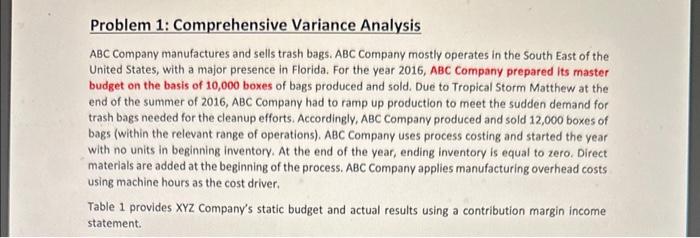

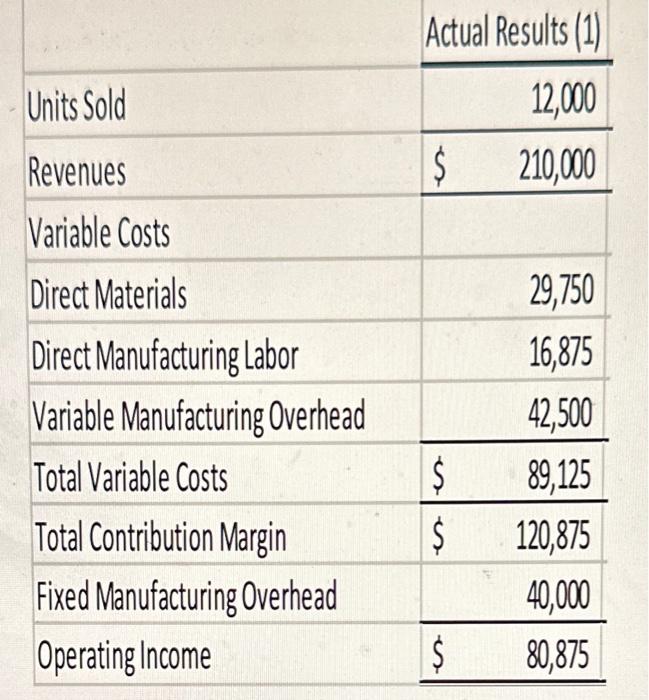

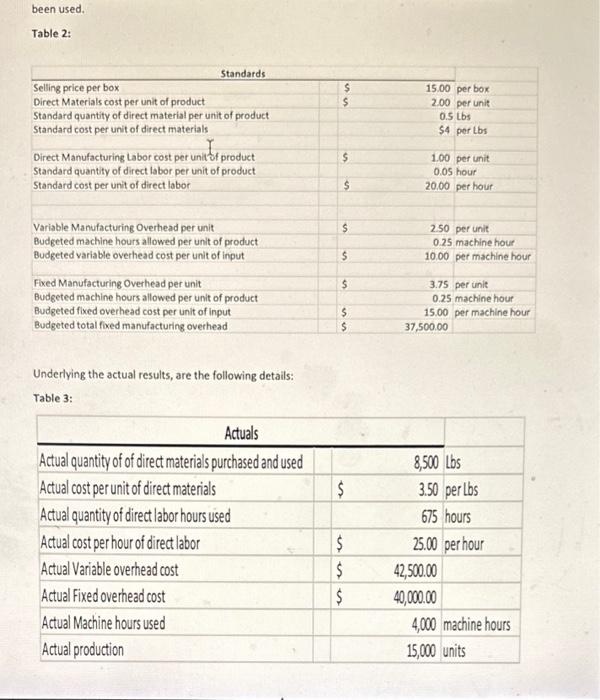

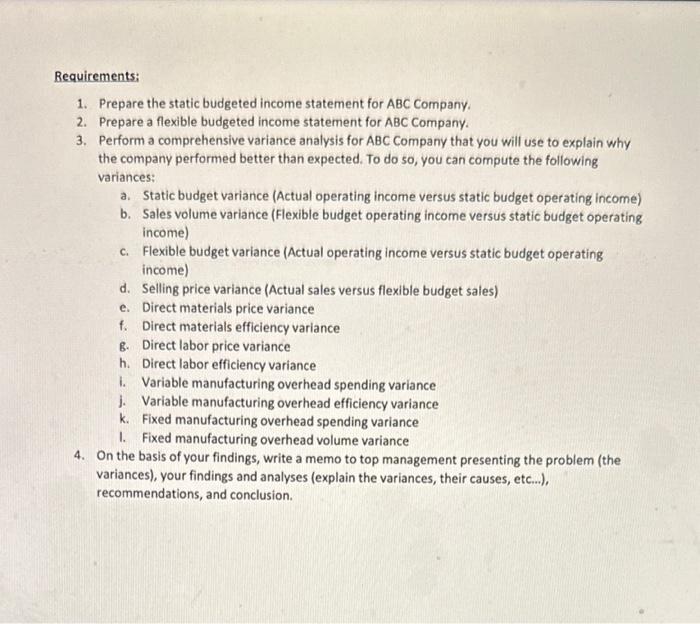

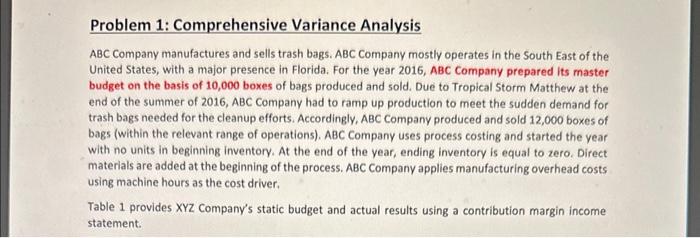

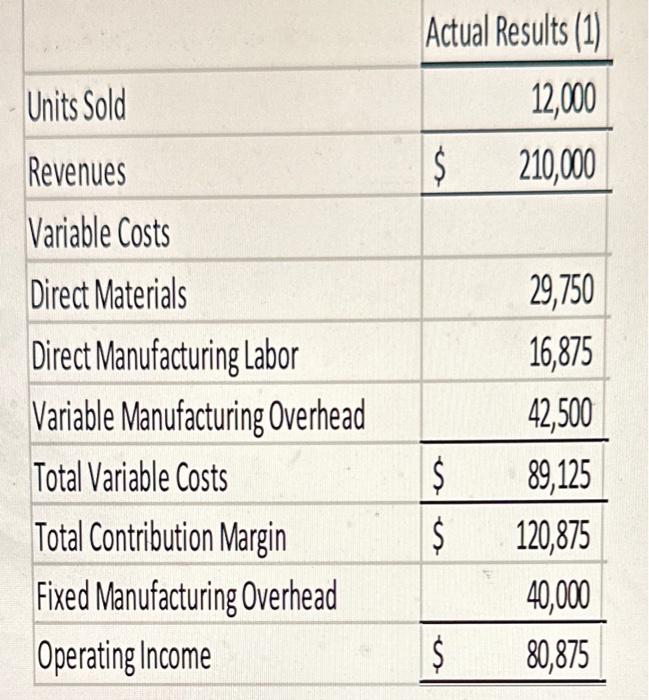

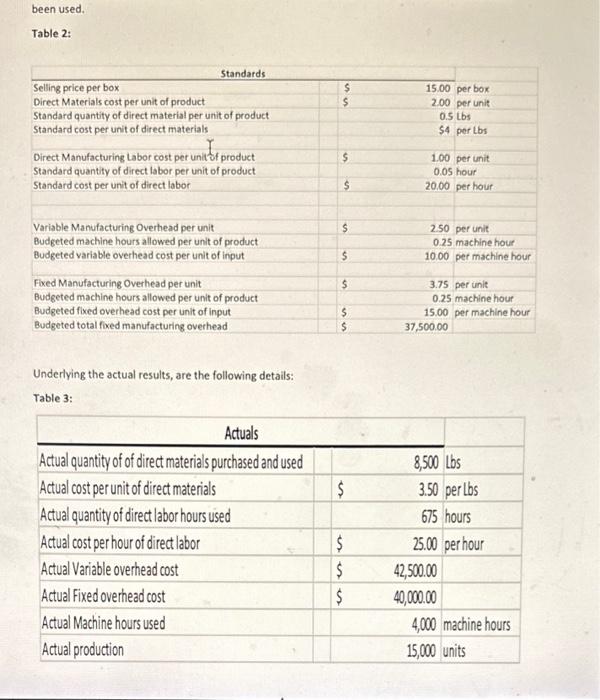

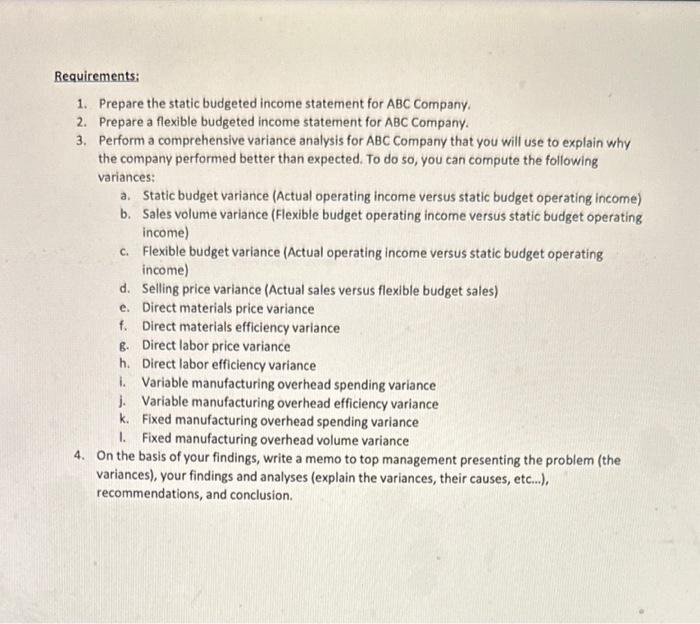

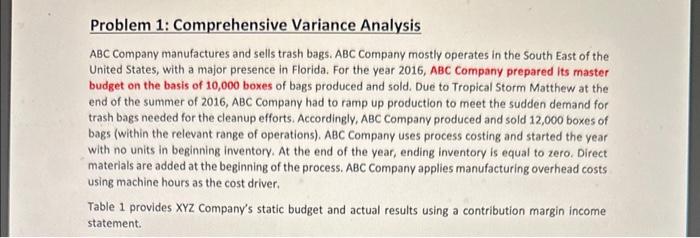

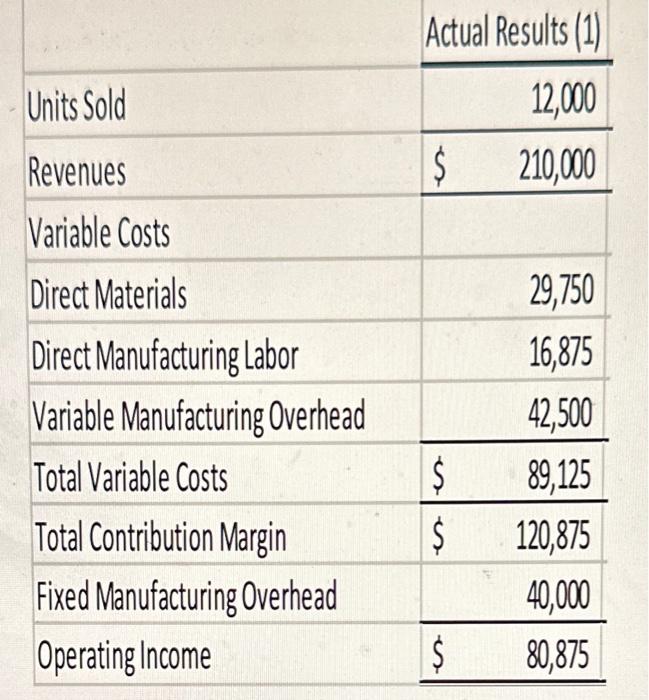

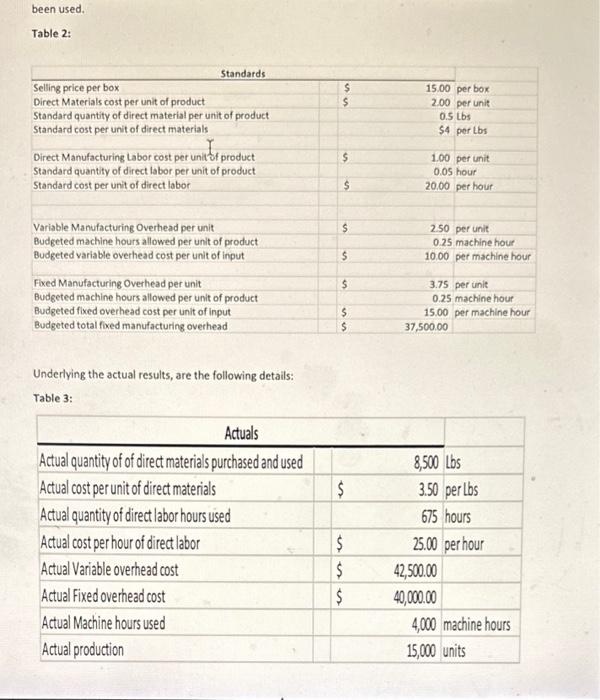

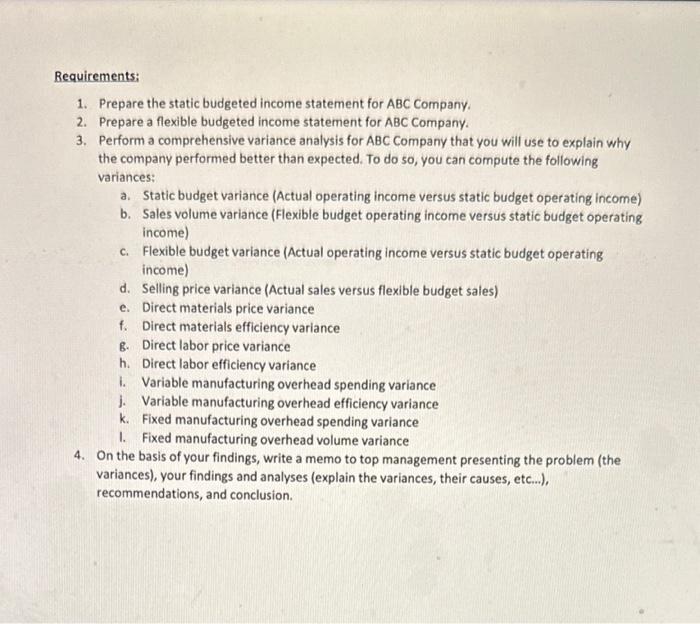

Problem 1: Comprehensive Variance Analysis ABC Company manufactures and sells trash bags. ABC Company mostly operates in the South East of the United States, with a major presence in Florida. For the