Answered step by step

Verified Expert Solution

Question

1 Approved Answer

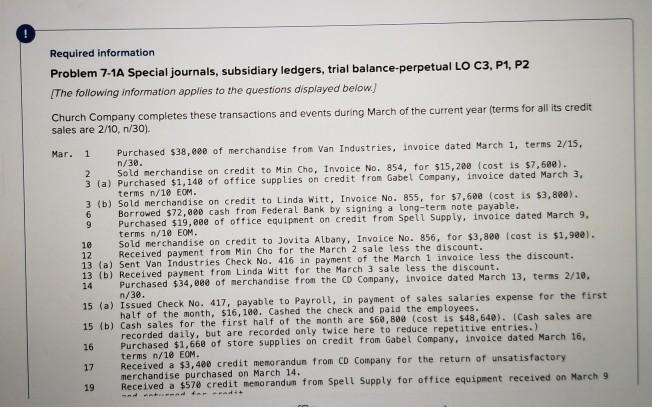

Required information Problem 7-1A Special journals, subsidiary ledgers, trial balance-perpetual LO C3, P1, P2 [The following information applies to the questions displayed below. Church Company

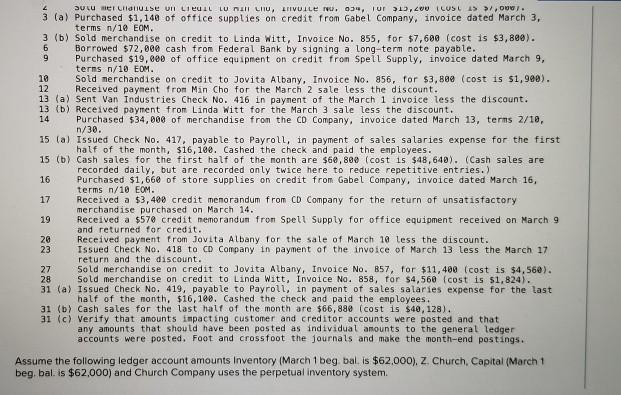

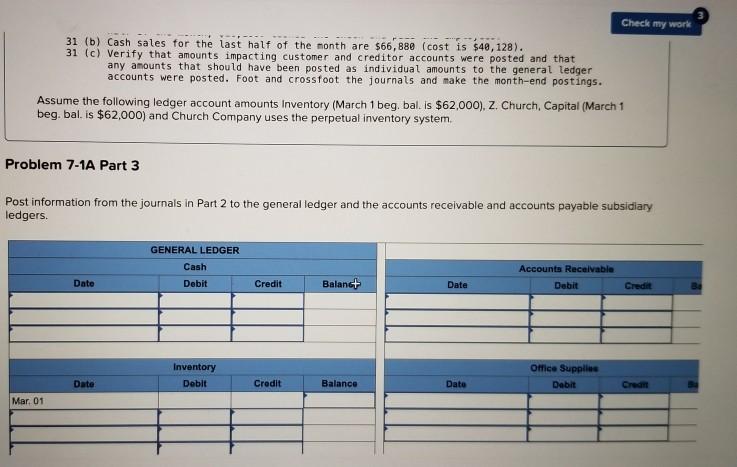

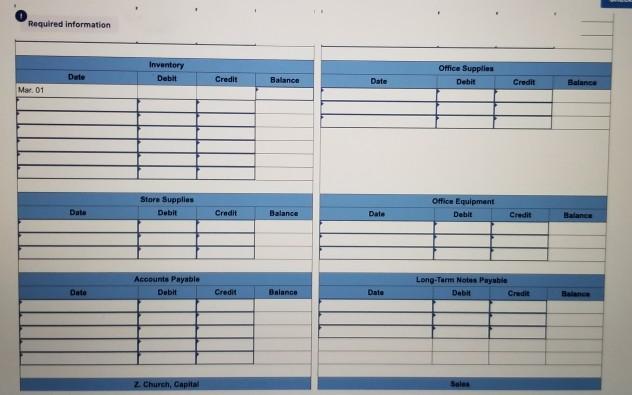

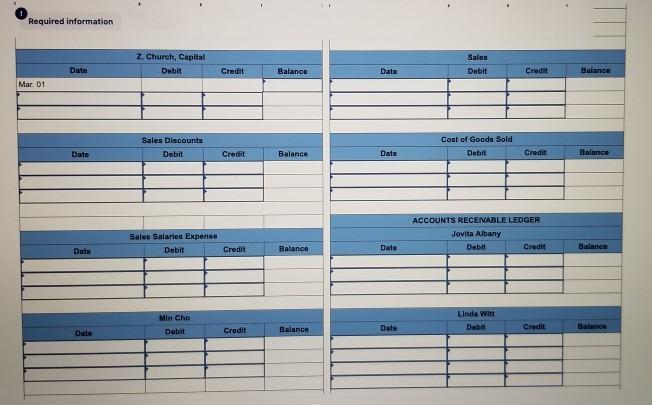

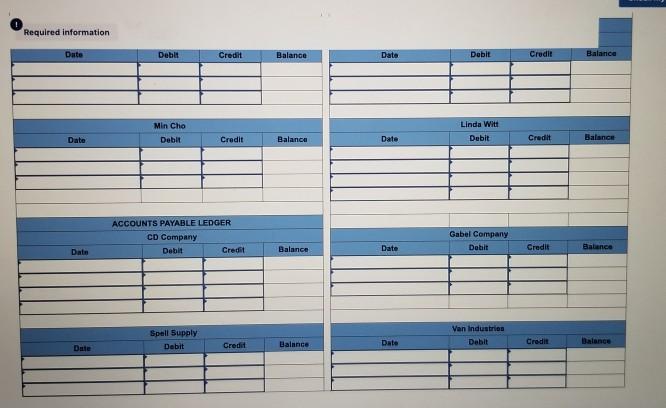

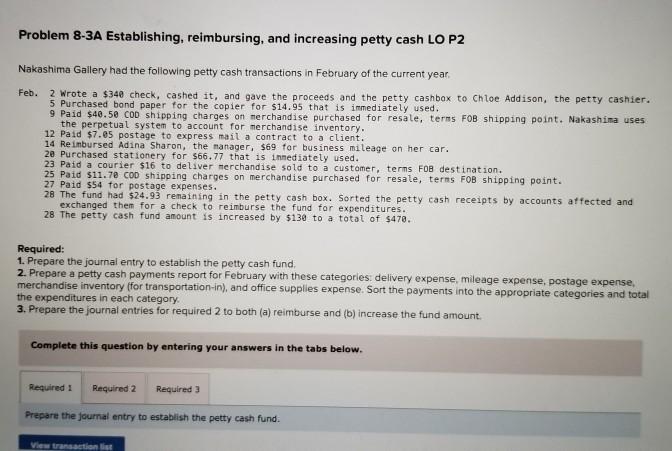

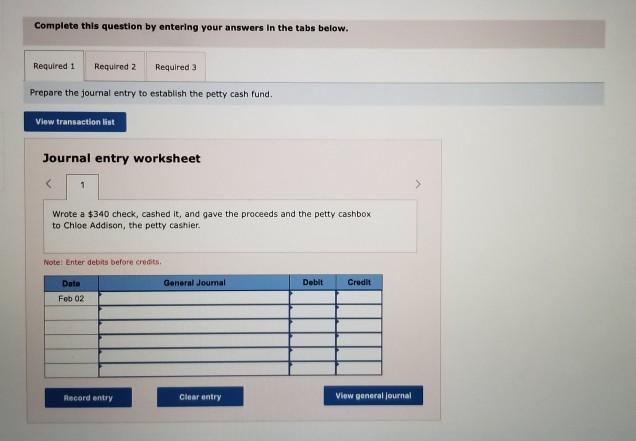

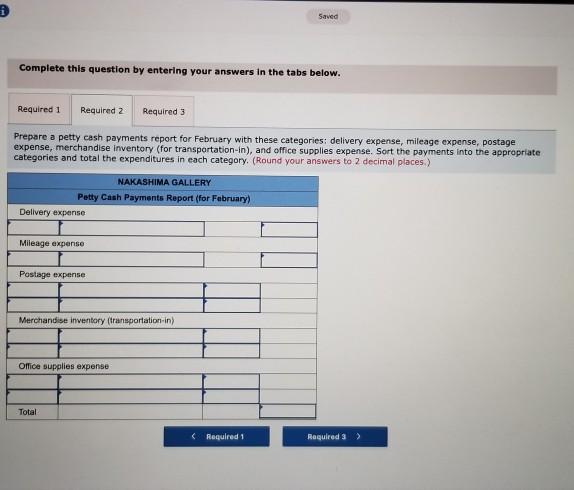

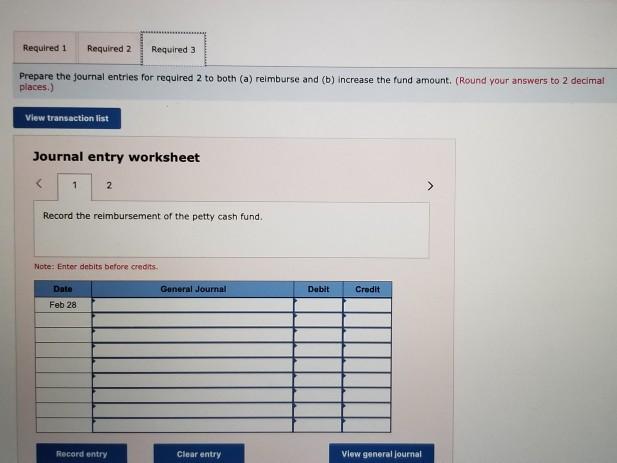

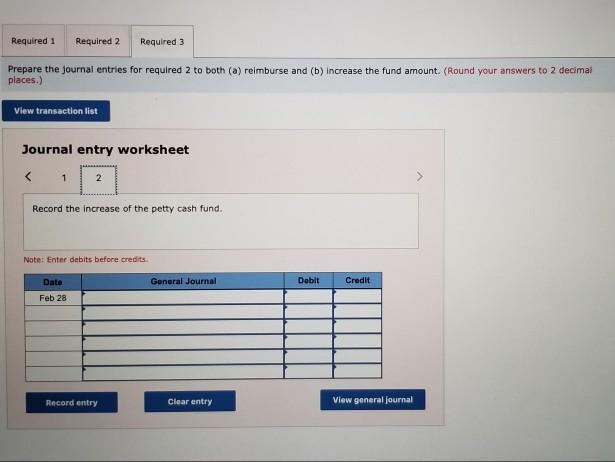

Required information Problem 7-1A Special journals, subsidiary ledgers, trial balance-perpetual LO C3, P1, P2 [The following information applies to the questions displayed below. Church Company completes these transactions and events during March of the current year (terms for all its credit sales are 2/10, 1/30). Mar. 1 Purchased $38,000 of merchandise from Van Industries, invoice dated March 1, terms 2/15, n/30. 2 Sold merchandise on credit to Min Cho, Invoice No. 854, for $15,200 (cost is $7,580). 3 (a) Purchased $1,140 of office supplies on credit from Gabel Company, invoice dated March 3, terms n/10 EOM. 3 (b) Sold merchandise on credit to Linda Witt, Invoice No. 855, for $7.500 (cost is $3,880). 6 Borrowed $72,600 cash from Federal Bank by signing a long-term note payable. 9 Purchased $19,000 of office equipment on credit from Spell Supply, invoice dated March 9. terms n/10 EOM. 10 Sold merchandise on credit to Jovita Albany, Invoice No. 856, for $3,800 (cost is $1,980). 12 Received payment from Min Cho for the March 2 sale less the discount. 13 (a) Sent Van Industries Check No. 416 in payment of the March 1 invoice less the discount. 