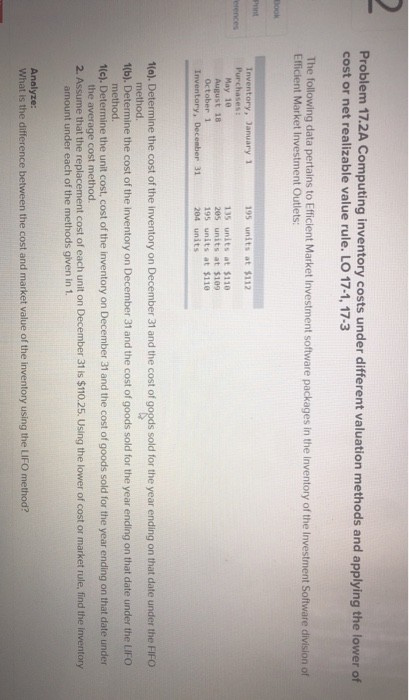

Problem 17.2A Computing inventory costs under different valuation methods and applying the lower of cost or net realizable value rule. LO 17-1, 17-3 The following data pertains to Efficient Market Investment software packages in the inventory of the Investment Software division of Efficient Market Investment Outlets: Book 195 units at $112 Inventory, January 1 Purchases May 10 August 18 October 1 Inventory, December 31 135 units at $110 205 units at $109 195 units at $110 204 units 1(a). Determine the cost of the inventory on December 31 and the cost of goods sold for the year ending on that date under the FIFO method. 1(b). Determine the cost of the inventory on December 31 and the cost of goods sold for the year ending on that date under the LIFO method. 1(c). Determine the unit cost, cost of the inventory on December 31 and the cost of goods sold for the year ending on that date under the average cost method. 2. Assume that the replacement cost of each unit on December 31 is $110.25. Using the lower of cost or market rule, find the inventory amount under each of the methods given in 1. Analyze: What is the difference between the cost and market value of the inventory using the LIFO method? Problem 17.2A Computing inventory costs under different valuation methods and applying the lower of cost or net realizable value rule. LO 17-1, 17-3 The following data pertains to Efficient Market Investment software packages in the inventory of the Investment Software division of Efficient Market Investment Outlets: Book 195 units at $112 Inventory, January 1 Purchases May 10 August 18 October 1 Inventory, December 31 135 units at $110 205 units at $109 195 units at $110 204 units 1(a). Determine the cost of the inventory on December 31 and the cost of goods sold for the year ending on that date under the FIFO method. 1(b). Determine the cost of the inventory on December 31 and the cost of goods sold for the year ending on that date under the LIFO method. 1(c). Determine the unit cost, cost of the inventory on December 31 and the cost of goods sold for the year ending on that date under the average cost method. 2. Assume that the replacement cost of each unit on December 31 is $110.25. Using the lower of cost or market rule, find the inventory amount under each of the methods given in 1. Analyze: What is the difference between the cost and market value of the inventory using the LIFO method