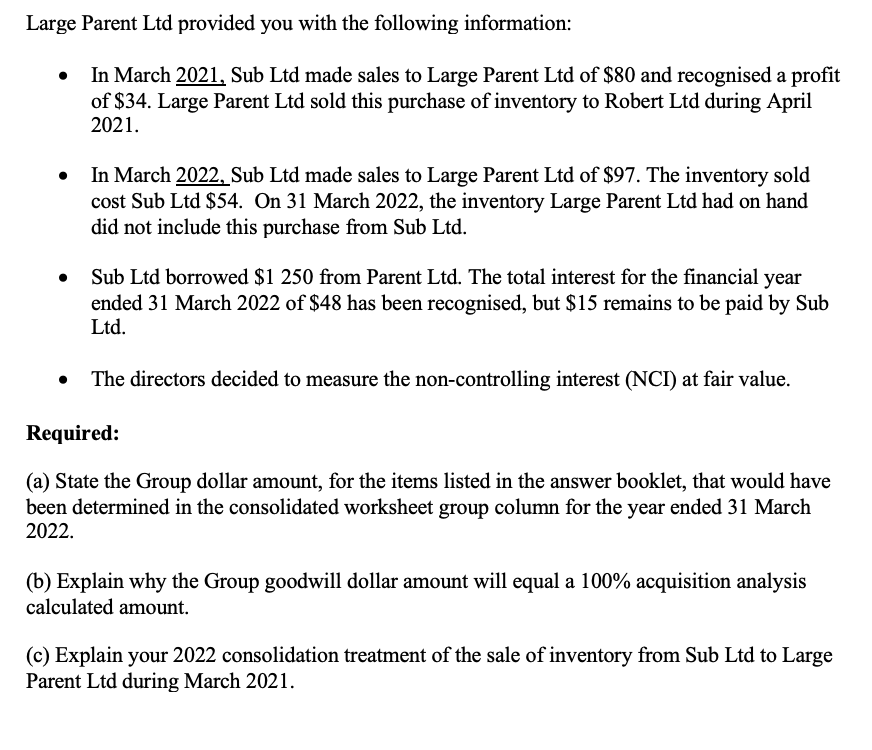

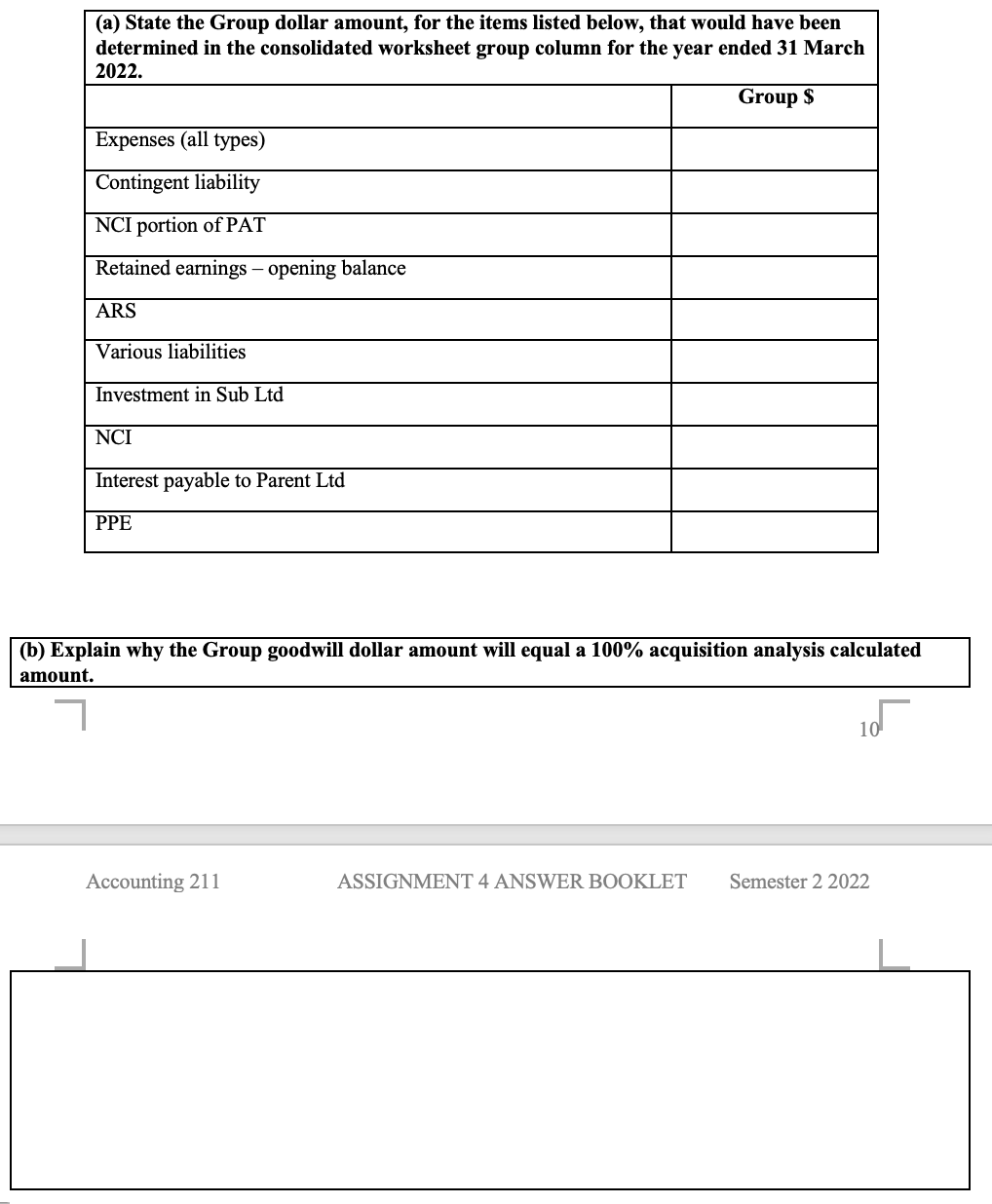

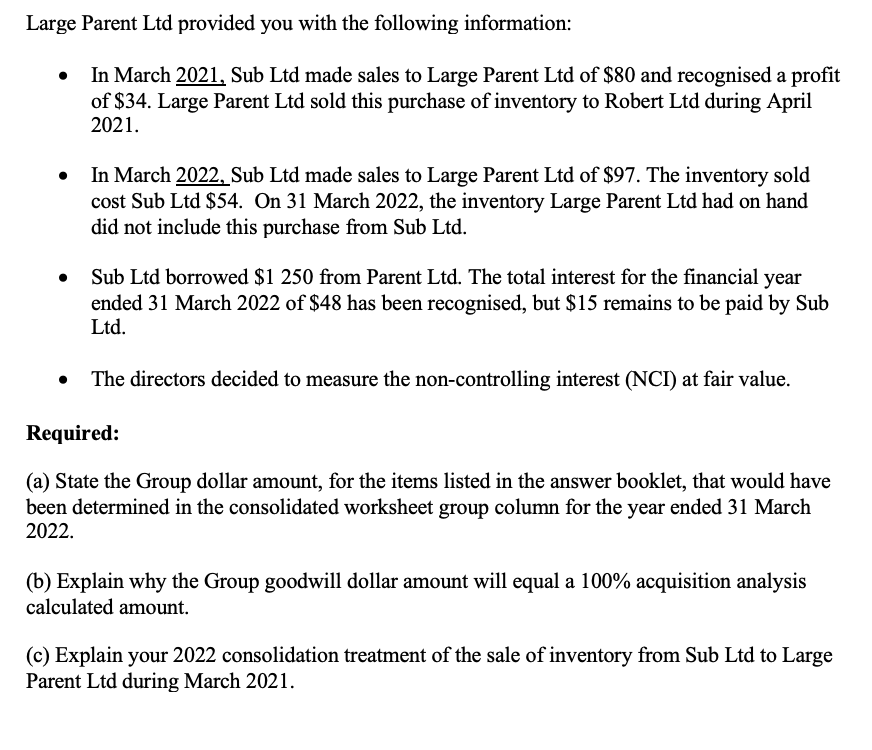

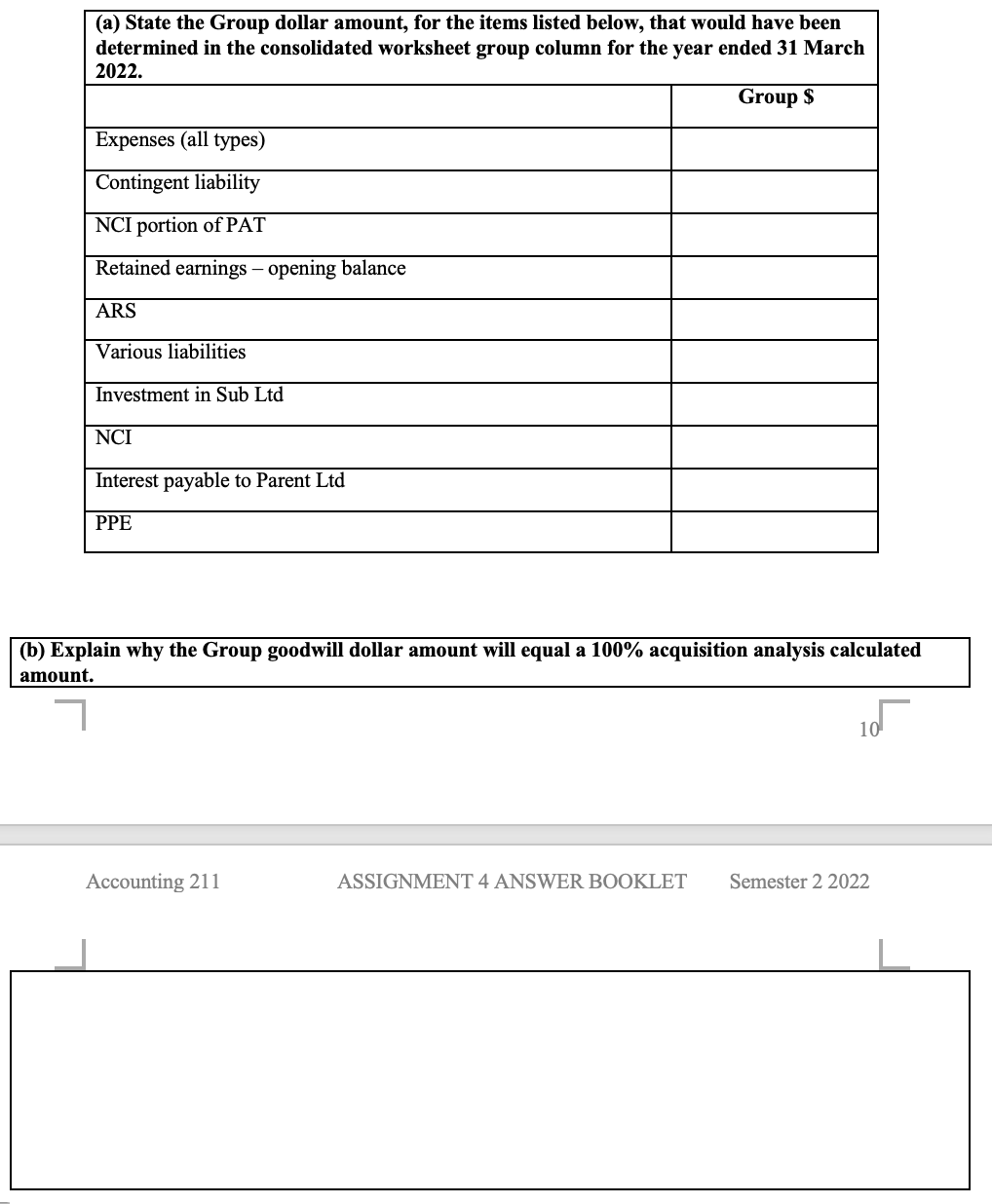

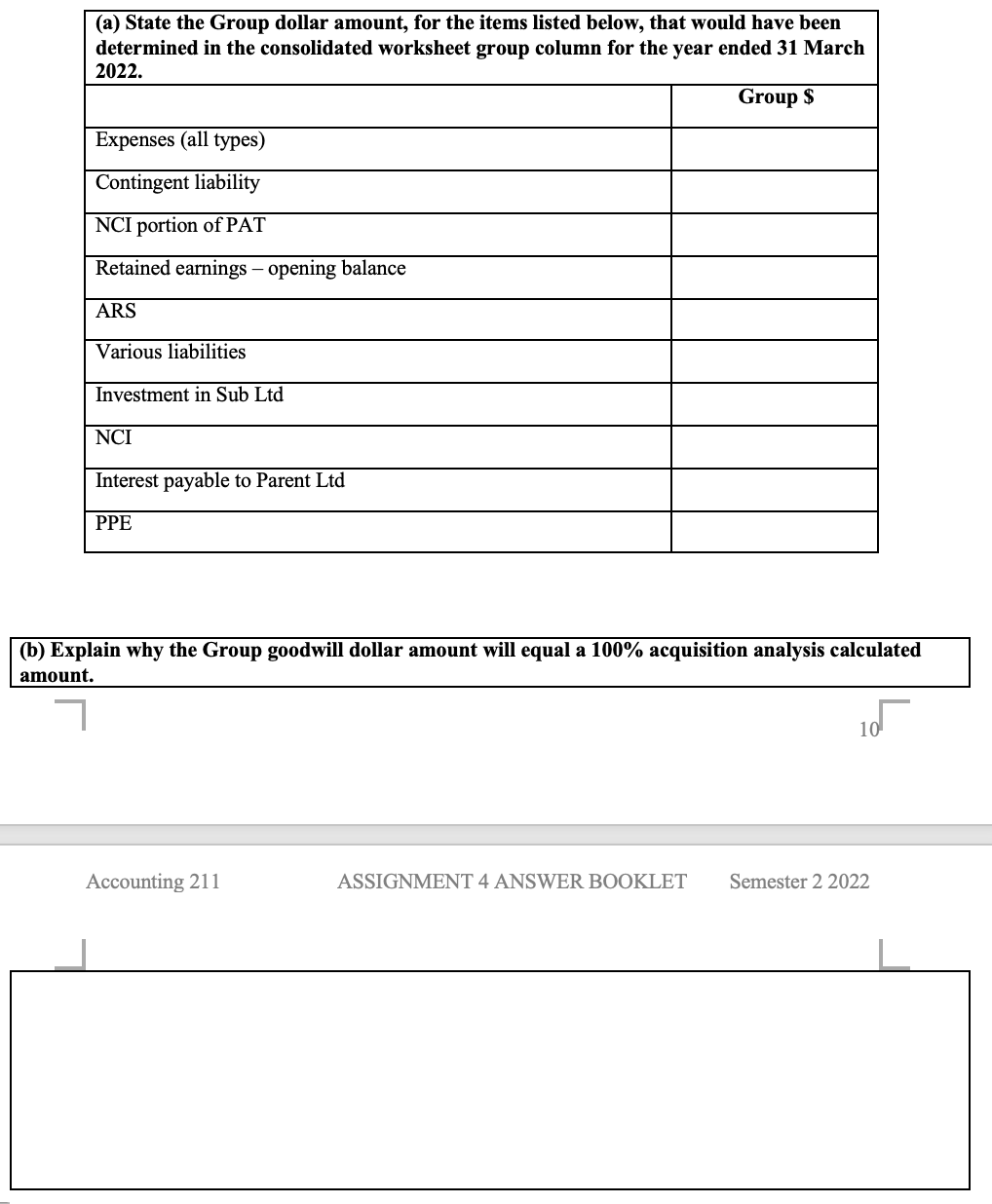

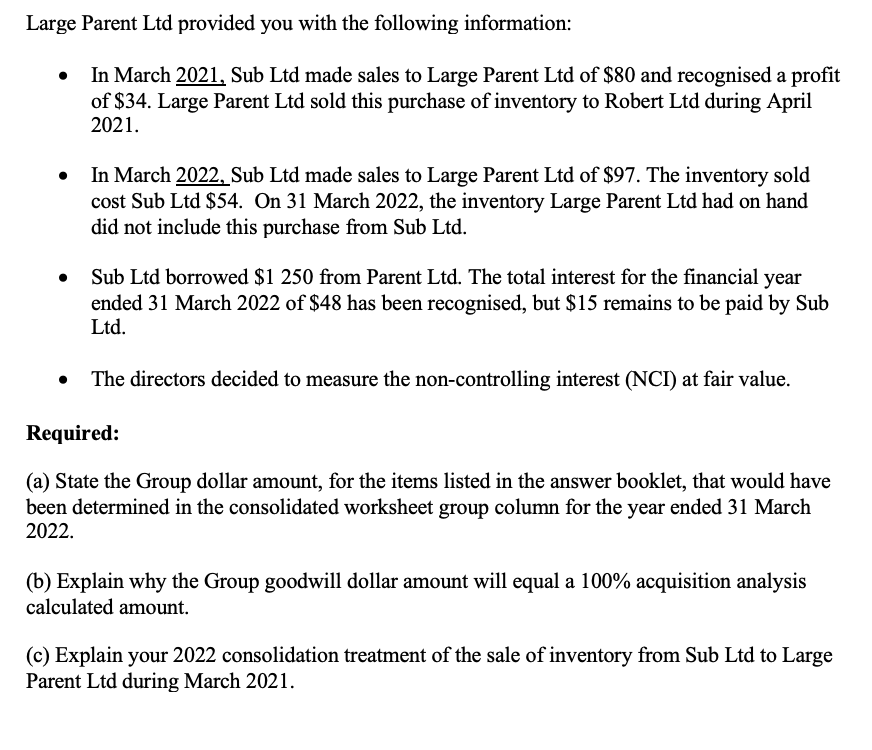

Large Parent Ltd provided you with the following information: - In March 2021, Sub Ltd made sales to Large Parent Ltd of $80 and recognised a profit of $34. Large Parent Ltd sold this purchase of inventory to Robert Ltd during April 2021. - In March 2022, Sub Ltd made sales to Large Parent Ltd of \$97. The inventory sold cost Sub Ltd \$54. On 31 March 2022, the inventory Large Parent Ltd had on hand did not include this purchase from Sub Ltd. - Sub Ltd borrowed \$1 250 from Parent Ltd. The total interest for the financial year ended 31 March 2022 of $48 has been recognised, but $15 remains to be paid by Sub Ltd. - The directors decided to measure the non-controlling interest (NCI) at fair value. Required: (a) State the Group dollar amount, for the items listed in the answer booklet, that would have been determined in the consolidated worksheet group column for the year ended 31 March 2022. (b) Explain why the Group goodwill dollar amount will equal a 100% acquisition analysis calculated amount. (c) Explain your 2022 consolidation treatment of the sale of inventory from Sub Ltd to Large Parent Ltd during March 2021. \begin{tabular}{|l|l|} \hline (a) State the Group dollar amount, for the items listed below, that would have been determined in the consolidated worksheet group column for the year ended 31 March 2022. & Group \$ \\ \hline Expenses (all types) & \\ \hline Contingent liability & \\ \hline NCI portion of PAT & \\ \hline Retained earnings - opening balance & \\ \hline ARS & \\ \hline Various liabilities & \\ \hline Investment in Sub Ltd & \\ \hline NCI & \\ \hline Interest payable to Parent Ltd & \\ \hline PPE & \\ \hline \end{tabular} (b) Explain why the Group goodwill dollar amount will equal a 100% acquisition analysis calculated amount. Accounting 211 ASSIGNMENT 4 ANSWER BOOKLET Semester 22022 (c) Explain your 2022 consolidation treatment of the sale of inventory from Sub Ltd to Large Parent Ltd during March 2021. Large Parent Ltd provided you with the following information: - In March 2021, Sub Ltd made sales to Large Parent Ltd of $80 and recognised a profit of $34. Large Parent Ltd sold this purchase of inventory to Robert Ltd during April 2021. - In March 2022, Sub Ltd made sales to Large Parent