13 (b) Received paynent from Linda Witt for the March 3 sale less the discount. 14 Purchased $34,080 of merchandise from the CD Company, invoice dated March 13, terms 2/10, n/30. 15 (a) Issued Check No. 417, payable to Payroll, in payment of sales salaries expense for the first half of the month, $16, 100. Cashed the check and paid the employees. 15 (b) Cash sales for the first half of the month are $68,800 (cost is $48,640). (Cash sales are recorded daily, but are recorded only twice here to reduce repetitive entries.) 16 Purchased $1,660 of store supplies on credit from Gabel Company, invoice dated March 16, terms n/18 EOM. 17 Received a $3,400 credit memorandum from CD Company for the return of unsatisfactory merchandise purchased on March 14. 19 Received a $570 credit memorandum from Spell Supply for office equipment received on March 9 ---- su terlalu Se un LIUL LUNII LU, LIIVUILE N. 03. Tur 13,200 COSL 45.00). 3 (a) Purchased $1,140 of office supplies on credit from Gabel Company, invoice dated March 3. terms n/10 EOM. 3 (b) Sold merchandise on credit to Linda Witt, Invoice No. 855, for $7,500 (cost is $3,880). 6 Borrowed $72,000 cash from Federal Bank by signing a long-term note payable. 9 Purchased $19,000 of office equipment on credit from Spell Supply, invoice dated March 9, terms n/10 EDM 19 Sold merchandise on credit to Jovita Albany, Invoice No. 856, for $3,880 (cost is $1,990). 12 Received payment from Min Cho for the March 2 sale less the discount. 13 (a) Sent Van Industries Check No. 416 in payment of the March 1 invoice less the discount. 13 (b) Received payment from Linda Witt for the March 3 sale less the discount. 14 Purchased $34,000 of merchandise from the CD Company, invoice dated March 13, terms 2/10, n/30. 15 lal Issued Check No. 417, payable to Payroll, in payment of sales salaries expense for the first half of the month, $16,190. Cashed the check and paid the employees. 