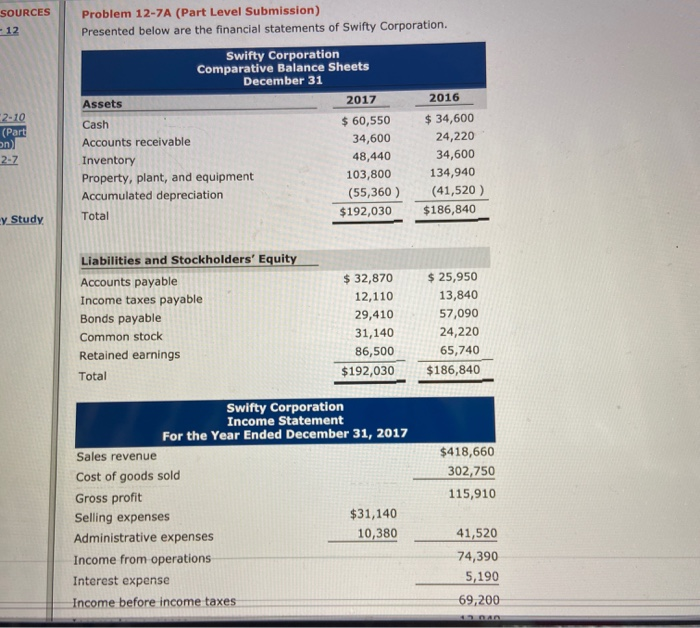

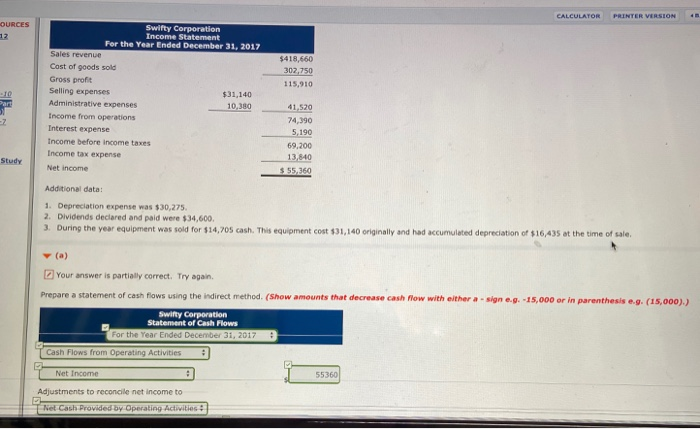

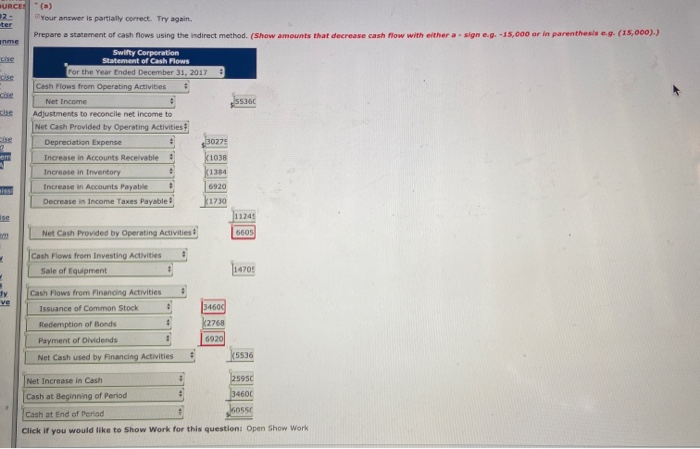

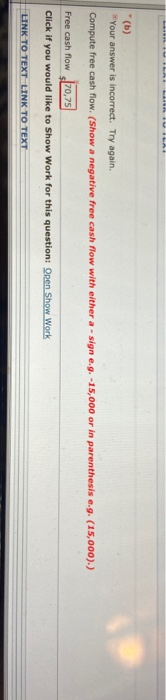

Problem 12-7A (Part Level Submission) Presented below are the financial statements of Swifty Corporation. SSURCES -12 Swifty Corporation Comparative Balance Sheets December 31 2016 2017 Assets $ 34,600 2-10 (Part on) 2-7 $ 60,550 34,600 Cash 24,220 Accounts receivable 34,600 48,440 Inventory 134,940 103,800 Property, plant, and equipment (41,520 ) (55,360 ) Accumulated depreciation $186,840 $192,030 Total y Study Liabilities and Stockholders' Equity $ 32,870 $ 25,950 Accounts payable 13,840 12,110 Income taxes payable 57,090 29,410 Bonds payable 24,220 31,140 Common stock 65,740 86,500 Retained earnings $192,030 $186,840 Total Swifty Corporation Income Statement For the Year Ended December 31, 2017 $418,660 Sales revenue 302,750 Cost of goods sold 115,910 Gross profit $31,140 Selling expenses 10,380 41,520 Administrative expenses 74,390 Income from operations 5,190 Interest expense 69,200 Income before income taxes CALCULATOR PRINTER VERSION OURCES Swifty Corporation Income Statement For the Year Ended December 31, 2017 12 Sales revenue $418,660 Cost of goods sold 302,750 Gross profit Selling expenses 115,910 $31,140 Part Administrative expenses 10,380 41.520 Income from operations 74,390 Interest expense 5,190 Income before income taxes 69,200 Income tax expense 13,840 Study Net income $ 55,360 Additional data: 1. Depreciation expense was $30,275. 2. Dividends declared and paid were $34,600. 3. During the year equipment was sold for $14,705 cash. This equipment cost $31,140 originally and had accumulated depreciation of $16,435 at the time of sale. v (a) 2 Your answer is partially correct. Try again. Prepare a statement of cash flows using the indirect method. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).) Swity Corporation Statement of Cash Flows For the Year Ended December 31, 2017 Cash Flows from Operating Activities Net Income 55360 Adjustments to reconcile net income to Net Cash Provided by Operating Activities : BURCE (a) BYour answer is partially correct. Try again. ter Prepare a statement of cash flows using the indirect method. (Show amounts that decrease cash flow with either a- sign e.g. -15,000 or in parenthesis e.g. (15,000).) nme Swifty Corporation Statement of Cash Flows cise For the Year Ended December 31, 2017 cise Cesh Flows from Operating Activities cise ss360 Net Income ise Adjustments to reconcile net income to Net Cash Provided by Operating Activities cise 30275 Depreciation Expense k1038 em Increase in Accounts Receivable k1384 Increase in tnventory Increase in Accounts Payable 6920 siss Decrease in Income Taxes Payable k1730 11245 ise 6605 Net Cash Provided by Operating Activities Cash Flows from Investing Activities 1470 Sale of Equipment Cash Flows from Financing Activities dy ve 34600 Issuance of Common Stock k2768 Redemption of Bonds 6920 Payment of Dividends k5536 Net Cash used by Financing Activities 2595C Net Increase in Cash 34600 Cash at Beginning of Period Jknsse Cash at End of Periad Click if you would like to Show Work for this question: Open Show Work *(b) Your answer is incorrect. Try again. Compute free cash flow. (Showa negative free cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).) Free cash flow 70,75 Click if you would like to Show Work for this question: QRen Show Work LINK TO TEXT LINK TO TEXT