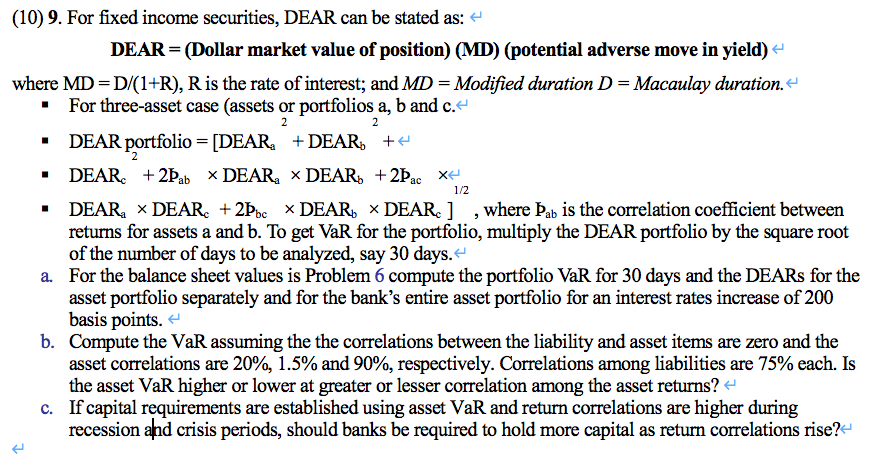

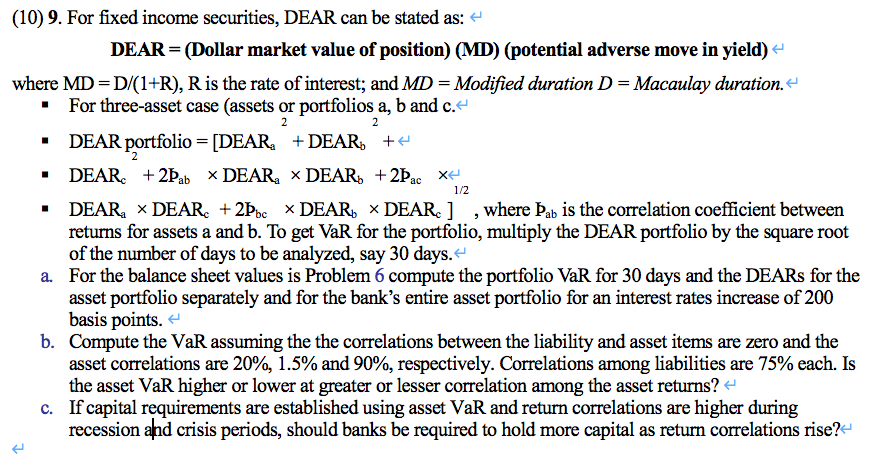

2 2 1/2 (10) 9. For fixed income securities, DEAR can be stated as: DEAR = (Dollar market value of position) (MD) (potential adverse move in yield) where MD=D/(1+R), R is the rate of interest; and MD = Modified duration D= Macaulay duration. . For three-asset case (assets or portfolios a, b and c. DEAR portfolio = [DEAR, + DEAR, + DEAR +2ab * DEAR, * DEAR+2ac DEAR, * DEAR +2bbc * DEAR* DEAR ) , where ab is the correlation coefficient between returns for assets a and b. To get VaR for the portfolio, multiply the DEAR portfolio by the square root of the number of days to be analyzed, say 30 days. a. For the balance sheet values is Problem 6 compute the portfolio VaR for 30 days and the DEARs for the asset portfolio separately and for the bank's entire asset portfolio for an interest rates increase of 200 basis points. b. Compute the VaR assuming the the correlations between the liability and asset items are zero and the asset correlations are 20%, 1.5% and 90%, respectively. Correlations among liabilities are 75% each. Is the asset VaR higher or lower at greater or lesser correlation among the asset returns? + c. If capital requirements are established using asset VaR and return correlations are higher during recession and crisis periods, should banks be required to hold more capital as return correlations rise?- 2 2 1/2 (10) 9. For fixed income securities, DEAR can be stated as: DEAR = (Dollar market value of position) (MD) (potential adverse move in yield) where MD=D/(1+R), R is the rate of interest; and MD = Modified duration D= Macaulay duration. . For three-asset case (assets or portfolios a, b and c. DEAR portfolio = [DEAR, + DEAR, + DEAR +2ab * DEAR, * DEAR+2ac DEAR, * DEAR +2bbc * DEAR* DEAR ) , where ab is the correlation coefficient between returns for assets a and b. To get VaR for the portfolio, multiply the DEAR portfolio by the square root of the number of days to be analyzed, say 30 days. a. For the balance sheet values is Problem 6 compute the portfolio VaR for 30 days and the DEARs for the asset portfolio separately and for the bank's entire asset portfolio for an interest rates increase of 200 basis points. b. Compute the VaR assuming the the correlations between the liability and asset items are zero and the asset correlations are 20%, 1.5% and 90%, respectively. Correlations among liabilities are 75% each. Is the asset VaR higher or lower at greater or lesser correlation among the asset returns? + c. If capital requirements are established using asset VaR and return correlations are higher during recession and crisis periods, should banks be required to hold more capital as return correlations rise