15 (b) Cash sales for the first half of the month are $60,800 (cost 15 $48,640). (Cash sales are recorded daily, but are recorded only twice here to reduce repetitive entries.) 16 Purchased $1,660 of store supplies on credit from Gabel Company, invoice dated March 16, terms n/10 EOM. 17 Received a $3,480 credit memorandum from CD Company for the return of unsatisfactory merchandise purchased on March 14. 19 Received a $570 credit memorandum from Spell Supply for office equipment received on March 9 and returned for credit. 28 Received payment from Jovita Albany for the sale of March 10 less the discount. 23 Issued Check No. 418 to CD Company in payment of the invoice of March 13 less the March 17 return and the discount. 27 Sold merchandise on credit to Jovita Albany, Invoice No. 357, for $11,480 (cost is $4,560). 28 Sold merchandise on credit to Linda Witt, Invoice No. 858, for $4,560 (cost is $1,824). 31 (a) Issued Check No. 419, payable to Payroll, in payment of sales salaries expense for the last half of the month, $16, 100. Cashed the check and paid the employees. 31 (b) Cash sales for the last half of the month are $66,880 (cost is $40,128). 31 (c) Verify that amounts impacting customer and creditor accounts were posted and that any amounts that should have been posted as individual amounts to the general ledger accounts were posted. Foot and crosstoot the journals and make the month-end postings. Assume the following ledger account amounts Inventory (March 1 beg bal is $62,000), Z. Church, Capital (March 1 beg, bal is $62,000) and Church Company uses the perpetual inventory system. Check my work 31 (b) Cash sales for the last half of the month are $66,880 (cost is $40,128). 