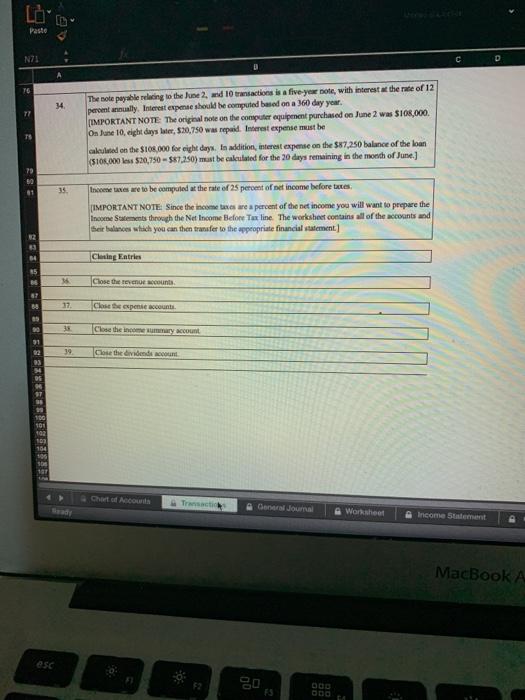

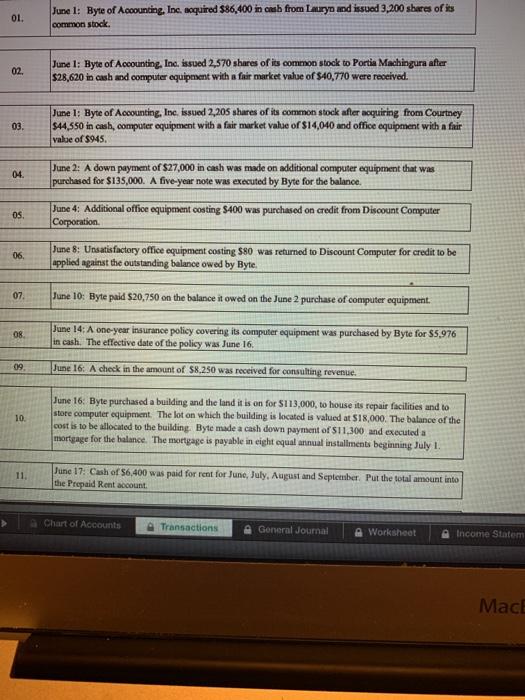

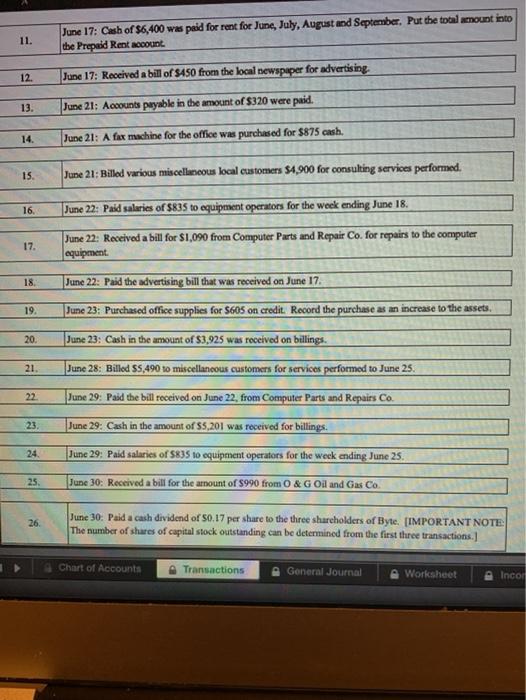

Paste N7 TO 34 T7 The note payable relating to the June 2, and 10 transactions is a five-yek note, with interest at the rate of 12 percentually. Interest expense should be computed based on a 360 day your [IMPORTANT NOTE The original note on the computer equipment purchased on June 2 was $100,000 On June 10, eight days later, 520.750 was repaid. Interest expense must be calculated on the $10,000 for eight days. In addition, interest expense on the $87,250 balance of the loan (5105,000 520,750 - $87,290) must be calculated for the 20 days remaining in the month of June.) 79 59 35 Income taxes are to be computed at the rate of 25 percent of set income before tates (IMPORTANT NOTE: Since the income taxes are a percent of the net income you will want to prepare the Income Statements through the Net Income Before Tex line. The worksheet contains all of the accounts and Set balances which you can then transfer to the appropriate financial statement 84 Closing Entries 85 86 35 Close the counts 38 17 Close the expense counts Close the income my account 19 01 92 03 94 Close the dividendi con 104 102 100 154 105 101 Chart Account Journal Worksheet Income Statement MacBook A 80 01. June 1: Byte of Accounting. Inc. acquired $86,400 in cash from Lauryn and issued 3,200 shares of its common stock 02. June 1: Byte of Accounting, Inc. issued 2,570 shares of its common stock to Portia Machingura after $28,620 in cash and computer equipment with a fair market value of $40,770 were received. 03. June 1: Byte of Accounting, Inc. issued 2,205 shares of its common stock after acquiring from Courtney $44,550 in cash, computer equipment with a fair market value of $14,040 and office equipment with a fair value of $945 04. June 2: A down payment of $27,000 in cash was made on additional computer equipment that was purchased for $135,000. A five-year note was executed by Byte for the balance OS. June 4: Additional office equipment costing $400 was purchased on credit from Discount Computer Corporation 06 June 8: Unsatisfactory office equipment costing $80 was returned to Discount Computer for credit to be applied against the outstanding balance owed by Byte 07 June 10: Byte paid $20,750 on the balance it owed on the June 2 purchase of computer equipment. 