Ltd of \$97. The inventory sold cost Sub Ltd \$54. On 31 March 2022, the inventory Large Parent Ltd had on hand did not include this purchase from Sub Ltd. - Sub Ltd borrowed \$1 250 from Parent Ltd. The total interest for the financial year ended 31 March 2022 of $48 has been recognised, but $15 remains to be paid by Sub Ltd. - The directors decided to measure the non-controlling interest (NCI) at fair value. Required: (a) State the Group dollar amount, for the items listed in the answer booklet, that would have been determined in the consolidated worksheet group column for the year ended 31 March 2022. (b) Explain why the Group goodwill dollar amount will equal a 100% acquisition analysis calculated amount. (c) Explain your 2022 consolidation treatment of the sale of inventory from Sub Ltd to Large Parent Ltd during March 2021. \begin{tabular}{|l|l|} \hline (a) State the Group dollar amount, for the items listed below, that would have been determined in the consolidated worksheet group column for the year ended 31 March 2022. & Group \$ \\ \hline Expenses (all types) & \\ \hline Contingent liability & \\ \hline NCI portion of PAT & \\ \hline Retained earnings - opening balance & \\ \hline ARS & \\ \hline Various liabilities & \\ \hline Investment in Sub Ltd & \\ \hline NCI & \\ \hline Interest payable to Parent Ltd & \\ \hline PPE & \\ \hline \end{tabular} (b) Explain why the Group goodwill dollar amount will equal a 100% acquisition analysis calculated amount. Accounting 211 ASSIGNMENT 4 ANSWER BOOKLET Semester 22022 (c) Explain your 2022 consolidation treatment of the sale of inventory from Sub Ltd to Large Parent Ltd during March 2021