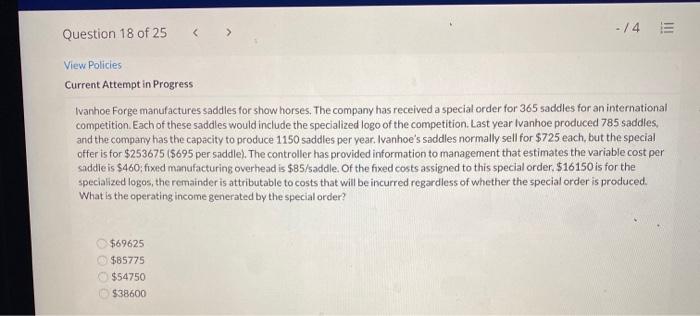

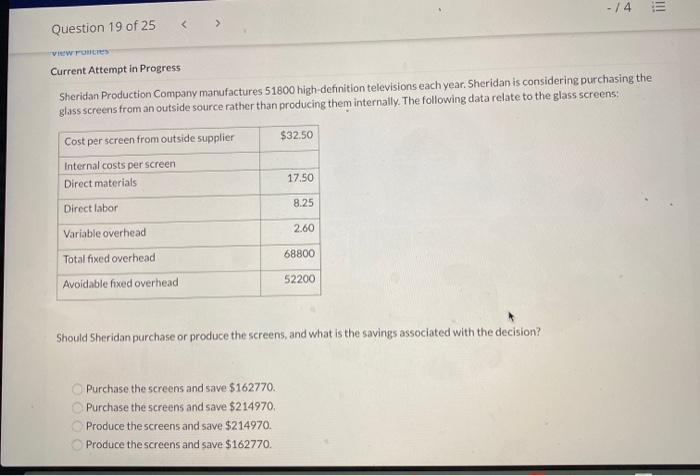

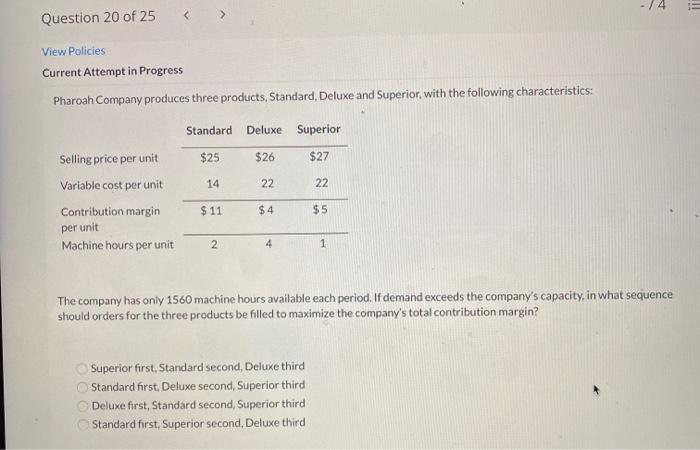

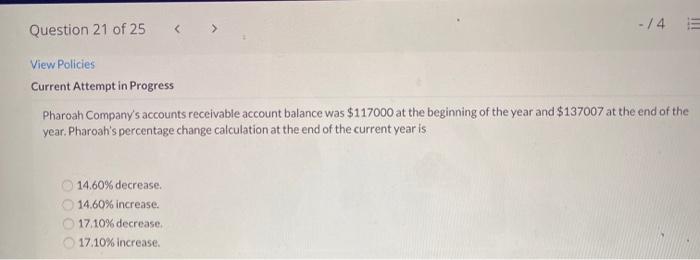

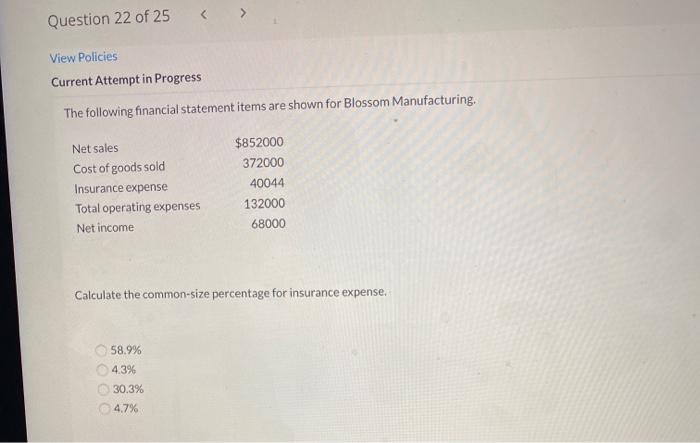

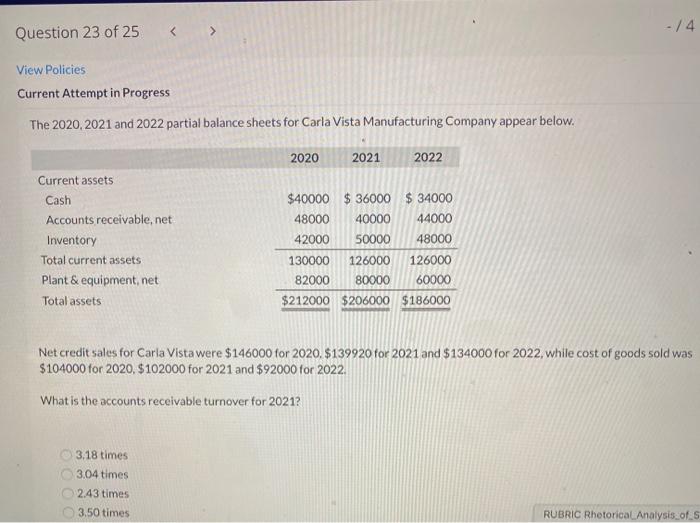

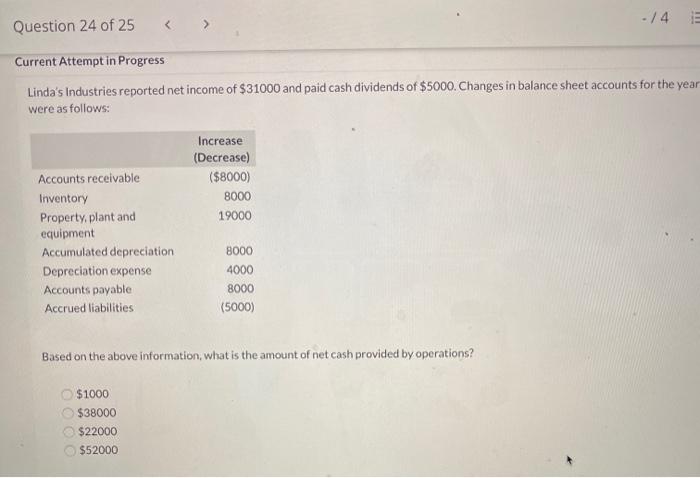

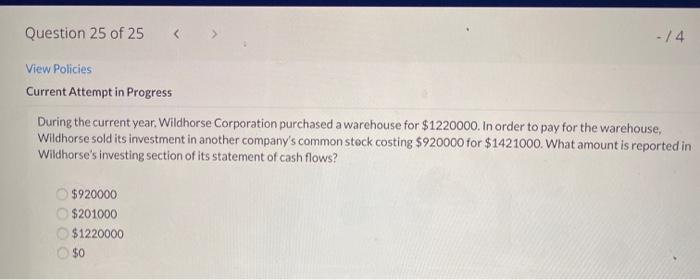

Question 18 of 25 -/4 E View Policies Current Attempt in Progress Ivanhoe Forge manufactures saddles for show horses. The company has received a special order for 365 saddles for an international competition. Each of these saddles would include the specialized logo of the competition. Last year Ivanhoe produced 785 saddles, and the company has the capacity to produce 1150 saddles per year. Ivanhoe's saddles normally sell for $725 each, but the special offer is for $253675 (5695 per saddle). The controller has provided information to management that estimates the variable cost per saddle is $460; fixed manufacturing overhead is $85/saddle. Of the fixed costs assigned to this special order. $16150 is for the specialized logos, the remainder is attributable to costs that will be incurred regardless of whether the special order is produced. What is the operating income generated by the special order? $69625 $85775 $54750 $38600 -14 III Question 19 of 25 VW Toutes Current Attempt in Progress Sheridan Production Company manufactures 51800 high-definition televisions each year. Sheridan is considering purchasing the glass screens from an outside source rather than producing them internally. The following data relate to the glass screens Cost per screen from outside supplier $32.50 Internal costs per screen Direct materials 17.50 8.25 Direct labor Variable overhead 2.60 Total fixed overhead 68800 Avoidable fixed overhead 52200 Should Sheridan purchase or produce the screens, and what is the savings associated with the decision? Purchase the screens and save $162770. Purchase the screens and save $214970. Produce the screens and save $214970. Produce the screens and save $162770. E -/4 -14 View Policies Current Attempt in Progress Pharoah Company's accounts receivable account balance was $117000 at the beginning of the year and $137007 at the end of the year. Pharoah's percentage change calculation at the end of the current year is 14.60% decrease. 