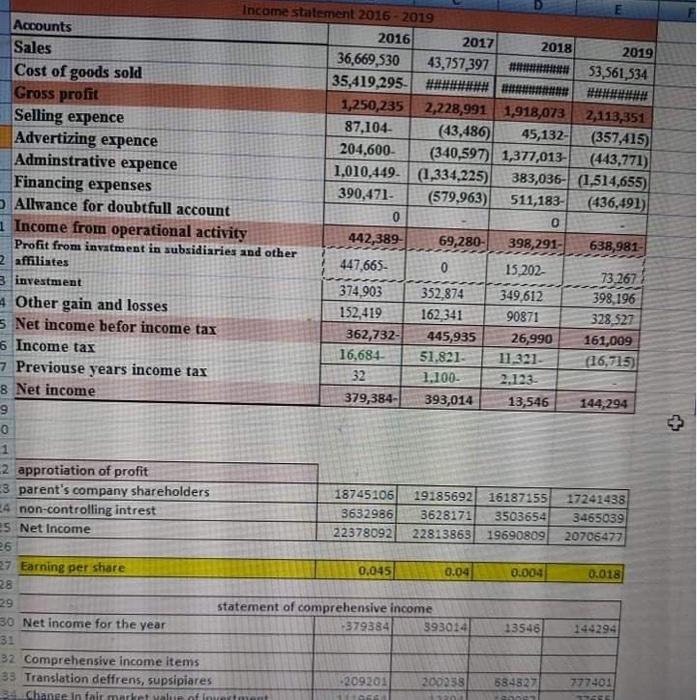

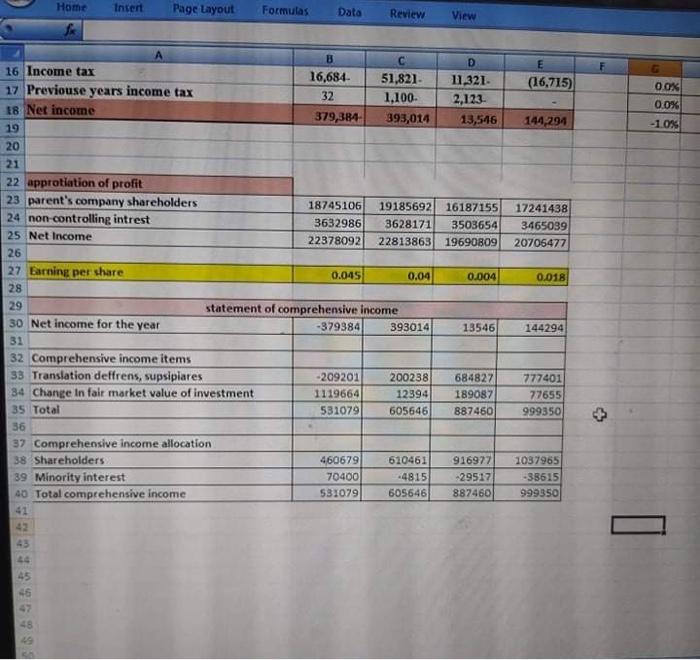

Income statement 2016 - 2019 Accounts 2016 2017 2018 Sales 2019 36,669,530 43,757,397 53,561,534 Cost of goods sold 35,419,295 Gross profit 1,250,235 2,228,991 1,918,073 2,113,351 Selling expence 87,104 (43,486) 45,132 (357,415) Advertizing expence 204.600 (340,597) 1,377,013- Adminstrative expence (443,771) 1,010,449- (1,334,225) 383,036- (1,514,655) Financing expenses 390,471 (579,963) 511,183 (436,491) Allwance for doubtfull account 0 0 Income from operational activity 442,389 69,280 398,291 638,981 Profit from invatment in subsidiaries and other 2 affiliates 447,665 0 15,202 73.267 3 investment 374,903 352,874 349,612 398, 196 Other gain and losses 152,419 162,341 90871 328,527 5 Net income befor income tax 362,732 445,935 26,990 161,009 6 Income tax 16,684 51.821 11,321 (16,715) 7 Previouse years income tax 32 1.100. 2.123 8 Net income 379,384 393,014 13,546 144,294 9 0 1 2 approtiation of profit 3 parent's company shareholders 18745106 19185692 16187155 17241438 24 non-controlling intrest 3632986 3628171 3503654 3465039 25 Net Income 22378092 22813863 19690809 20706477 26 27 Earning per share 0.045 0.04 0.004 0.018 28 statement of comprehensive income 30 Net income for the year 379384 393014 13546 144294 31 32 Comprehensive income items 33 Translation deffrens, supsipiares 209201 200238 584527 777401 change in fair market value of In + OG Home Intent Page Layout Formulas Data Review View D (16,715) 11,321 2,123 13,516 0 0% 0.0% -1.0% 144,294 16187155 3503654 19690809 17241438 3465039 20706477 B 16 Income tax 16,684 51,821 17 Previouse years income tax 32 1.100 18 Net income 379,3B4 393,014 19 20 21 22 approtiation of profit 23 parent's company shareholders 18745106 19185692 24 non-controlling intrest 3632986 3628171 25 Net Income 22378092 22813863 26 27 Earning per share 0.045 0.04 28 29 statement of comprehensive income 30 Net income for the year -379384 393014 31 32 Comprehensive income items 33 Translation deffrens, supsipiares -209201 200238 34 Change In fair market value of investment 1119664 12394 35 Total 531079 605646 36 37 Comprehensive income allocation 38 Shareholders 460679 610461 39 Minority interest 70400 -4815 40 Total comprehensive income 5310791 605646 0.004 0.018 13546 144294 684827 189087 887460 777401 77655 999350 4 916977 -29517 887460 1037965 -38515 999350 42 46 Income statement 2016 - 2019 Accounts 2016 2017 2018 Sales 2019 36,669,530 43,757,397 53,561,534 Cost of goods sold 35,419,295 Gross profit 1,250,235 2,228,991 1,918,073 2,113,351 Selling expence 87,104 (43,486) 45,132 (357,415) Advertizing expence 204.600 (340,597) 1,377,013- Adminstrative expence (443,771) 1,010,449- (1,334,225) 383,036- (1,514,655) Financing expenses 390,471 (579,963) 511,183 (436,491) Allwance for doubtfull account 0 0 Income from operational activity 442,389 69,280 398,291 638,981 Profit from invatment in subsidiaries and other 2 affiliates 447,665 0 15,202 73.267 3 investment 374,903 352,874 349,612 398, 196 Other gain and losses 152,419 162,341 90871 328,527 5 Net income befor income tax 362,732 445,935 26,990 161,009 6 Income tax 16,684 51.821 11,321 (16,715) 7 Previouse years income tax 32 1.100. 2.123 8 Net income 379,384 393,014 13,546 144,294 9 0 1 2 approtiation of profit 3 parent's company shareholders 18745106 19185692 16187155 17241438 24 non-controlling intrest 3632986 3628171 3503654 3465039 25 Net Income 22378092 22813863 19690809 20706477 26 27 Earning per share 0.045 0.04 0.004 0.018 28 statement of comprehensive income 30 Net income for the year 379384 393014 13546 144294 31 32 Comprehensive income items 33 Translation deffrens, supsipiares 209201 200238 584527 777401 change in fair market value of In + OG Home Intent Page Layout Formulas Data Review View D (16,715) 11,321 2,123 13,516 0 0% 0.0% -1.0% 144,294 16187155 3503654 19690809 17241438 3465039 20706477 B 16 Income tax 16,684 51,821 17 Previouse years income tax 32 1.100 18 Net income 379,3B4 393,014 19 20 21 22 approtiation of profit 23 parent's company shareholders 18745106 19185692 24 non-controlling intrest 3632986 3628171 25 Net Income 22378092 22813863 26 27 Earning per share 0.045 0.04 28 29 statement of comprehensive income 30 Net income for the year -379384 393014 31 32 Comprehensive income items 33 Translation deffrens, supsipiares -209201 200238 34 Change In fair market value of investment 1119664 12394 35 Total 531079 605646 36 37 Comprehensive income allocation 38 Shareholders 460679 610461 39 Minority interest 70400 -4815 40 Total comprehensive income 5310791 605646 0.004 0.018 13546 144294 684827 189087 887460 777401 77655 999350 4 916977 -29517 887460 1037965 -38515 999350 42 46