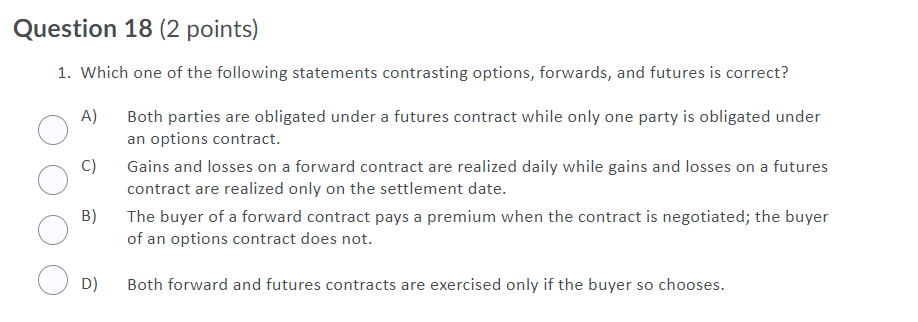

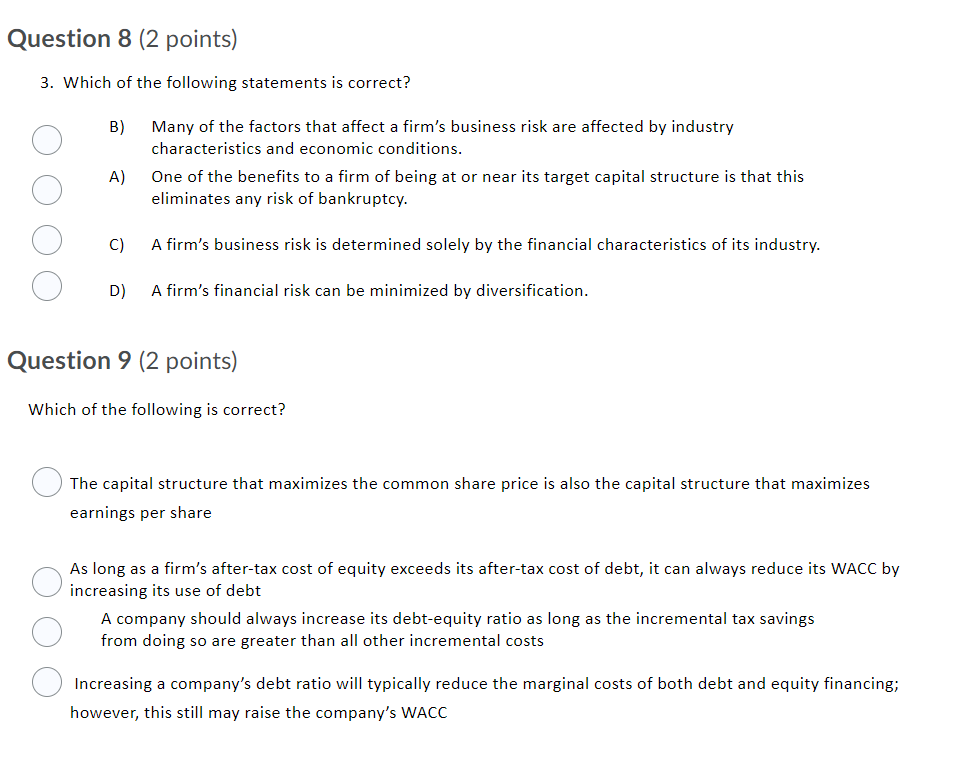

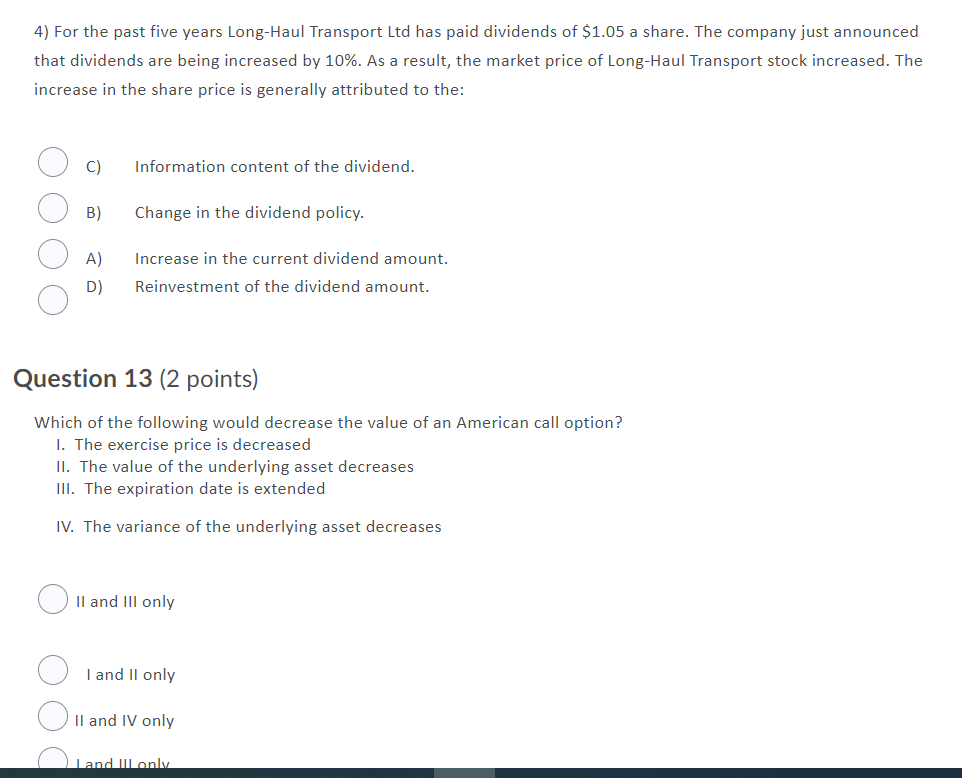

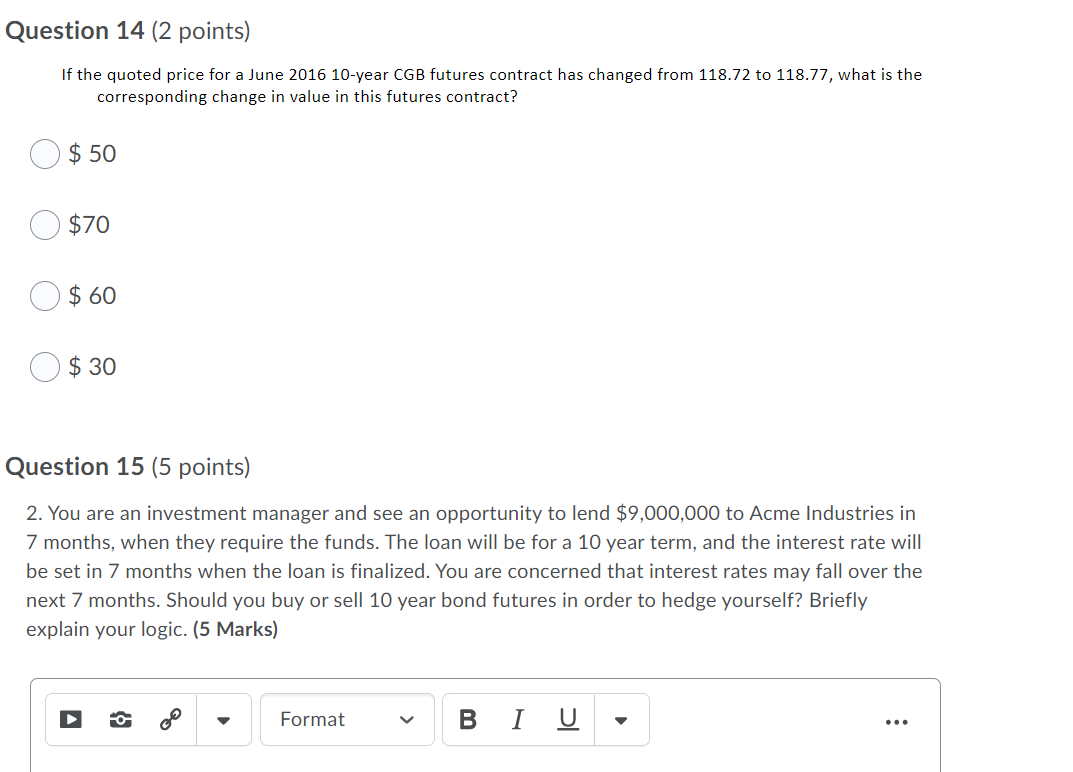

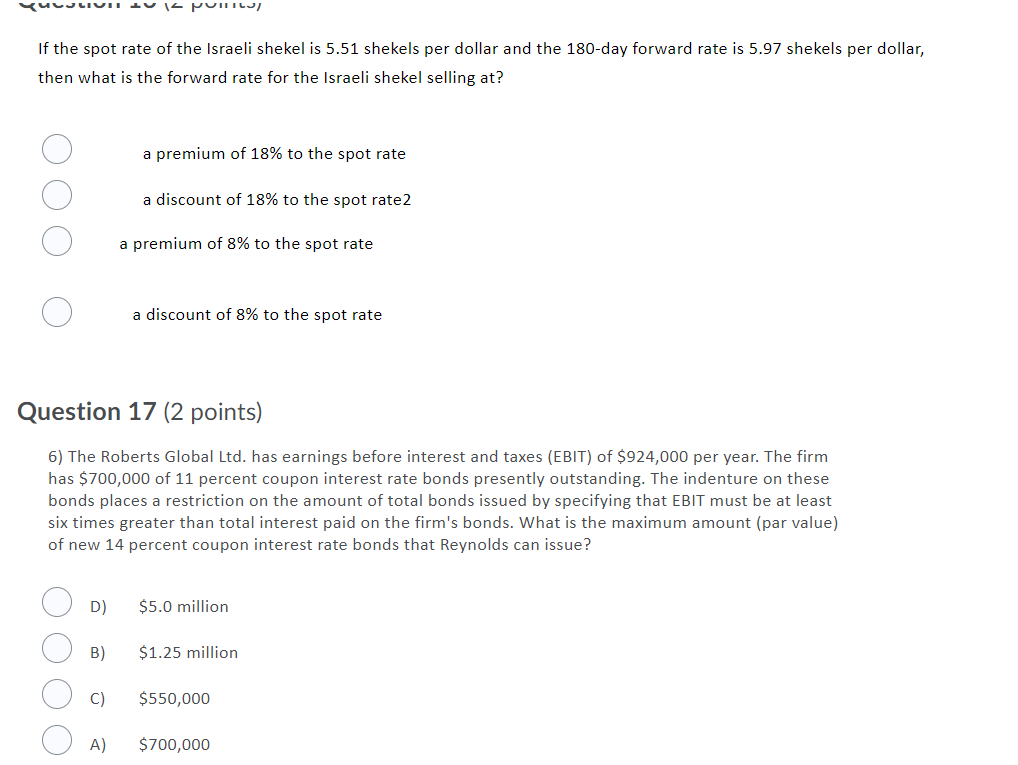

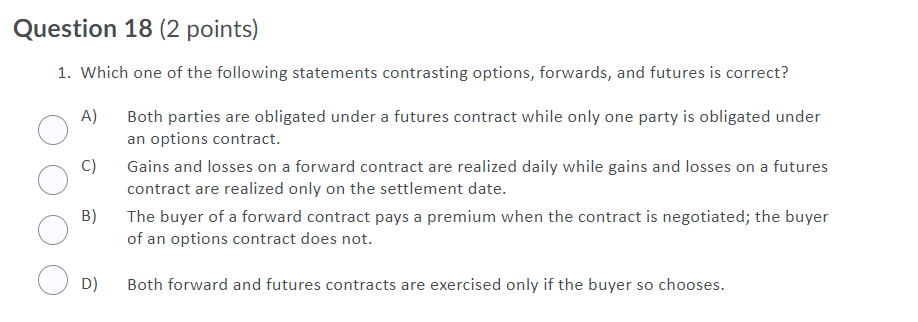

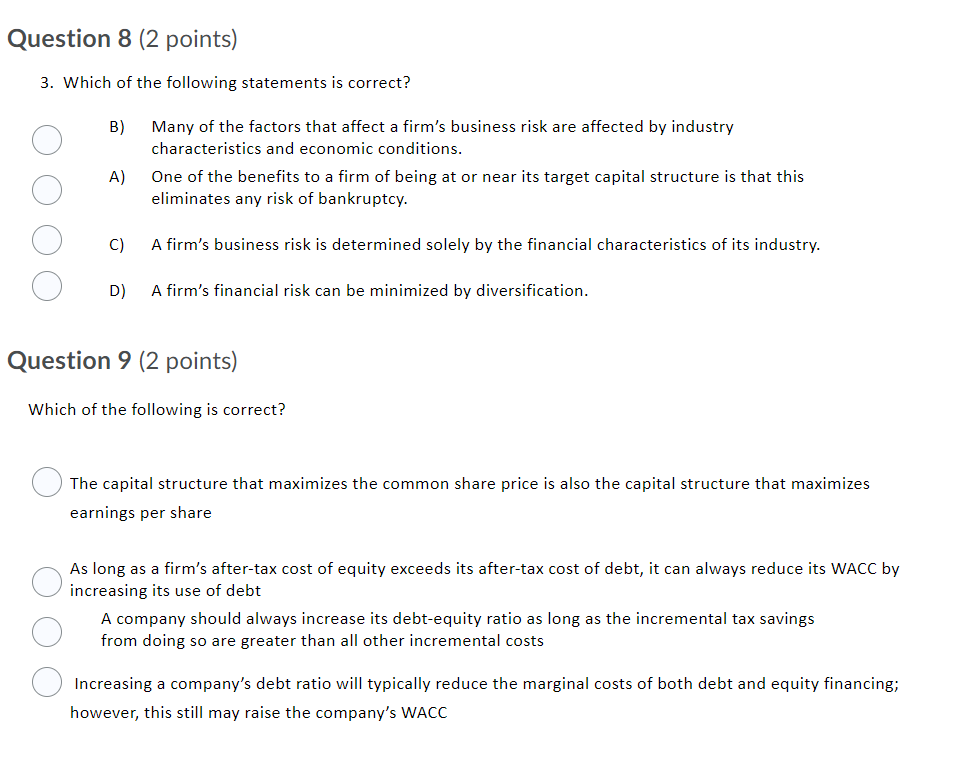

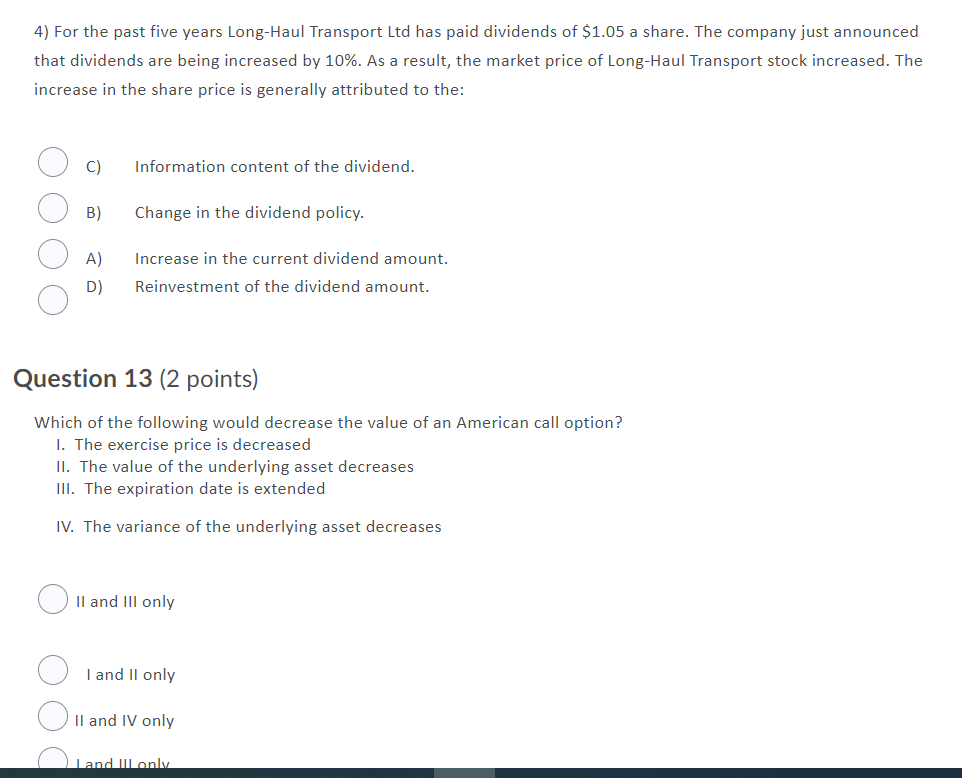

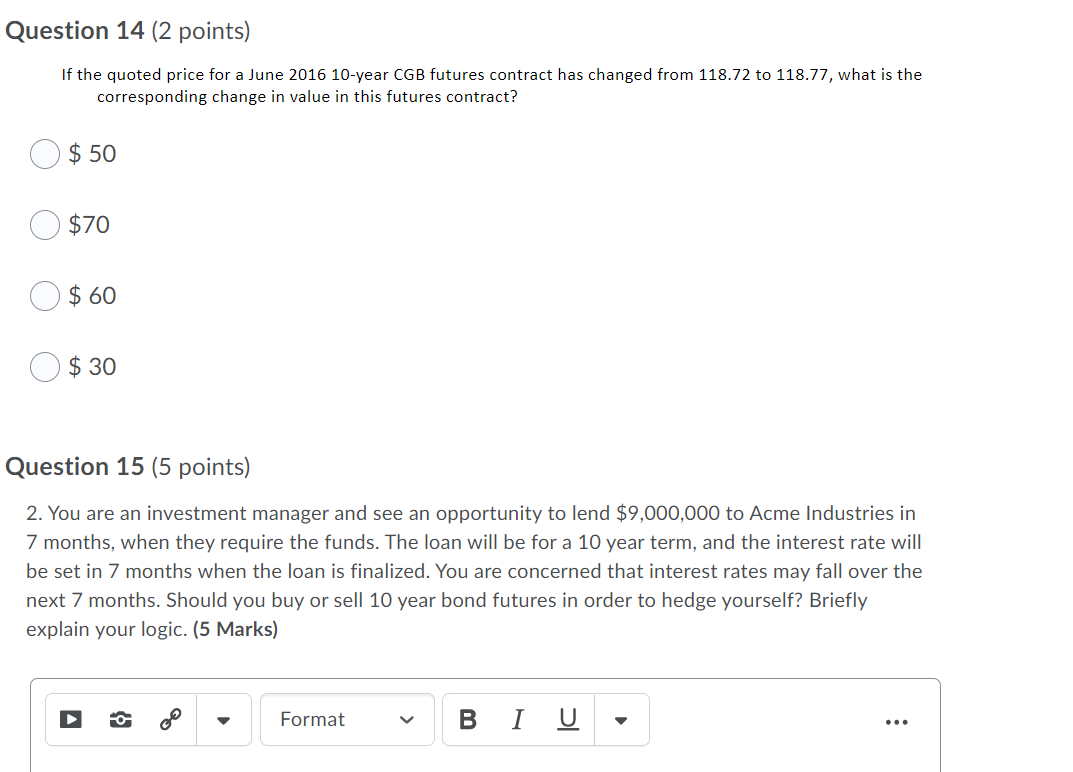

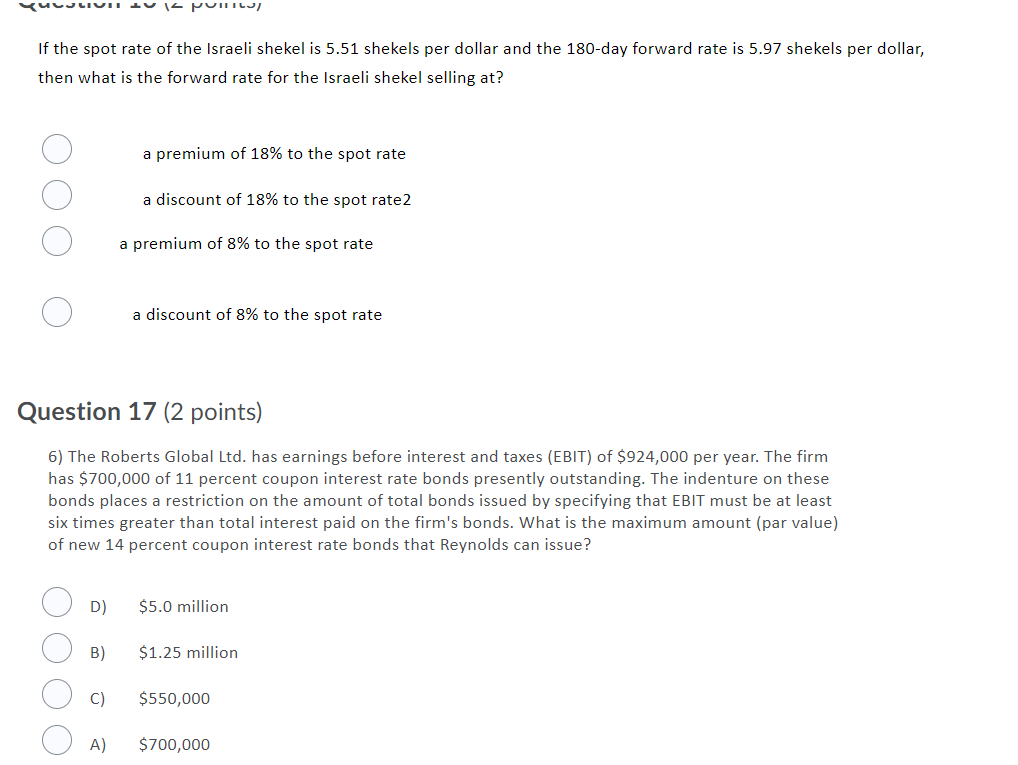

Question 18 (2 points) 1. Which one of the following statements contrasting options, forwards, and futures is correct? A) C) Both parties are obligated under a futures contract while only one party is obligated under an options contract. Gains and losses on a forward contract are realized daily while gains and losses on a