14.60% increase 17.10% decrease 17.10% Increase Question 22 of 25 Si View Policies Current Attempt in Progress The following financial statement items are shown for Blossom Manufacturing, Net sales Cost of goods sold Insurance expense Total operating expenses Net income $852000 372000 40044 132000 68000 Calculate the common-size percentage for insurance expense. 58.9% 4.3% 30.3% 4.7% - 14 Question 23 of 25 View Policies Current Attempt in Progress The 2020 2021 and 2022 partial balance sheets for Carla Vista Manufacturing Company appear below. 2020 2021 2022 Current assets Cash Accounts receivable, net Inventory Total current assets Plant & equipment, net Total assets $40000 $ 36000 $ 34000 48000 40000 44000 42000 50000 48000 130000 126000 126000 82000 80000 60000 $212000 $206000 $186000 Net credit sales for Carla Vista were $146000 for 2020.$139920 for 2021 and $134000 for 2022, while cost of goods sold was $104000 for 2020, $102000 for 2021 and $92000 for 2022. What is the accounts receivable turnover for 2021? 3.18 times 3.04 times 2.43 times 3.50 times RUBRIC Rhetorical Analysis of S - 14 TI Question 24 of 25 Current Attempt in Progress Linda's Industries reported net income of $31000 and paid cash dividends of $5000. Changes in balance sheet accounts for the year were as follows: Increase (Decrease) ($8000) 8000 19000 Accounts receivable Inventory Property, plant and equipment Accumulated depreciation Depreciation expense Accounts payable Accrued liabilities 8000 4000 8000 (5000) Based on the above information, what is the amount of net cash provided by operations? $1000 $38000 $22000 $52000 Question 25 of 25 - 14 View Policies Current Attempt in Progress During the current year. Wildhorse Corporation purchased a warehouse for $1220000. In order to pay for the warehouse, Wildhorse sold its investment in another company's common stock costing $920000 for $1421000. What amount is reported in Wildhorse's investing section of its statement of cash flows? $920000 $201000 $1220000 $0