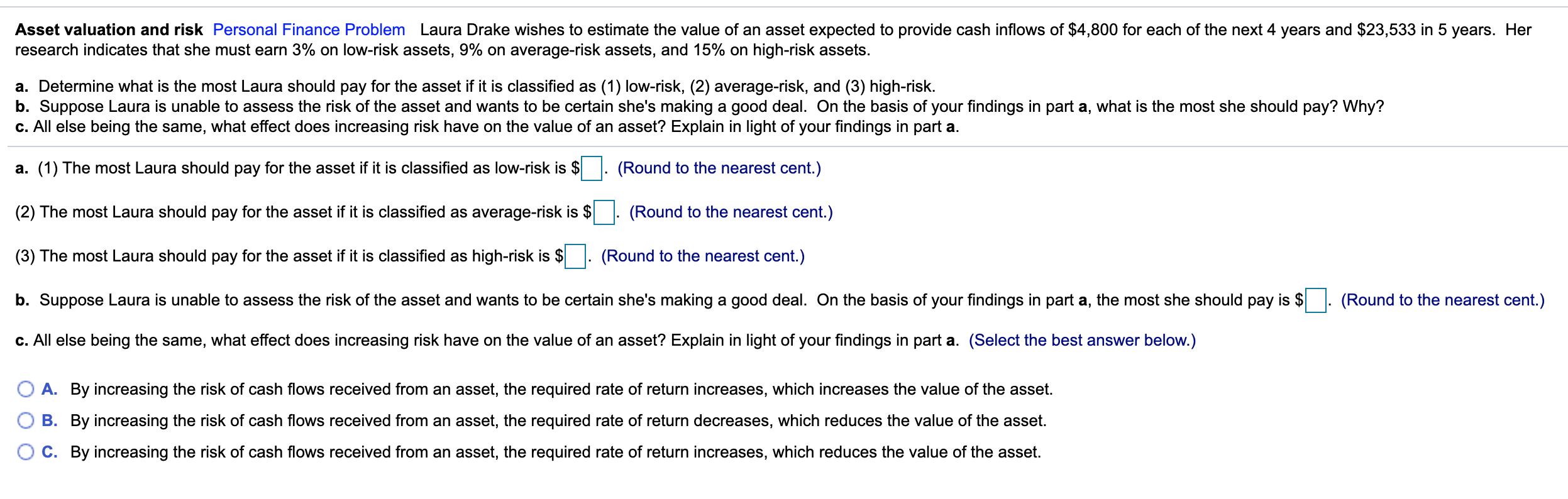

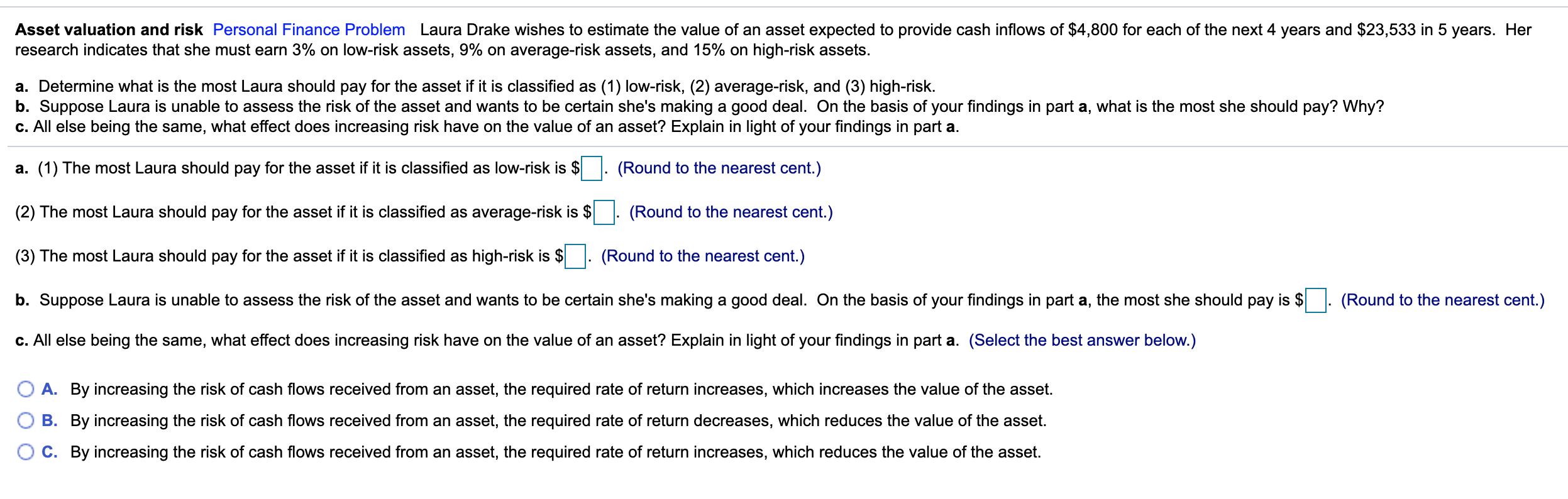

Asset valuation and risk Personal Finance Problem Laura Drake wishes to estimate the value of an asset expected to provide cash inflows of $4,800 for each of the next 4 years and $23,533 in 5 years. Her research indicates that she must earn 3% on low-risk assets, 9% on average-risk assets, and 15% on high-risk assets. a. Determine what is the most Laura should pay for the asset if it is classified as (1) low-risk, (2) average-risk, and (3) high-risk. b. Suppose Laura is unable to assess the risk of the asset and wants to be certain she's making a good deal. On the basis of your findings in part a, what is the most she should pay? Why? c. All else being the same, what effect does increasing risk have on the value of an asset? Explain in light of your findings in part a. a. (1) The most Laura should pay for the asset if it is classified as low-risk is $ . (Round to the nearest cent.) (2) The most Laura should pay for the asset if it is classified as average-risk is $ (Round to the nearest cent.) (3) The most Laura should pay for the asset if it is classified as high-risk is $ (Round to the nearest cent.) b. Suppose Laura is unable to assess the risk of the asset and wants to be certain she's making a good deal. On the basis of your findings in part a, the most she should pay is $ (Round to the nearest cent.) c. All else being the same, what effect does increasing risk have on the value of an asset? Explain in light of your findings in part a. (Select the best answer below.) O A. By increasing the risk of cash flows received from an asset, the required rate of return increases, which increases the value of the asset. B. By increasing the risk of cash flows received from an asset, the required rate of return decreases, which reduces the value of the asset. C. By increasing the risk of cash flows received from an asset, the required rate of return