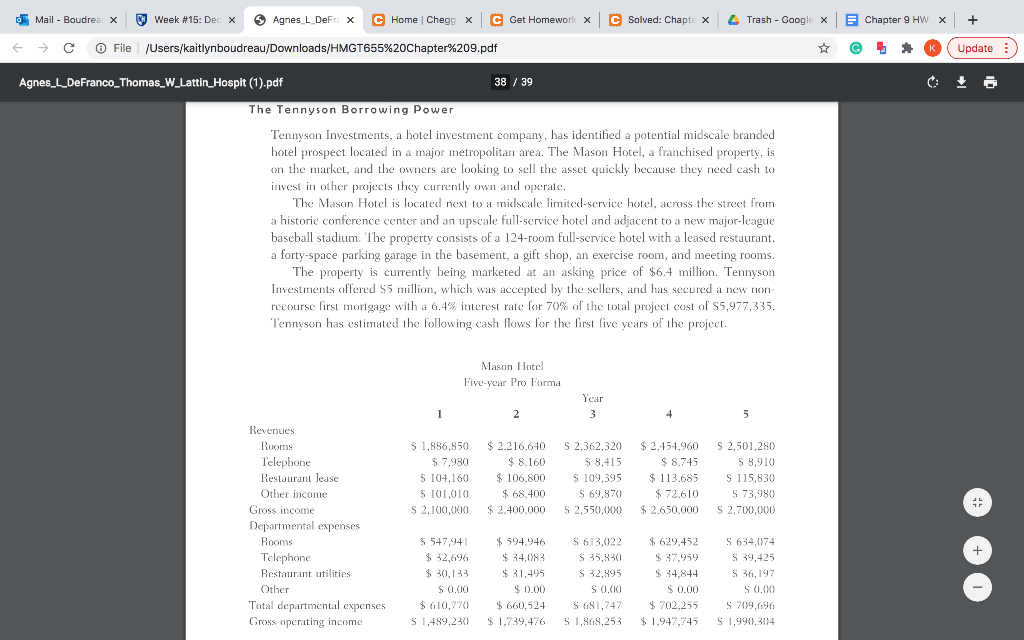

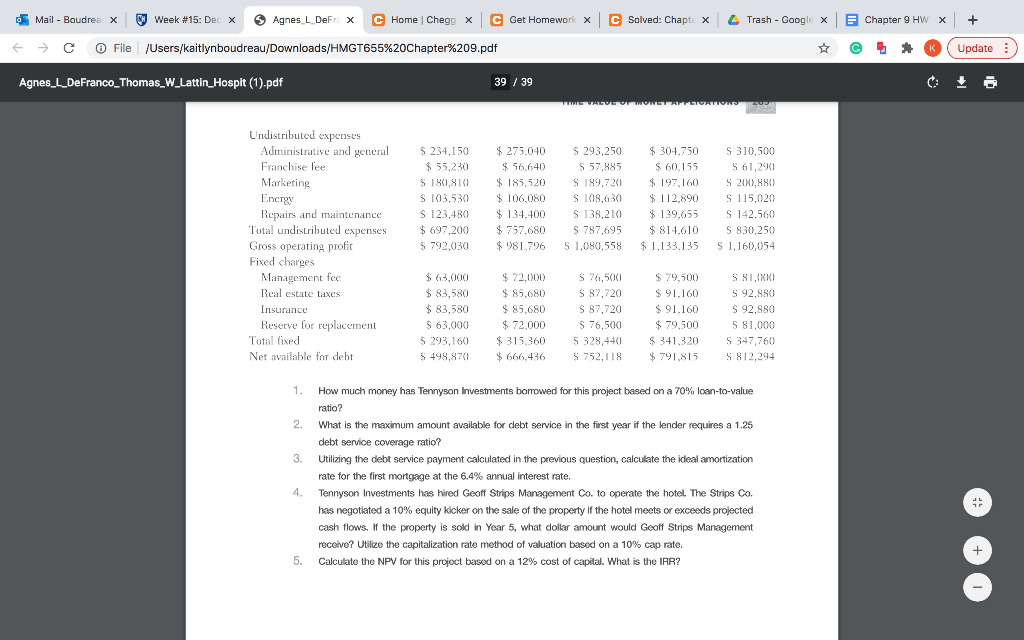

o Mail - Boudrea x W Week #15: Dec X Agnes L DeFrex C Home Chegg. x C Get Homework X C Solved: Chapte x Trash - Google x E Chapter 9 HW X + + e File /Users/kaitlynboudreau/Downloads/HMGT655%20Chapter%209.pdf K Update Agnes_L_DeFranco_Thomas_W_Lattin_Hospit (1).pdf 38 / 39 The Tennyson Borrowing Power Tennyson Investments, a hotel investment company, has identified a potential midscale branded hotel prospect located in a major metropolitan area. The Mason Hotel, a franchised property, is on the market, and the owners are looking to sell the asset quickly because they need cash to invest in other projects they currently own and operate. The Mason Hotel is located next to a miscale limited-service hotel, across the street from a historic conference center and an upscale full-service hotel and adjacent to a new major-league baseball stadium. The property consists of a 124-room full-service hotel with a leased restaurant, a forty-space parking garage in the basement, a gift shop, an exercise room, and meeting rooms. The property is currently being marketed at an asking price of $6.4 million. Tennyson Investments offered $5 million, which was accepted by the sellers, and has secured a new non- recourse first mortgage with a 6.4% interest rate for 70% of the total project cost of $5,977,335. Tennyson has estimated the following cash flows for the first five years of the project. Mason Hotel Five-year Pro Forma Year 3 1 2 5 $ 1,886,850 $ 7,980 $ 104,160 $ 101,010 $ 2.100,000 $ 2.216.610 $ 8.160 $ 106.800 $ 68.400 $ 2.400.000 S 2,362,320 $ 8,415 S 109,395 $ 69,870 S 2,550,000 $ 2.454.960 $ 8.745 $ 113,685 $ 72,610 $ 2,650.000 S 2,501,280 S 8,910 S 115,830 S 73,980 $ 2,700,000 Revenues Ruoms Telephone Restaurant lease Oth Other income Gross income Departmental expenses Rooms Telephone Restaurant utilities Other Total departmental expenses Gross operating income + $ 547,941 $ 32,696 $ 30,133 $ 0.00 $ 610,770 S 1,489,230 $ 594,946 $ 34,083 $ 31,495 $ 0.00 $ 660,524 $ 1,739,476 S 613,022 $ 35,830 $ $ 32,895 S 0.X S 681,747 S 1.968,253 $ 629,452 $ 37,959 $ 34,844 $ 0.00 $ 702,255 $ 1,947,745 5 634,074 S 39,425 S 36,197 S 0.0 S 7119,696 S 1,990,304 o Mail - Boudrea x W Week #15: Dec X Agnes L DeFrex C Home | Chegg. X C Get Homework x C Solved: Chapte X Trash - Google x E Chapter 9 HW X + + e File /Users/kaitlynboudreau/Downloads/HMGT655%20Chapter%209.pdf * K Update Agnes_L_DeFranco_Thomas_W_Lattin_Hospit (1).pdf 39 / 39 TUSVALVE WONTACTATIONS ZUD Undistributed expenses Administrative and general Franchise lee Marketing Energy Repairs and maintenance Total undistributed expenses Gross operating profit Fixed charges Management fee Real estate taxes Insurance Reserve for replacement Total fixed Net available for det $ 234,150 $ 55,230 $ 180,810 $ 