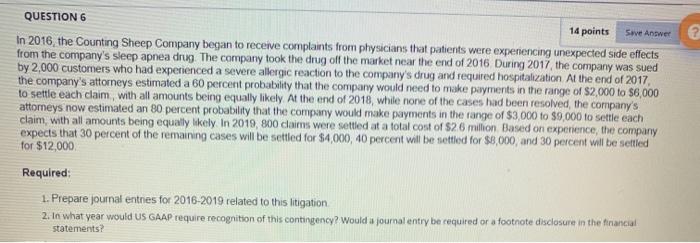

QUESTION 6 14 points Save Answer In 2016 the Counting Sheep Company began to receive complaints from physicians that patients were experiencing unexpected side effects from the company's sleep apnea drug. The company took the drug off the market near the end of 2016 During 2017 the company was sued by 2,000 customers who had experienced a severe allergic reaction to the company's drug and required hospitalization At the end of 2017, the company's attorneys estimated a 60 percent probability that the company would need to make payments in the range of $2,000 to $6,000 to settle each claim with all amounts being equally likely At the end of 2018, while none of the cases had been resolved, the company's attorneys now estimated an 80 percent probability that the company would make payments in the range of $3,000 to $9,000 to settle each claim, with all amounts being equally likely in 2019,800 claims were settled at a total cost of $26 million Based on experience, the company expects that 30 percent of the remaining cases will be settled for $4,000, 40 percent will be settled for $8,000, and 30 percent will be settled for $12,000 Required: 1. Prepare journal entres for 2016-2019 related to this litigation 2. In what year would US GAAP require recognition of this contingency? Would a journal entry be required or a footnote disclosure in the financial statements? QUESTION 6 14 points Save Answer In 2016 the Counting Sheep Company began to receive complaints from physicians that patients were experiencing unexpected side effects from the company's sleep apnea drug. The company took the drug off the market near the end of 2016 During 2017 the company was sued by 2,000 customers who had experienced a severe allergic reaction to the company's drug and required hospitalization At the end of 2017, the company's attorneys estimated a 60 percent probability that the company would need to make payments in the range of $2,000 to $6,000 to settle each claim with all amounts being equally likely At the end of 2018, while none of the cases had been resolved, the company's attorneys now estimated an 80 percent probability that the company would make payments in the range of $3,000 to $9,000 to settle each claim, with all amounts being equally likely in 2019,800 claims were settled at a total cost of $26 million Based on experience, the company expects that 30 percent of the remaining cases will be settled for $4,000, 40 percent will be settled for $8,000, and 30 percent will be settled for $12,000 Required: 1. Prepare journal entres for 2016-2019 related to this litigation 2. In what year would US GAAP require recognition of this contingency? Would a journal entry be required or a footnote disclosure in the financial statements