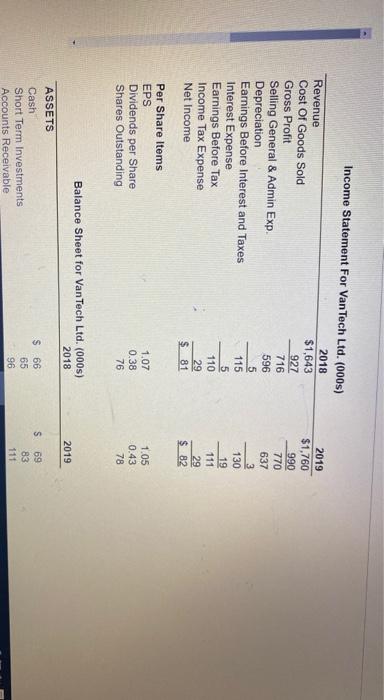

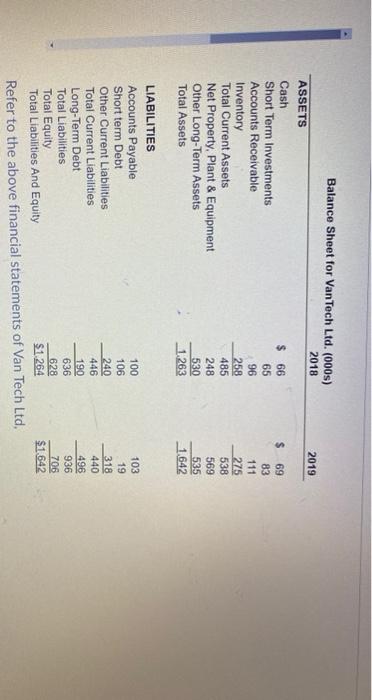

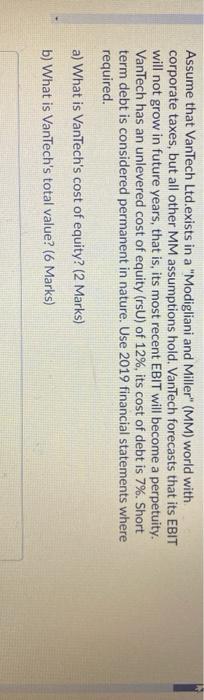

Income Statement For Van Tech Ltd. (000s) 2018 Revenue $1,643 Cost Of Goods Sold 927 Gross Profit 716 Selling General & Admin Exp. Depreciation 5 Earnings Before Interest and Taxes 115 Interest Expense 5 Earnings Before Tax 110 Income Tax Expense 29 Net Income $ 81 596 2019 $1,760 990 770 637 3 130 19 111 29 $ 82 Per Share Items EPS Dividends per Share Shares Outstanding 1.07 0.38 76 1.05 0.43 78 2019 Balance Sheet for Van Tech Ltd. (000s) 2018 ASSETS Cash $ 66 Short Term Investments 65 Accounts Receivable 96 S 69 83 111 2019 Balance Sheet for Van Tech Ltd. (000s) 2018 ASSETS Cash $ 66 Short Term Investments 65 Accounts Receivable 96 Inventory 258 Total Current Assets 485 Net Property, Plant & Equipment 248 Other Long-Term Assets 530 Total Assets 1.263 $ 69 83 111 275 538 569 535 1642 LIABILITIES Accounts Payable 100 Short term Debt 106 Other Current Liabilities 240 Total Current Liabilities 446 Long-Term Debt 190 Total Liabilities 636 Total Equity 628 Total Liabilities And Equity $1264 Refer to the above financial statements of Van Tech Ltd, 103 19 318 440 496 936 706 $1642 Assume that VanTech Ltd.exists in a "Modigliani and Miller" (MM) world with corporate taxes, but all other MM assumptions hold. VanTech forecasts that its EBIT will not grow in future years, that is, its most recent EBIT will become a perpetuity. VanTech has an unlevered cost of equity (rsU) of 12%, its cost of debt is 7%. Short term debt is considered permanent in nature. Use 2019 financial statements where required. a) What is VanTech's cost of equity? (2 Marks) b) What is VanTech's total value? (6 Marks) Income Statement For Van Tech Ltd. (000s) 2018 Revenue $1,643 Cost Of Goods Sold 927 Gross Profit 716 Selling General & Admin Exp. Depreciation 5 Earnings Before Interest and Taxes 115 Interest Expense 5 Earnings Before Tax 110 Income Tax Expense 29 Net Income $ 81 596 2019 $1,760 990 770 637 3 130 19 111 29 $ 82 Per Share Items EPS Dividends per Share Shares Outstanding 1.07 0.38 76 1.05 0.43 78 2019 Balance Sheet for Van Tech Ltd. (000s) 2018 ASSETS Cash $ 66 Short Term Investments 65 Accounts Receivable 96 S 69 83 111 2019 Balance Sheet for Van Tech Ltd. (000s) 2018 ASSETS Cash $ 66 Short Term Investments 65 Accounts Receivable 96 Inventory 258 Total Current Assets 485 Net Property, Plant & Equipment 248 Other Long-Term Assets 530 Total Assets 1.263 $ 69 83 111 275 538 569 535 1642 LIABILITIES Accounts Payable 100 Short term Debt 106 Other Current Liabilities 240 Total Current Liabilities 446 Long-Term Debt 190 Total Liabilities 636 Total Equity 628 Total Liabilities And Equity $1264 Refer to the above financial statements of Van Tech Ltd, 103 19 318 440 496 936 706 $1642 Assume that VanTech Ltd.exists in a "Modigliani and Miller" (MM) world with corporate taxes, but all other MM assumptions hold. VanTech forecasts that its EBIT will not grow in future years, that is, its most recent EBIT will become a perpetuity. VanTech has an unlevered cost of equity (rsU) of 12%, its cost of debt is 7%. Short term debt is considered permanent in nature. Use 2019 financial statements where required. a) What is VanTech's cost of equity? (2 Marks) b) What is VanTech's total value? (6 Marks)