Answered step by step

Verified Expert Solution

Question

1 Approved Answer

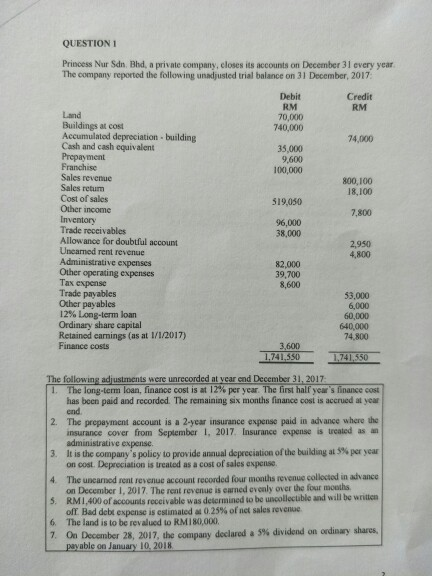

QUESTION 1 Princess Nur Sdn Bhd, a private company, closes its accounts on December 31 every year The company reported the following unadjusted trial balance

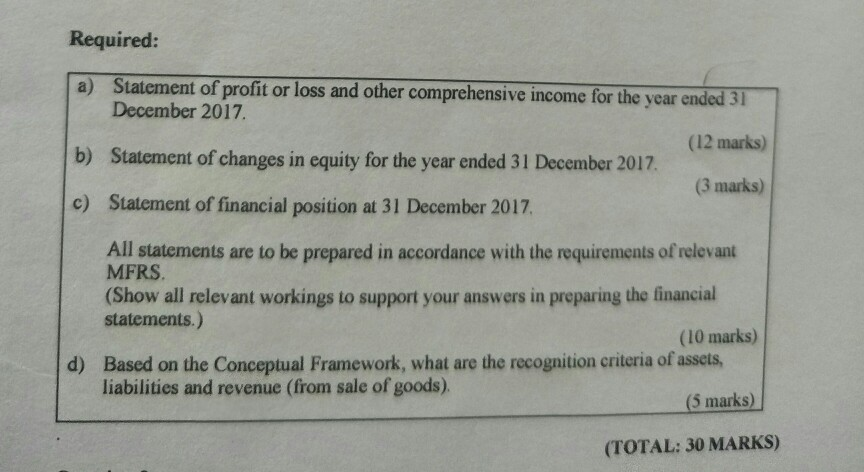

QUESTION 1 Princess Nur Sdn Bhd, a private company, closes its accounts on December 31 every year The company reported the following unadjusted trial balance on 31 December, 2017 Debit RM 70.000 740,000 Credit RM 74,000 35,000 9,600 100,000 800,100 18,100 519,050 7,800 Land Buildings at cost Accumulated depreciation building Cash and cash equivalent Prepayment Franchise Sales revenue Sales retum Cost of sales Other income Inventory Trade receivables Allowance for doubtful account Uneamed rent revenue Administrative expenses Other operating expenses Tax expense Trade payables Other payables 12% Long-term loan Ordinary share capital Retained carings (as at 1/1/2017) Finance costs 96,000 38,000 2,950 4,800 82,000 39,700 8,600 53.000 6.000 60.000 640.000 74.800 3,600) 1,741.550 1.741.350 The following adjustments were unrecorded at year end December 31, 2017 1 The long-term loan, finance cost is at 12% per year. The first half year's finance cost has been paid and recorded. The remaining six months finance cost is accrued alvear end 2. The prepayment account is a 2-year insurance expense paid in advance where the insurance cover from September 1, 2017 Insurance expense is treated as an administrative expense. 3. It is the company's policy to provide annual depreciation of the building at $ per year on cost. Depreciation is treated as a cost of sales experts The uncanned rent revenue account recorded four months revenue collected in advance on December 1, 2017. The rent revenue is earned evenly over the four months RM1,400 of accounts receivable was determined to be uncollectable and will be written ofl. Bad debt expense is estimated at 0.25% of net sales revenue 6. The land is to be revalued to RM180,000 7. On December 28, 2017, the company declared a 5% dividend on ordinary shares payable on January 10, 2018 Required: a) Statement of profit or loss and other comprehensive income for the year ended 31 December 2017 (12 marks) b) Statement of changes in equity for the year ended 31 December 2017, (3 marks) c) Statement of financial position at 31 December 2017 All statements are to be prepared in accordance with the requirements of relevant MFRS. (Show all relevant workings to support your answers in preparing the financial statements.) (10 marks) d) Based on the Conceptual Framework, what are the recognition criteria of assets, liabilities and revenue (from sale of goods). (5 marks) (TOTAL: 30 MARKS)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started