futures contract are realized only on the settlement date. The buyer of a forward contract pays a premium when the contract is negotiated; the buyer of an options contract does not. B) D) Both forward and futures contracts are exercised only if the buyer so chooses. Question 8 (2 points) 3. Which of the following statements is correct? B) Many of the factors that affect a firm's business risk are affected by industry characteristics and economic conditions. One of the benefits to a firm of being at or near its target capital structure is that this eliminates any risk of bankruptcy. A) C) A firm's business risk is determined solely by the financial characteristics of its industry. D) A firm's financial risk can be minimized by diversification. Question 9 (2 points) Which of the following is correct? The capital structure that maximizes the common share price is also the capital structure that maximizes earnings per share As long as a firm's after-tax cost of equity exceeds its after-tax cost of debt, it can always reduce its WACC by increasing its use of debt A company should always increase its debt-equity ratio as long as the incremental tax savings from doing so are greater than all other incremental costs Increasing a company's debt ratio will typically reduce the marginal costs of both debt and equity financing; however, this still may raise the company's WACC 4) For the past five years Long-Haul Transport Ltd has paid dividends of $1.05 a share. The company just announced that dividends are being increased by 10%. As a result, the market price of Long-Haul Transport stock increased. The increase in the share price is generally attributed to the: C) Information content of the dividend. B) Change in the dividend policy. A) Increase in the current dividend amount. D) Reinvestment of the dividend amount. Question 13 (2 points) Which of the following would decrease the value of an American call option? 1. The exercise price is decreased II. The value of the underlying asset decreases III. The expiration date is extended IV. The variance of the underlying asset decreases II and III only I and II only Oi II and IV only Land Ill only Question 14 (2 points) If the quoted price for a June 2016 10-year CGB