increases, which reduces the value of the asset. Asset valuation and risk Personal Finance Problem Laura Drake wishes to estimate the value of an asset expected to provide cash inflows of $4,800 for each of the next 4 years and $23,533 in 5 years. Her research indicates that she must earn 3% on low-risk assets, 9% on average-risk assets, and 15% on high-risk assets. a. Determine what is the most Laura should pay for the asset if it is classified as (1) low-risk, (2) average-risk, and (3) high-risk. b. Suppose Laura is unable to assess the risk of the asset and wants to be certain she's making a good deal. On the basis of your findings in part a, what is the most she should pay? Why? c. All else being the same, what effect does increasing risk have on the value of an asset? Explain in light of your findings in part a. a. (1) The most Laura should pay for the asset if it is classified as low-risk is $ . (Round to the nearest cent.) (2) The most Laura should pay for the asset if it is classified as average-risk is $ (Round to the nearest cent.) (3) The most Laura should pay for the asset if it is classified as high-risk is $ (Round to the nearest cent.) b. Suppose Laura is unable to assess the risk of the asset and wants to be certain she's making a good deal. On the basis of your findings in part a, the most she should pay is $ (Round to the nearest cent.) c. All else being the same, what effect does increasing risk have on the value of an asset? Explain in light of your findings in part a. (Select the best answer below.) O A. By increasing the risk of cash flows received from an asset, the required rate of return increases, which increases the value of the asset. B. By increasing the risk of cash flows received from an asset, the required rate of return decreases, which reduces the value of the asset. C. By increasing the risk of cash flows received from an asset, the required rate of return increases, which reduces the value of the asset