08 June 14: A one-year insurance policy covering its computer equipment was purchased by Byte for $5,976 in cash. The effective date of the policy was June 16. 09 June 16 A check in the amount of $8.250 was received for consulting revenue. 10. June 16: Byte purchased a building and the land it is on for 5113,000, to house its repair facilities and to store computer equipment. The lot on which the building is located is valued at $18,000. The balance of the cost is to be allocated to the building. Byte made a cash down payment of $11,300 and executed a mortgage for the balance. The mortgage is payable in eight equal annual installments beginning July 1 11 June 17: Cash of $6,400 was paid for rent for June July August and September. Put the total amount into the Prepaid Rent account Chart of Accounts Transactions General Journal Worksheet Income Statem Mac 11. June 17: Cash of $6,400 was paid for rent for June July August and September. Put the total amount into the Prepaid Rent account 12 June 17: Received a bill of S450 from the local newspaper for advertising 13. June 21: Accounts payable in the amount of $320 were paid. 14. June 21: A fax machine for the office was purchased for $875 cash. 15. June 21: Billed various miscellaneous local customers 54,900 for consulting services performed. 16 June 22: Paid salaries of $835 to equipment operators for the week ending June 18. 17. June 22: Received a bill for $1,090 from Computer Parts and Repair Co. for repairs to the computer equipment 18 June 22: Paid the advertising bill that was received on June 17. 19. June 23: Purchased office supplies for 5605 on credit. Record the purchase as an increase to the assets. 20. June 23: Cash in the amount of $3,925 was received on billings. 21 June 28: Billod 55,490 10 miscellaneous customers for services performed to June 25. 22 June 29: Paid the bill received on June 22. from Computer Parts and Repairs Co. 23. June 29: Cash in the amount of 55,201 was received for billings. 24 June 29: Paid salaries of 5835 to equipment operators for the week ending June 25. 25. June 30: Received a bill for the amount of $990 from O & G Oil and Gas Co. 26 June 30 Paid a cash dividend of 50.17 per share to the three shareholders of Byte [IMPORTANT NOTE The number of shares of capital stock outstanding can be determined from the first three transactions Chart of Accounts Transactions General Journal Worksheet Incol