is included in Net Income A $5,000 cash payment was made to pay down the Note Payable Long-Term The April 1 to June 30, 2021 Income Statement showed Net Income of $30.100 An $8.000 dividend was declared and paid during the period April 1 to June 30, 2021 Use the following to complete this problem A copy of the worksheet located in the workbook 15-12 Blank Cash Flow Worksheet. The form on Tab 12-4 in the Excel Workbook Problem 12-1 to 12-4 Forms Requirement 1 Prepare a Cash Flow Worksheet for the period April 1 to June 30, 2021 Tips: For this statement of Cash Flows the period of time na 3 mintha-April to June 30, 2021 On your Cash Flow Worksheet spot the Equipment US4000 to a U 50.000 and a U 4.000 On your Cash Flow Worksheet combine the two Accumud Dogrution Source amounts Requirement 2 Prepare a Statement of Cash Flows for the period Act 1 to June 30, 2025 D12 Problem 12-4 Statement of Cash Flows for April 1 to June 30, 2021 Larry's Landscaping Statement of Cash Flows (Indirect Method) for the Period April 1 to June 30, 2021 Cash Flows from Operating Activities Net Income Cash Provided by Operating Activities Cash Flows from Investing Activities Cash Provided by Investing Activities Cash Flows from Financing Activities Cash Used by Financing Activities Increase in Cash from April 1 to June 30, 2021 Beginning Cash Balance April 1.2021 Increase in Cash from April 1 to June 30, 2021 Ending Cash Balance June 30, 2021 NonCash Investing and Financing Activities 12-1 12-2 12-3 2-4 + 190 SOLID FOOTING Chapter 12 - Statement of Cash Flows Contnued 0 Problem 12-4 Larry's Landscaping April to June Statement of Cash Flows The following are the Balance Sheets for Larry's as of March 31, 2021 and June 30, 2021: Assets June 30.2021 March 31, 2021 Cash $ 25,000 $ 17,500 Accounts Receivable 9,500 0 Supplies 1.600 Prepaid Insurance 2.700 0 Total Current Assets 38,800 17.500 Equipment 94.000 40.000 Building 100.000 100,000 Accumulated Depreciation Equipment (2.200) (500) Accumulated Depreciation Building (4.000) (1,000) Land 17.000 20.000 Total Property, Plant & Equipment 204,800 158,500 Total Assets $243.600 $176.000 Liabilities Wages Payable Interest Payable 500 Total Current Liabilities 500 Note Payable Long-Term 105,000 110.000 Note Payable for Equipment 50.000 Total Liabilities 155,500 110,000 Owners' Equity Common Stock 6,000 6,000 Paid-in Capital in Excess of Par Value 54,000 54,000 Retained Earnings 28,100 6,000 Total Owners' Equity 88,100 66,000 Total Liabilities and Equity $243.600 $176.000 The following is additional information for the period April 1 to June 30, 2021: $50,000 of Equipment was purchased by issuing a Note to the equipment vendor. No cash was paid to the vendor. $4,000 of Equipment was purchased for $4,000 cash. Land was sold for $5,000 cash. The land had a cost of $3,000; thus there was a $2,000 gain on the sale of the land. The $2,000 gain is included in Net Income. > A $5,000 cash payment was made to pay down the Note Payable Long-Term. The April 1 to June 30, 2021 Income Statement showed Net Income of $30,100. An $8.000 dividend was declared and paid during the period April 1 to June 30, 2021. Use the following to complete this problem: A copy of the worksheet located in the workbook 11-12 Blank Cash Flow Worksheet. The form on Tab 12.4 in the Excel workbook Problem 12-1 to 12-4 Forms. Requirement 1 Prepare a Cash Flow Worksheet for the period April 1 to June 30, 2021. Tips For this Statement of Cash Flows the period of time is 3 months-April to June 30, 2021 On your Cash Flow Worksheet, split the Equipment U 54,000 into a U 50,000 and a U 4,000. On your Cash Flow Worksheet combine the two Accumulated Depreciation Source amounts Requirement 2 Prepare a Statement of Cash Flows for the period April 1 to June 30, 2021