year 2016, ABC Company prepared its master budget on the basis of 10,000 boxes of bags produced and sold. Due to Tropical Storm Matthew at the end of the summer of 2016, ABC Company had to ramp up production to meet the sudden demand for trash bags needed for the cleanup efforts. Accordingly. ABC Company produced and sold 12,000 boxes of bags (within the relevant range of operations). ABC Company uses process costing and started the year with no units in beginning inventory. At the end of the year, ending inventory is equal to zero. Direct materials are added at the beginning of the process. ABC Company applies manufacturing overhead costs using machine hours as the cost driver. Table 1 provides XYZ Company's static budget and actual results using a contribution margin income statement. Underlying the actual results, are the following details: Table 3: Requirements: 1. Prepare the static budgeted income statement for ABC Company. 2. Prepare a flexible budgeted income statement for ABC Company. 3. Perform a comprehensive variance analysis for ABC Company that you will use to explain why the company performed better than expected. To do so, you can compute the following variances: a. Static budget variance (Actual operating income versus static budget operating income) b. Sales volume variance (Flexible budget operating income versus static budget operating income) c. Flexible budget variance (Actual operating income versus static budget operating income) d. Selling price variance (Actual sales versus flexible budget sales) e. Direct materials price variance f. Direct materials efficiency variance g. Direct labor price variance h. Direct labor efficiency variance i. Variable manufacturing overhead spending variance j. Variable manufacturing overhead efficiency variance k. Fixed manufacturing overhead spending variance I. Fixed manufacturing overhead volume variance 4. On the basis of your findings, write a memo to top management presenting the problem (the variances), your findings and analyses (explain the variances, their causes, etc...), recommendations, and conclusion