Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 4 (25 marks) (a) Tom Company is a trading company which sells components for computers. The financial controller is preparing the budget for three

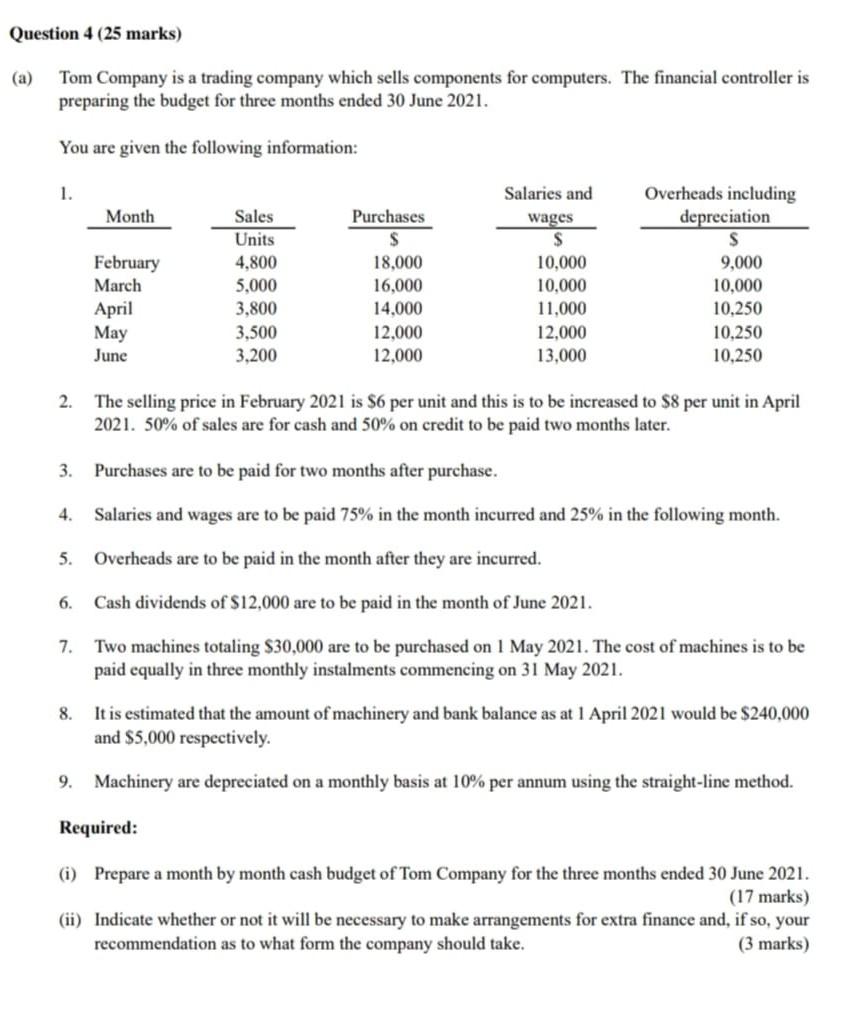

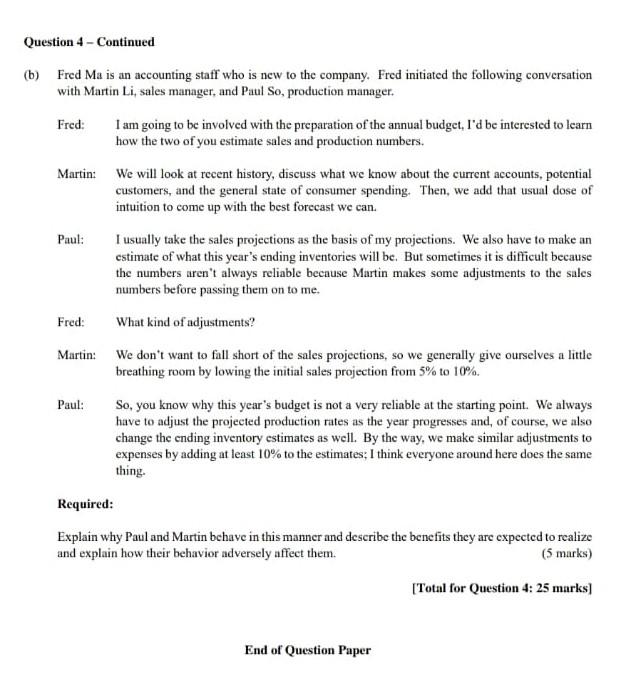

Question 4 (25 marks) (a) Tom Company is a trading company which sells components for computers. The financial controller is preparing the budget for three months ended 30 June 2021. You are given the following information: 1. Overheads including depreciation Month Purchases February March April May June Sales Units 4,800 5,000 3,800 3,500 3,200 18,000 16,000 14.000 12.000 12,000 Salaries and wages S 10,000 10,000 11,000 12.000 13,000 9,000 10.000 10.250 10.250 10,250 2. The selling price in February 2021 is $6 per unit and this is to be increased to $8 per unit in April 2021. 50% of sales are for cash and 50% on credit to be paid two months later. 3. Purchases are to be paid for two months after purchase. 4. Salaries and wages are to be paid 75% in the month incurred and 25% in the following month. 5. Overheads are to be paid in the month after they are incurred. 6. Cash dividends of $12,000 are to be paid in the month of June 2021. 7. Two machines totaling $30,000 are to be purchased on 1 May 2021. The cost of machines is to be paid equally in three monthly instalments commencing on 31 May 2021. 8. It is estimated that the amount of machinery and bank balance as at 1 April 2021 would be $240,000 and $5,000 respectively. 9. Machinery are depreciated on a monthly basis at 10% per annum using the straight-line method. Required: (i) Prepare a month by month cash budget of Tom Company for the three months ended 30 June 2021. (17 marks) (ii) Indicate whether or not it will be necessary to make arrangements for extra finance and, if so, your recommendation as to what form the company should take. (3 marks) Question 4 - Continued (b) Fred Ma is an accounting staff who is new to the company. Fred initiated the following conversation with Martin Li, sales manager, and Paul So, production manager. Fred: I am going to be involved with the preparation of the annual budget, I'd be interested to learn how the two of you estimate sales and production numbers. Martin: Paul: We will look at recent history, discuss what we know about the current accounts, potential customers, and the general state of consumer spending. Then, we add that usual dose of intuition to come up with the best forecast we can. I usually take the sales projections as the basis of my projections. We also have to make an estimate of what this year's ending inventories will be. But sometimes it is difficult because the numbers aren't always reliable because Martin makes some adjustments to the sales numbers before passing them on to me. What kind of adjustments? We don't want to fall short of the sales projections, so we generally give ourselves a little breathing room by lowing the initial sales projection from 5% to 10%. Fred: Martin: Paul: So, you know why this year's budget is not a very reliable at the starting point. We always have to adjust the projected production rates as the year progresses and, of course, we also change the ending inventory estimates as well. By the way, we make similar adjustments to expenses by adding at least 10% to the estimates; I think everyone around here does the same thing. Required: Explain why Paul and Martin behave in this manner and describe the benefits they are expected to realize and explain how their behavior adversely affect them. (5 marks) [Total for Question 4: 25 marks) End of Question Paper

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started