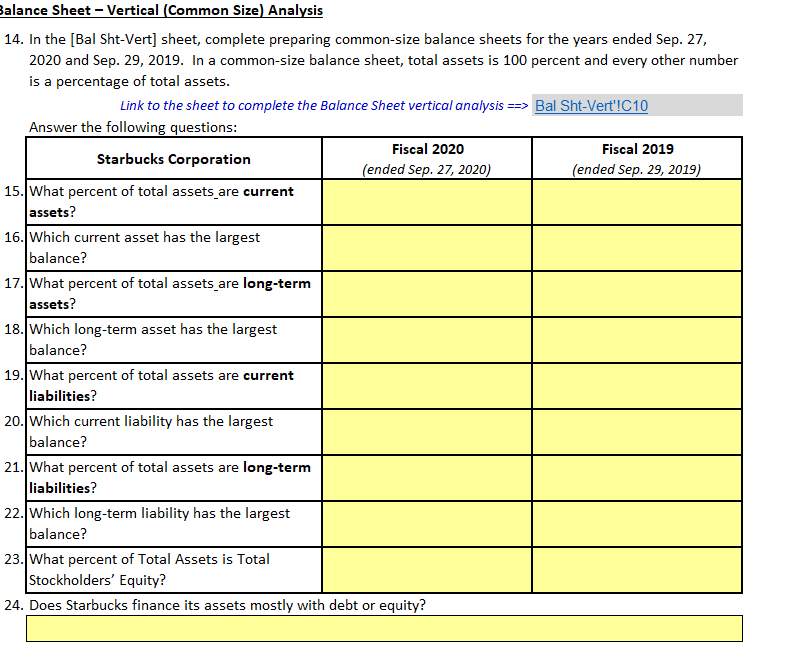

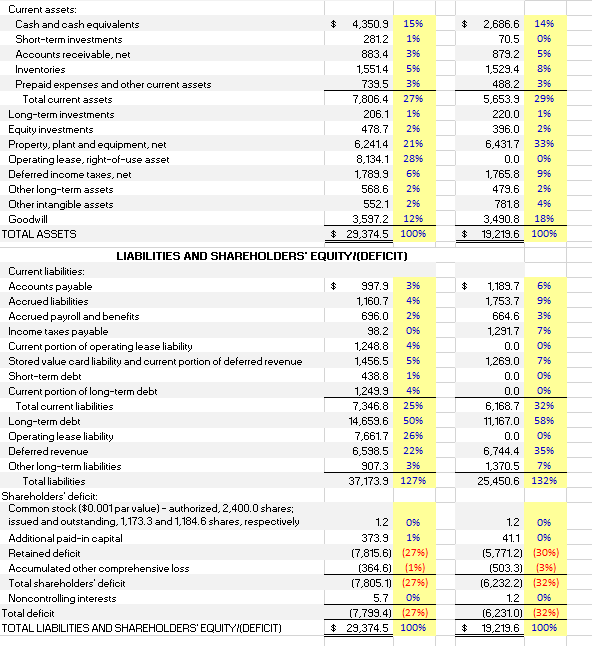

Balance Sheet - Vertical (Common Size) Analysis 14. In the [Bal Sht-Vert] sheet, complete preparing common-size balance sheets for the years ended Sep. 27, 2020 and Sep. 29, 2019. In a common-size balance sheet, total assets is 100 percent and every other number is a percentage of total assets. Link to the sheet to complete the Balance Sheet vertical analysis ==> Bal Sht-Vert'!C10 Answer the following questions: Fiscal 2020 Fiscal 2019 Starbucks Corporation (ended Sep. 27, 2020) (ended Sep. 29, 2019) 15. What percent of total assets are current assets? 16. Which current asset has the largest balance? 17. What percent of total assets are long-term assets? 18. Which long-term asset has the largest balance? 19. What percent of total assets are current liabilities? 20. Which current liability has the largest balance? 21. What percent of total assets are long-term liabilities? 22. Which long-term liability has the largest balance? 23. What percent of Total Assets is Total Stockholders' Equity? 24. Does Starbucks finance its assets mostly with debt or equity? $ Current assets: Cash and cash equivalents Short-term investments Accounts receivable, net Inventories Prepaid expenses and other current assets Total current assets Long-term investments Equity investments Property, plant and equipment, net Operating lease, right-of-use asset Deferred income taxes, net Other long-term assets Other intangible assets Goodwill TOTAL ASSETS $ 4,350.9 1596 281.2 196 883.4 396 1,551.4 596 739.5 396 7,806.4 2796 206.1 196 478.7 296 6,241.4 2196 8,134.1 2896 1,789.9 696 568.6 296 552.1 296 3,597.2 1296 $ 29,374.5 100% 2,686.6 1496 70.5 096 879.2 596 1,529.4 896 488.2 396 5,653.9 2996 220.0 196 396.0 296 6,431.7 3396 0.0 096 1,765.8 996 479.6 296 781.8 496 3,490.8 1896 19,219.6 100% LIABILITIES AND SHAREHOLDERS' EQUITYI(DEFICIT) Current liabilities: Accounts payable $ 997.9 396 Accrued liabilities 1.160.7 496 Accrued payroll and benefits 696.0 296 Income taxes payable 98.2 096 Current portion of operating lease liability 1,248.8 496 Stored value card liability and current portion of deferred revenue 1,456.5 596 Short-term debt 438.8 196 Current portion of long-term debt 1,249.9 496 Total current liabilities 7,346.8 2596 Long-term debt 14,659.6 5096 Operating lease liability 7,661.7 2696 Deferred revenue 6,598.5 2296 Other long-term liabilities 907.3 396 Total liabilities 37,173.9 12796 Shareholders' deficit: Common stock ($0.001 par value) - authorized. 2,400.0 shares; issued and outstanding, 1.173.3 and 1.184.6 shares, respectively 1.2 096 Additional paid-in capital 373.9 196 Retained deficit (7,815.6) (2796) Accumulated other comprehensive loss (364.6) (196) Total shareholders' deficit (7,805.1) (2796) Noncontrolling interests 5.7 096 Total deficit (7.799.4) (2796) TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY/(DEFICIT) $ 29,374.5 10096 1,189.7 696 1,753.7 996 664.6 396 1,291.7 796 0.0 096 1,269.0 796 0.0 096 0.0 096 6.168.7 3296 11,167.0 5896 0.0 096 6,744.4 3596 1,370.5 796 25,450.6 13296 1.2 096 41.1 096 (5,771.2) (3096) (503.3) (395) (6.232.2) (329) 1.2 096 (6.231.0) (3296) 19,219.6 100%