futures contract has changed from 118.72 to 118.77, what is the corresponding change in value in this futures contract? $ 50 $70 $ 60 $ 30 Question 15 (5 points) 2. You are an investment manager and see an opportunity to lend $9,000,000 to Acme Industries in 7 months, when they require the funds. The loan will be for a 10 year term, and the interest rate will be set in 7 months when the loan is finalized. You are concerned that interest rates may fall over the next 7 months. Should you buy or sell 10 year bond futures in order to hedge yourself? Briefly explain your logic. (5 Marks) A Format U v - PVI SI If the spot rate of the Israeli shekel is 5.51 shekels per dollar and the 180-day forward rate is 5.97 shekels per dollar, then what is the forward rate for the Israeli shekel selling at? a premium of 18% to the spot rate a discount of 18% to the spot rate2 a premium of 8% to the spot rate a discount of 8% to the spot rate Question 17 (2 points) 6) The Roberts Global Ltd. has earnings before interest and taxes (EBIT) of $924,000 per year. The firm has $700,000 of 11 percent coupon interest rate bonds presently outstanding. The indenture on these bonds places a restriction on the amount of total bonds issued by specifying that EBIT must be at least six times greater than total interest paid on the firm's bonds. What is the maximum amount (par value) of new 14 percent coupon interest rate bonds that Reynolds can issue? D) $5.0 million B) $1.25 million C) $550,000 A) $700,000