103,530 $ 123,480 $ 697,200 $ 792,030 $ 275,040 $ 56,640 $ 185,520 $ 106,080 $ 134.400 $ 757.680 $ 981.796 $ 293,250 $ 57,885 $ 189,720 S 108,630 S 138,210 S 787,695 51,080,558 $ 304.750 $ 60,155 $ 197,160 $ 112,890 $ 139,655 $ $814,610 $ 1.133.135 S 310,500 5 61,290 S 20),880 S 115,020 S 142.560 S 830,250 S 1,160,054 $63,000 $ 83,580 $ 83,580 $ 63,000 $ 293,160 $ 498,870 $ 72.000 $ 85,680 $ 85.680 $ 72.000 $ 315,360 $ 666,436 $ 76,500 S 87,720 S 87,720 S 76,500 $ 328,440 S 752,118 $ 79,500 $ 91,160 $ 91,160 $ 79.500 $ 341,320 $ 791,815 SRI, S 92.880 S 92,880 S 81,000 S 347,760 S 812,294 1. How much money has Tennyson Investments borrowed for this project based on a 70% loan-to-value ratio? 2. What is the maximum amount available for debt service in the first year if the lender requires a 1.25 debt service coverage ratio? 3. Utilizing the debt service payment calculated in the previous question, calculate the ideal amortization rate for the first mortgage at the 6.4% annual interest rate. 4. Tennyson Investments has hired Geoff Strips Management Co. to operate the hotel. The Strips Co. has negotiated a 10% equity kicker on the sale of the property if the hotel meets or exceeds projected cash flows. If the property is sold in Year 5, what dollar amount would Geoff Strips Management receive? Utilize the capitalization rate method of valuation based on a 10% cap rate. 5. Calculate the NPV for this project based on a 12% cost of capital. What is the IRR? + o Mail - Boudrea x W Week #15: Dec X Agnes L DeFrex C Home Chegg. x C Get Homework X C Solved: Chapte x Trash - Google x E Chapter 9 HW X + + e File /Users/kaitlynboudreau/Downloads/HMGT655%20Chapter%209.pdf K Update Agnes_L_DeFranco_Thomas_W_Lattin_Hospit (1).pdf 38 / 39 The Tennyson Borrowing Power Tennyson Investments, a hotel investment company, has identified a potential midscale branded hotel prospect located in a major metropolitan area. The Mason Hotel, a franchised property, is on the market, and the owners are looking to sell the asset quickly because they need cash to invest in other projects they currently own and operate. The Mason Hotel is located next to a miscale limited-service hotel, across the street from a historic conference center and an upscale full-service hotel and adjacent to a new major-league baseball stadium. The property consists of a 124-room full-service hotel with a leased restaurant, a forty-space parking garage in the basement, a gift shop, an exercise room, and meeting rooms. The property is currently being marketed at an asking price of $6.4 million. Tennyson Investments offered $5 million, which was accepted by the sellers, and has secured a new non- recourse first mortgage with a 6.4% interest rate for 70% of the total project cost of $5,977,335. Tennyson has estimated the following cash flows for the first five years of the