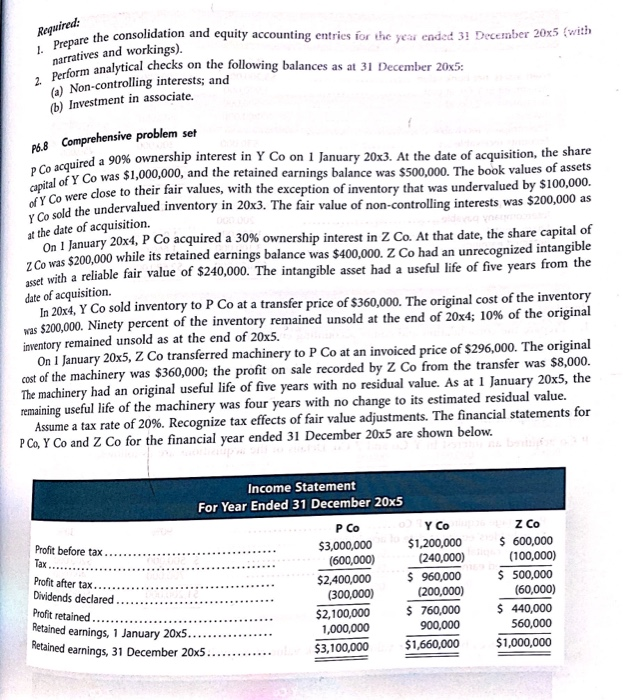

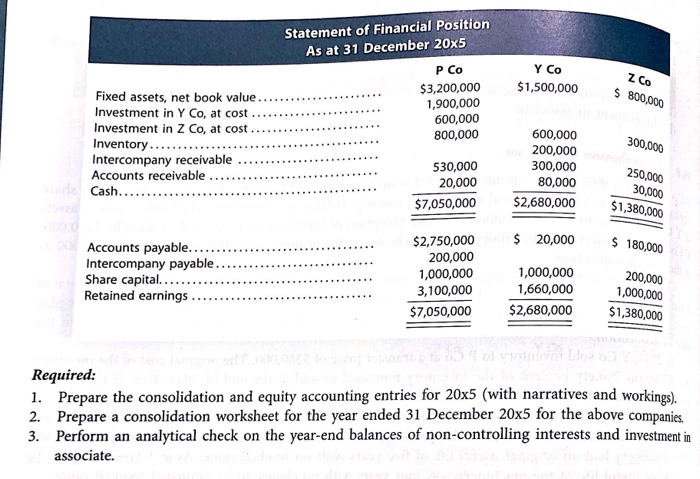

Required: 1. Prepare the con are the consolidation and equity accounting entries for the year eaded 31 December 20x5 with narratives and workings). m analytical checks on the following balances as at 31 December 2015 2 Perform analytics (a) Non-controlling interests and (b) Investment in associate. P6.8 Comprehensive problem set P Co acquired a 90% OW quired a 90% ownership interest in Y Co on 1 January 20x3. At the date of acquisition, the share Joy Co was $1,000,000, and the retained earnings balance was $500,000. The book values of assets co were close to their fair values, with the exception of inventory that was undervalued by $100,000. cold the undervalued inventory in 20x3. The fair value of non-controlling interests was $200,000 as of Y Co were close to at the date of acquisition On1 January 20x4, P Co acquired a 30% ownership interest in Z Co. At that date, the share capital of Co was $200,000 while its retained earnings balance was $400,000. Z Co had an unrecognized intangible asset with a reliable fair value of $240,000. The intangible asset had a useful life of five years from the date of acquisition. In 20x4, Y Co sold inventory to P Co at a transfer price of $360,000. The original cost of the inventory was $200,000. Ninety percent of the inventory remained unsold at the end of 20x4; 10% of the original inventory remained unsold as at the end of 20x5. On 1 January 20x5, Z Co transferred machinery to P Co at an invoiced price of $296,000. The original cost of the machinery was $360,000; the profit on sale recorded by Z Co from the transfer was $8,000. The machinery had an original useful life of five years with no residual value. As at 1 January 20x5, the remaining useful life of the machinery was four years with no change to its estimated residual value. Assume a tax rate of 20%. Recognize tax effects of fair value adjustments. The financial statements for PCO, Y Co and Z Co for the financial year ended 31 December 20x5 are shown below. Income Statement For Year Ended 31 December 20x5 Y COZ Co Profit before tax...................... $3,000,000 $1,200,000 $600,000 Tax.. (600,000) (240,000) (100,000) $2,400,000 S960,000 $ 500,000 (300,000) (200,000) (60,000) $2,100,000 $760,000 $ 440,000 1,000,000 900,000 560,000 $3,100,000 $1,660,000 $1,000,000 Profit after tax. Dividends declared ............. .. . Profit retained ............... Retained earnings, 1 January 20x5............. Retained earnings, 31 December 20x5............. Statement of Financial Position As at 31 December 20x5 Y CO Z Co $1,500,000 $ 800.0 $ 800,000 P Co $3,200,000 1,900,000 600,000 800,000 Fixed assets, net book value........ Investment in Y Co, at cost ...... Investment in Z Co, at cost ....... Inventory ......... Intercompany receivable ........... Accounts receivable ............ Cash......... 300,000 530,000 20,000 $7,050,000 600,000 200,000 300,000 80,000 $2,680,000 250,000 30,000 $1,380,000 $ 20,000 $ 180,000 Accounts payable.............. Intercompany payable............... Share capital....................... Retained earnings ............... $2,750,000 200,000 1,000,000 3,100,000 $7,050,000 1,000,000 1,660,000 $2,680,000 200,000 1,000,000 $1,380,000 Required: 1. Prepare the consolidation and equity accounting entries for 20x5 (with narratives and workings). 2. Prepare a consolidation worksheet for the year ended 31 December 20x5 for the above companies. 3. Perform an analytical check on the year-end balances of non-controlling interests and investment in associate