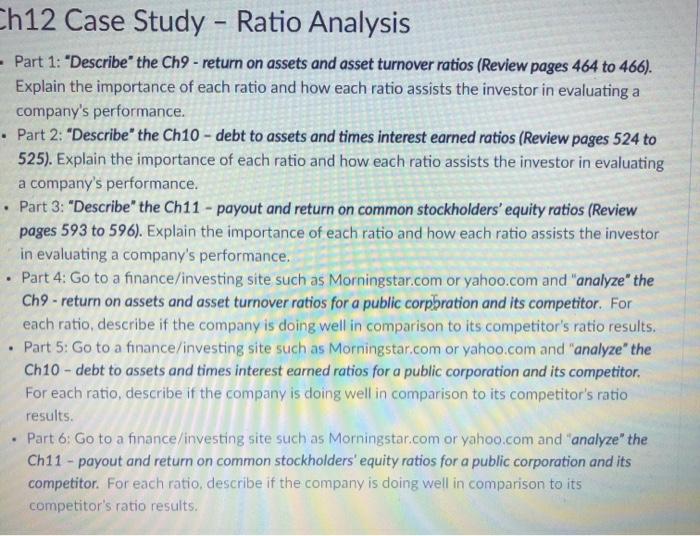

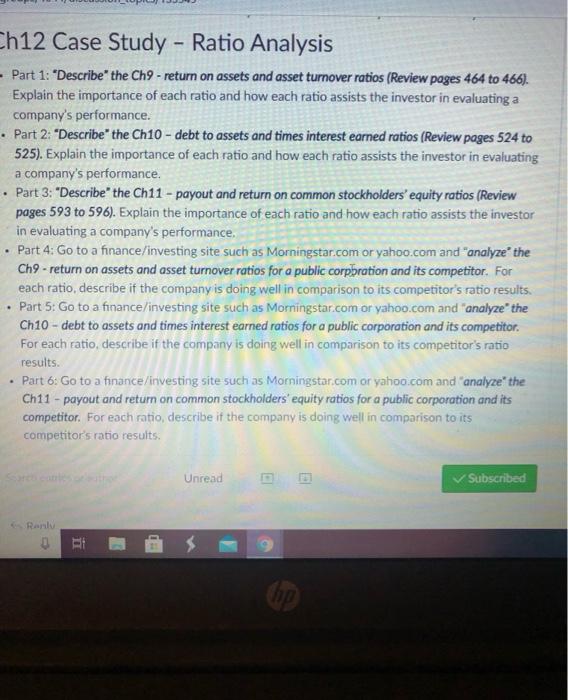

. Ch12 Case Study - Ratio Analysis - Part 1: Describe the Ch9 - return on assets and asset turnover ratios (Review pages 464 to 466). Explain the importance of each ratio and how each ratio assists the investor in evaluating a company's performance. Part 2: "Describe" the Ch10 - debt to assets and times interest earned ratios (Review pages 524 to 525). Explain the importance of each ratio and how each ratio assists the investor in evaluating a company's performance. Part 3: "Describe" the Ch11 - payout and return on common stockholders' equity ratios (Review pages 593 to 596). Explain the importance of each ratio and how each ratio assists the investor in evaluating a company's performance. Part 4: Go to a finance/investing site such as Morningstar.com or yahoo.com and "analyze" the Cho - return on assets and asset turnover ratios for a public corpbration and its competitor. For each ratio, describe if the company is doing well in comparison to its competitor's ratio results. Part 5: Go to a finance/investing site such as Morningstar.com or yahoo.com and "analyze" the Ch10 - debt to assets and times interest earned ratios for a public corporation and its competitor. For each ratio, describe if the company is doing well in comparison to its competitor's ratio results, Part 6: Go to a finance/investing site such as Morningstar.com or yahoo.com and analyze" the Ch11 - payout and return on common stockholders' equity ratios for a public corporation and its competitor. For each ratio, describe if the company is doing well in comparison to its competitor's ratio results. . Ch12 Case Study - Ratio Analysis - Part 1: "Describe the Ch9 - return on assets and asset turnover ratios (Review pages 464 to 466). Explain the importance of each ratio and how each ratio assists the investor in evaluating a company's performance. Part 2: "Describe" the Ch10 - debt to assets and times interest earned ratios (Review pages 524 to 525). Explain the importance of each ratio and how each ratio assists the investor in evaluating a company's performance. Part 3: "Describe" the Ch11 - payout and return on common stockholders' equity ratios (Review pages 593 to 596). Explain the importance of each ratio and how each ratio assists the investor in evaluating a company's performance, Part 4: Go to a finance/investing site such as Morningstar.com or yahoo.com and "analyze the Ch9 - return on assets and asset turnover ratios for a public corpbration and its competitor. For each ratio, describe if the company is doing well in comparison to its competitor's ratio results. Part 5: Go to a finance/investing site such as Morningstar.com or yahoo.com and analyze the Ch10 - debt to assets and times interest earned ratios for a public corporation and its competitor. For each ratio, describe if the company is doing well in comparison to its competitor's ratio results. Part 6: Go to a finance/investing site such as Morningstar.com or yahoo.com and "analyze the Ch11 - payout and return on common stockholders' equity ratios for a public corporation and its competitor. For each ratio describe if the company is doing well in comparison to its competitor's ratio results. . . Unread Subscribed Ranty