project. Mason Hotel Five-year Pro Forma Year 3 1 2 5 $ 1,886,850 $ 7,980 $ 104,160 $ 101,010 $ 2.100,000 $ 2.216.610 $ 8.160 $ 106.800 $ 68.400 $ 2.400.000 S 2,362,320 $ 8,415 S 109,395 $ 69,870 S 2,550,000 $ 2.454.960 $ 8.745 $ 113,685 $ 72,610 $ 2,650.000 S 2,501,280 S 8,910 S 115,830 S 73,980 $ 2,700,000 Revenues Ruoms Telephone Restaurant lease Oth Other income Gross income Departmental expenses Rooms Telephone Restaurant utilities Other Total departmental expenses Gross operating income + $ 547,941 $ 32,696 $ 30,133 $ 0.00 $ 610,770 S 1,489,230 $ 594,946 $ 34,083 $ 31,495 $ 0.00 $ 660,524 $ 1,739,476 S 613,022 $ 35,830 $ $ 32,895 S 0.X S 681,747 S 1.968,253 $ 629,452 $ 37,959 $ 34,844 $ 0.00 $ 702,255 $ 1,947,745 5 634,074 S 39,425 S 36,197 S 0.0 S 7119,696 S 1,990,304 o Mail - Boudrea x W Week #15: Dec X Agnes L DeFrex C Home | Chegg. X C Get Homework x C Solved: Chapte X Trash - Google x E Chapter 9 HW X + + e File /Users/kaitlynboudreau/Downloads/HMGT655%20Chapter%209.pdf * K Update Agnes_L_DeFranco_Thomas_W_Lattin_Hospit (1).pdf 39 / 39 TUSVALVE WONTACTATIONS ZUD Undistributed expenses Administrative and general Franchise lee Marketing Energy Repairs and maintenance Total undistributed expenses Gross operating profit Fixed charges Management fee Real estate taxes Insurance Reserve for replacement Total fixed Net available for det $ 234,150 $ 55,230 $ 180,810 $ 103,530 $ 123,480 $ 697,200 $ 792,030 $ 275,040 $ 56,640 $ 185,520 $ 106,080 $ 134.400 $ 757.680 $ 981.796 $ 293,250 $ 57,885 $ 189,720 S 108,630 S 138,210 S 787,695 51,080,558 $ 304.750 $ 60,155 $ 197,160 $ 112,890 $ 139,655 $ $814,610 $ 1.133.135 S 310,500 5 61,290 S 20),880 S 115,020 S 142.560 S 830,250 S 1,160,054 $63,000 $ 83,580 $ 83,580 $ 63,000 $ 293,160 $ 498,870 $ 72.000 $ 85,680 $ 85.680 $ 72.000 $ 315,360 $ 666,436 $ 76,500 S 87,720 S 87,720 S 76,500 $ 328,440 S 752,118 $ 79,500 $ 91,160 $ 91,160 $ 79.500 $ 341,320 $ 791,815 SRI, S 92.880 S 92,880 S 81,000 S 347,760 S 812,294 1. How much money has Tennyson Investments borrowed for this project based on a 70% loan-to-value ratio? 2. What is the maximum amount available for debt service in the first year if the lender requires a 1.25 debt service coverage ratio? 3. Utilizing the debt service payment calculated in the previous question, calculate the ideal amortization rate for the first mortgage at the 6.4% annual interest rate. 4. Tennyson Investments has hired Geoff Strips Management Co. to operate the hotel. The Strips Co. has negotiated a 10% equity kicker on the sale of the property if the hotel meets or exceeds projected cash flows. If the property is sold in Year 5, what dollar amount would Geoff Strips Management receive? Utilize the capitalization rate method of valuation based on a 10% cap rate. 5. Calculate the NPV for this project based on a 12% cost of capital. What is the IRR? +