31 (c) Verify that amounts impacting customer and creditor accounts were posted and that any amounts that should have been posted as individual amounts to the general ledger accounts were posted. Foot and crosstoot the journals and make the month-end postings. Assume the following ledger account amounts Inventory (March 1 beg. bal is $62,000). Z. Church, Capital (March 1 beg. bal is $62,000) and Church Company uses the perpetual inventory system. Problem 7-1A Part 3 Post information from the journals in Part 2 to the general ledger and the accounts receivable and accounts payable subsidiary ledgers. GENERAL LEDGER Cash Date Accounts Receivable Debit Debit Credit Balanc+ Date Credit Inventory Debit Office Supplies Debit Date Credit Balance Dato Cream Mar 01 Required information Inventory Debit Office Supplies Date Credit Balance Date Debit Credit Balance Mar 01 Store Supplies Debit Date Office Equipment Debit Credit Balance Date Credit Accounts Payable Debit Long-Term Notes Payuhle Debit Credit Date Credit Balance Date z Church, Capital Sales Required information Sales Z. Church, Capital Debit Data Credit Balance Date Debit Credit Balance Mar. 01 Sales Discounts Debit Cost of Goods Sold Debit Date Credit Balance Date Credit Balance Sales Salaries Expense Debit ACCOUNTS RECEIVABLE LEDGER Jovita Albany Debit Credit Date Credit Balance Date Balance Min Cho Dabit Linda wa Dabis Credit Balance Date Date Credit Balance Required information Dute Debit Credit Balance Date Dobit Credit Balance Min Cho Linda Witt Debit Date Debit Credit Balance Date Credit Balance ACCOUNTS PAYABLE LEDGER CD Company Debit Credit Gabel Company Dobit Balance Date Date Credit Balance Spell Supply Van Industries Debit Date Dute Credit Balance Debat Credit Problem 8-3A Establishing, reimbursing, and increasing petty cash LO P2 Nakashima Gallery had the following petty cash transactions in February of the current year Feb. 2 Wrote a $340 check, cashed it, and gave the proceeds and the petty cashbox to Chloe Addison, the petty cashier. 