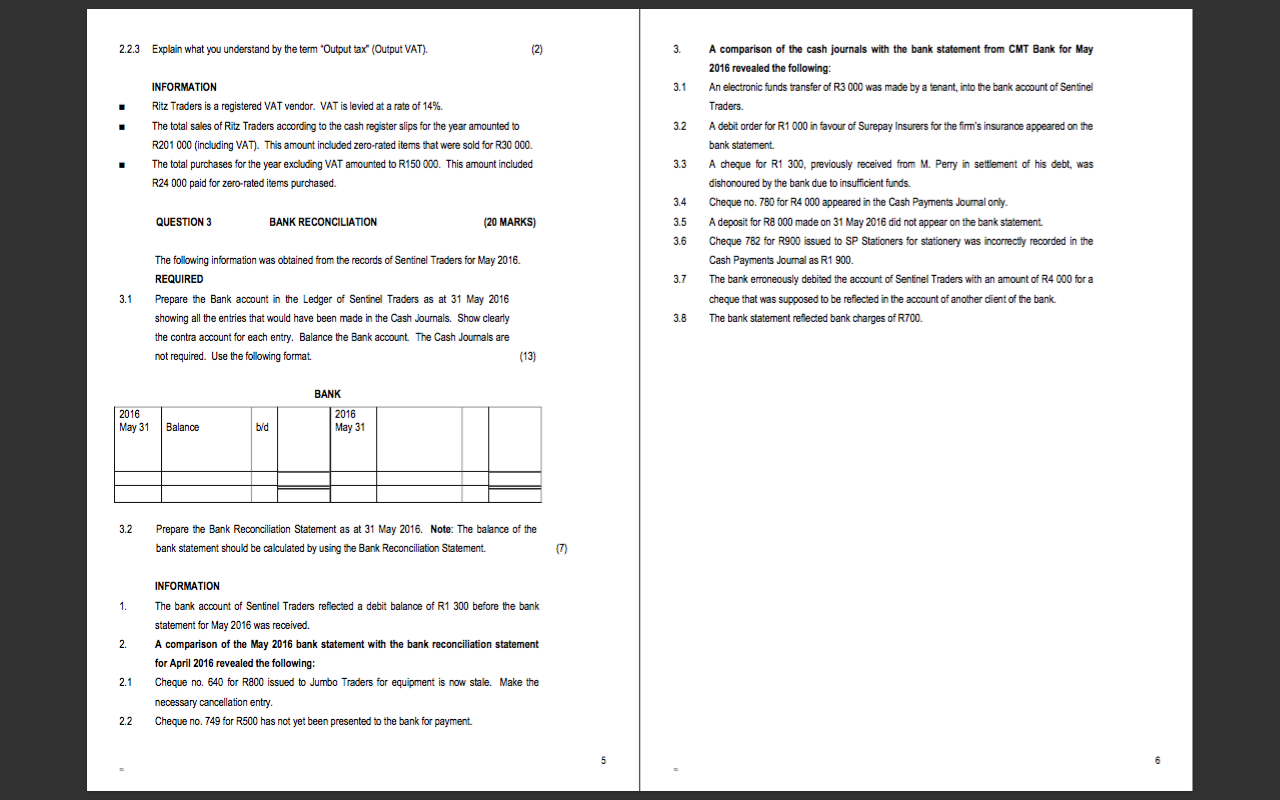

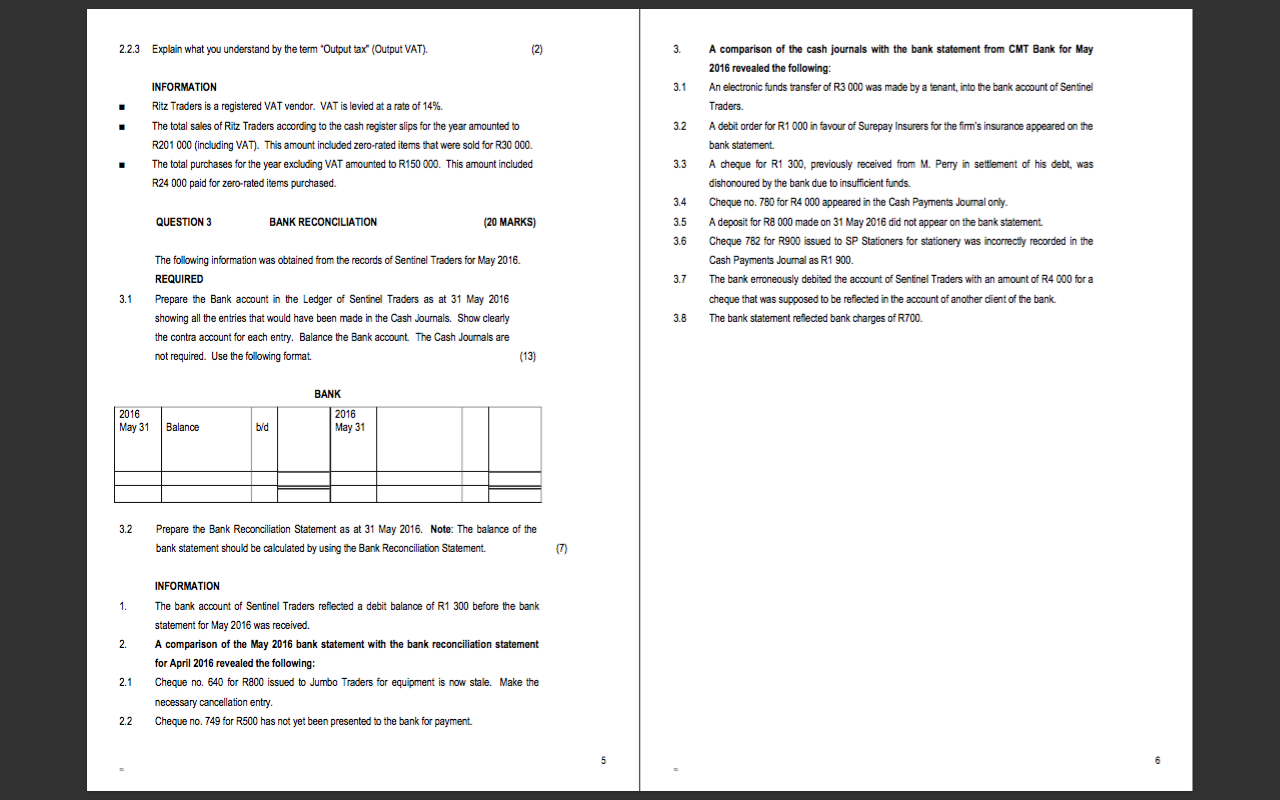

2.2.3 Explain what you understand by the term "Output tax" (Output VAT). 3. INFORMATION Ritz Traders is a registered VAT vendor. VAT is levied at a rate of 14%. The total sales of Ritz Traders according to the cash register slips for the year amounted to R201 000 (including VAT). This amount included zero-rated items that were sold for R30 000 The total purchases for the year excluding VAT amounted to R150 000. This amount included R24 000 paid for zero-rated items purchased. A comparison of the cash journals with the bank statement from CMT Bank for May 2016 revealed the following: An electronic funds transfer of R3 000 was made by a tenant, into the bank account of Sentinel Traders. A debit order for R1 000 in favour of Surepay Insurers for the firm's insurance appeared on the bank statement A cheque for R1 300, previously received from M. Perry in settlement of his debt, was dishonoured by the bank due to insufficient funds. Cheque no. 780 for R4 000 appeared in the Cash Payments Journal only. A deposit for R8 000 made on 31 May 2016 did not appear on the bank statement Cheque 782 for R900 issued to SP Stationers for stationery was incorrectly recorded in the Cash Payments Journal as R1 900 The bank erroneously debited the account of Sentinel Traders with an amount of R4 000 for a cheque that was supposed to be reflected in the account of another dient of the bank. The bank statement reflected bank charges of R700. QUESTION 3 BANK RECONCILIATION (20 MARKS) 3.6 3.1 The following information was obtained from the records of Sentinel Traders for May 2016 REQUIRED Prepare the Bank account in the Ledger of Sentinel Traders as at 31 May 2016 showing all the entries that would have been made in the Cash Journals. Show clearly the contra account for each entry. Balance the Bank account The Cash Journals are not required. Use the following format (13) 3.8 2016 May 31 BANK 2016 May 31 Balance 3.2 Prepare the Bank Reconciliation Statement as at 31 May 2016. Note: The balance of the bank statement should be calculated by using the Bank Reconciliation Statement. INFORMATION The bank account of Sentinel Traders reflected a debit balance of R1 300 before the bank statement for May 2016 was received. A comparison of the May 2016 bank statement with the bank reconciliation statement for April 2016 revealed the following: Cheque no. 640 for R800 issued to Jumbo Traders for equipment is now stale. Make the necessary cancellation entry. Cheque no. 749 for R500 has not yet been presented to the bank for payment 2.1 22