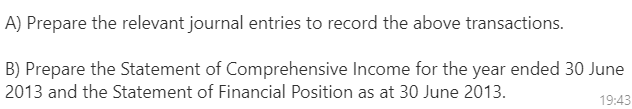

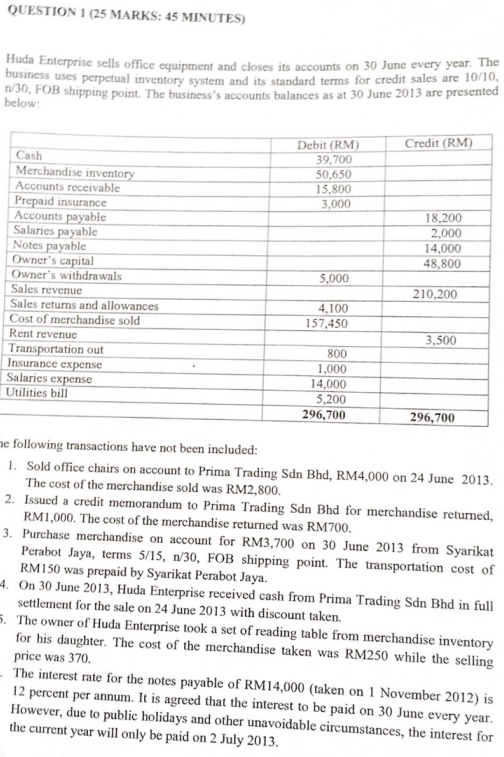

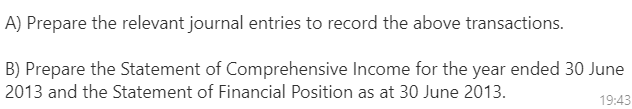

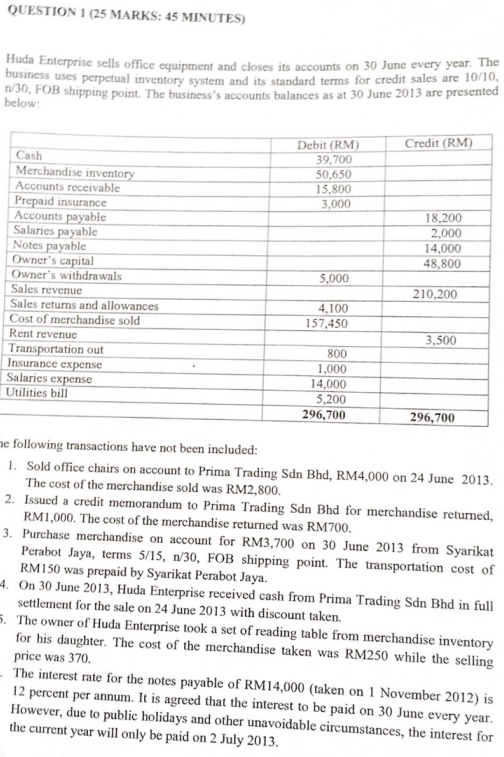

A) Prepare the relevant journal entries to record the above transactions. B) Prepare the Statement of Comprehensive Income for the year ended 30 June 2013 and the Statement of Financial Position as at 30 June 2013. 19:43 QUESTION 1 (25 MARKS: 45 MINUTES) Huda Enterprise sells office equipment and closes its accounts on 30 June every year. The business uses perpetual inventory system and its standard terms for credit sales are 10/10, 1/30, FOB shipping point. The business's accounts balances as at 30 June 2013 are presented below: Credit (RM) Debit (RM) 39,700 50,650 15,800 3,000 18,200 2,000 14,000 48,800 Cash Merchandise inventory Accounts receivable Prepaid insurance Accounts payable Salaries payable Notes payable Owner's capital Owner's withdrawals Sales revenue Sales returns and allowances Cost of merchandise sold Rent revenue Transportation out Insurance expense Salaries expense Utilities bill 5,000 210,200 4,100 157,450 3,500 800 1,000 14,000 5,200 296,700 296,700 he following transactions have not been included: 1. Sold office chairs on account to Prima Trading Sdn Bhd, RM4,000 on 24 June 2013. The cost of the merchandise sold was RM2,800. 2. Issued a credit memorandum to Prima Trading Sdn Bhd for merchandise returned, RM1,000. The cost of the merchandise returned was RM700. 3. Purchase merchandise on account for RM3,700 on 30 June 2013 from Syarikat Perabot Jaya, terms 5/15, n/30, FOB shipping point. The transportation cost of RM150 was prepaid by Syarikat Perabot Jaya. 4. On 30 June 2013, Huda Enterprise received cash from Prima Trading Sdn Bhd in full settlement for the sale on 24 June 2013 with discount taken. 5. The owner of Huda Enterprise took a set of reading table from merchandise inventory for his daughter. The cost of the merchandise taken was RM250 while the selling price was 370. The interest rate for the notes payable of RM 14,000 (taken on 1 November 2012) is 12 percent per annum. It is agreed that the interest to be paid on 30 June every year. However, due to public holidays and other unavoidable circumstances, the interest for the current year will only be paid on 2 July 2013