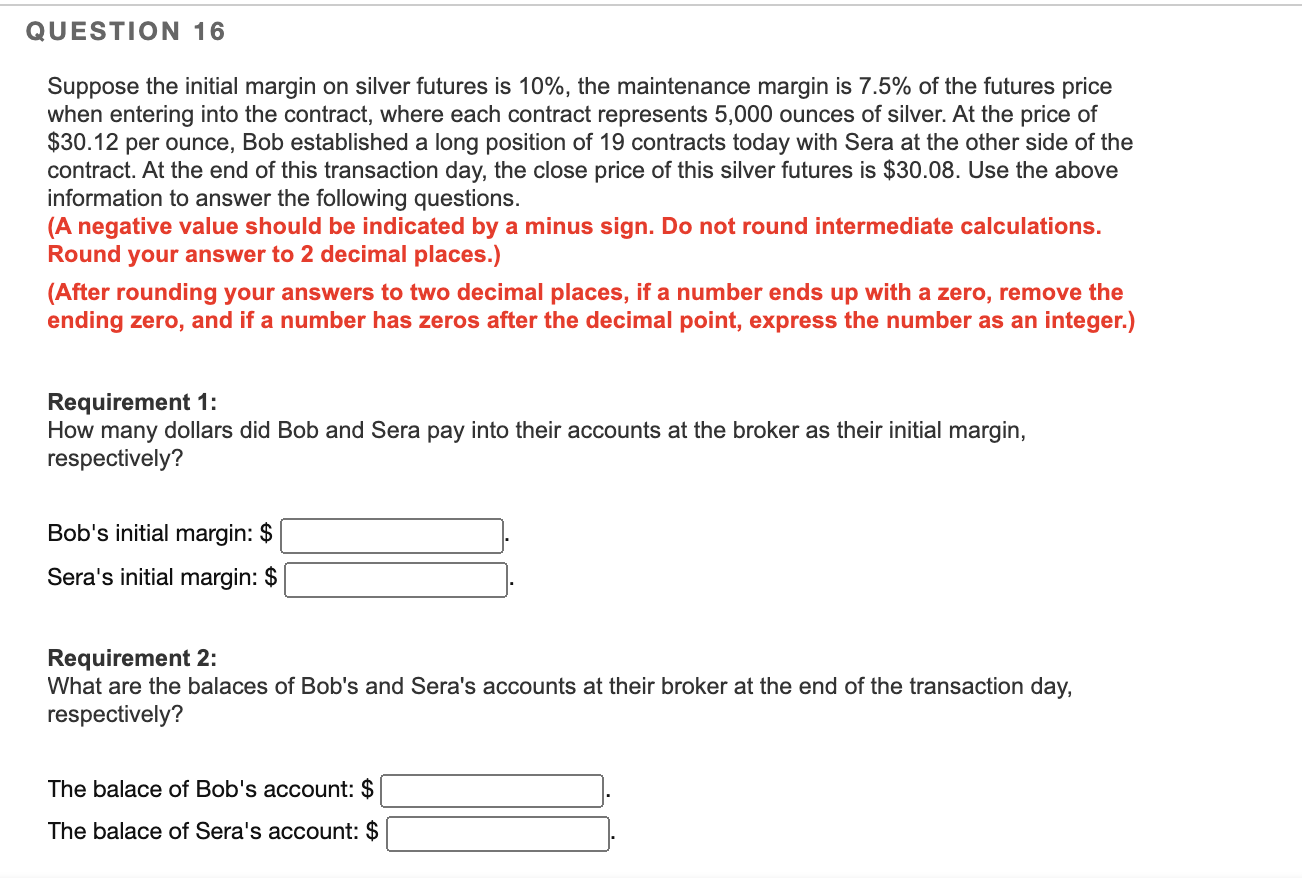

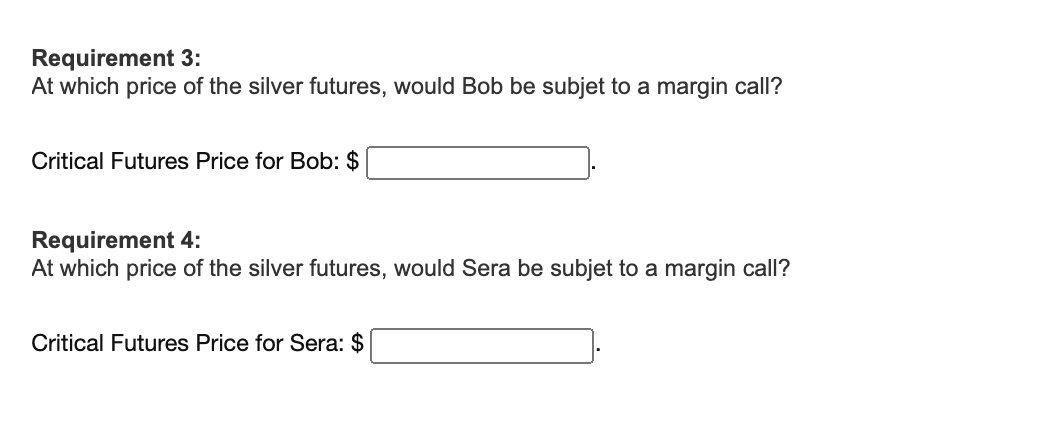

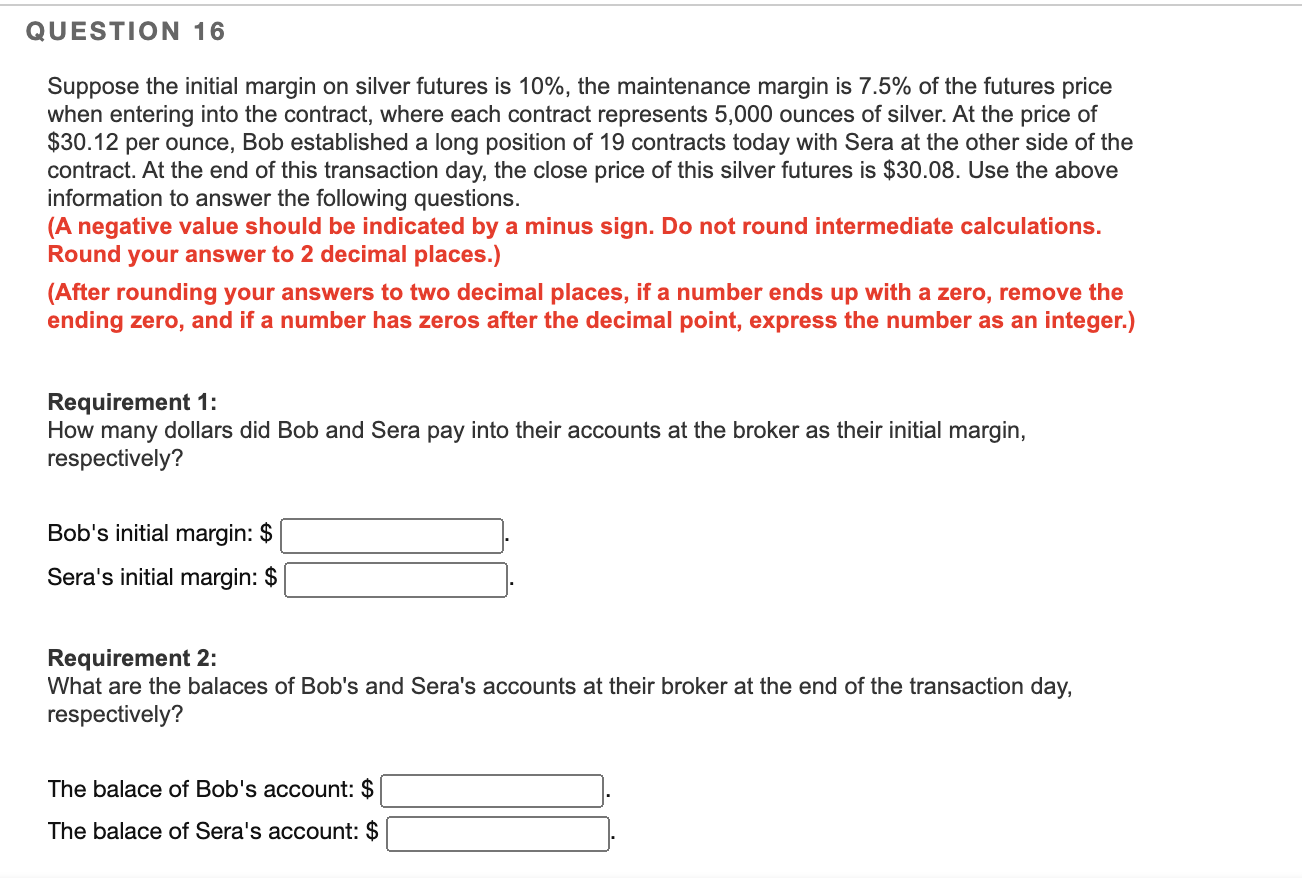

QUESTION 16 Suppose the initial margin on silver futures is 10%, the maintenance margin is 7.5% of the futures price when entering into the contract, where each contract represents 5,000 ounces of silver. At the price of $30.12 per ounce, Bob established a long position of 19 contracts today with Sera at the other side of the contract. At the end of this transaction day, the close price of this silver futures is $30.08. Use the above information to answer the following questions. (A negative value should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to 2 decimal places.) (After rounding your answers to two decimal places, if a number ends up with a zero, remove the ending zero, and if a number has zeros after the decimal point, express the number as an integer.) Requirement 1: How many dollars did Bob and Sera pay into their accounts at the broker as their initial margin, respectively? Bob's initial margin: $ Sera's initial margin: $ Requirement 2: What are the balaces of Bob's and Sera's accounts at their broker at the end of the transaction day, respectively? The balace of Bob's account: $ The balace of Sera's account: $ Requirement 3: At which price of the silver futures, would Bob be subjet to a margin call? Critical Futures Price for Bob: $ Requirement 4: At which price of the silver futures, would Sera be subjet to a margin call? Critical Futures Price for Sera: $ QUESTION 16 Suppose the initial margin on silver futures is 10%, the maintenance margin is 7.5% of the futures price when entering into the contract, where each contract represents 5,000 ounces of silver. At the price of $30.12 per ounce, Bob established a long position of 19 contracts today with Sera at the other side of the contract. At the end of this transaction day, the close price of this silver futures is $30.08. Use the above information to answer the following questions. (A negative value should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to 2 decimal places.) (After rounding your answers to two decimal places, if a number ends up with a zero, remove the ending zero, and if a number has zeros after the decimal point, express the number as an integer.) Requirement 1: How many dollars did Bob and Sera pay into their accounts at the broker as their initial margin, respectively? Bob's initial margin: $ Sera's initial margin: $ Requirement 2: What are the balaces of Bob's and Sera's accounts at their broker at the end of the transaction day, respectively? The balace of Bob's account: $ The balace of Sera's account: $ Requirement 3: At which price of the silver futures, would Bob be subjet to a margin call? Critical Futures Price for Bob: $ Requirement 4: At which price of the silver futures, would Sera be subjet to a margin call? Critical Futures Price for Sera: $