5 Purchased band paper for the copier for $14.95 that is immediately used. 9 Paid $40.50 COD shipping charges on merchandise purchased for resale, terms FOB shipping point. Nakashima uses the perpetual system to account for merchandise inventory. 12 Paid $7.95 postage to express mail a contract to a client. 14 Reimbursed Adina Sharon, the manager, $69 for business mileage on her car. 20 Purchased stationery for $66.77 that is inmediately used. 23 Paid a courier $16 to deliver merchandise sold to a customer, terms FOB destination. 25 Paid $11.78 COD shipping charges on merchandise purchased for resale, terns FOB shipping point. 27 Paid 554 for postage expenses. 28 The fund had $24.93 remaining in the petty cash box. Sorted the petty cash receipts by accounts affected and exchanged them for a check to reimburse the fund for expenditures. 28 The petty cash fund amount is increased by $130 to a total of $478. Required: 1. Prepare the journal entry to establish the petty cash fund, 2. Prepare a petty cash payments report for February with these categories: delivery expense, mileage expense, postage expense, merchandise inventory for transportation-in), and office supplies expense. Sort the payments into the appropriate categories and total the expenditures in each category 3. Prepare the journal entries for required 2 to both (a) reimburse and (b) increase the fund amount. Complete this question by entering your answers in the tabs below. Required: Required 2 Required 3 Prepare the journal entry to establish the petty cash fund. View transaction Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required a Prepare the foumal entry to establish the petty cash fund. View transaction list Journal entry worksheet 1 Wrote a $340 check, cashed it, and gave the proceeds and the petty cashbox to Chloe Addison, the petty cashier. Notel Enter debits before credits General Journal Debit Credit Date Feb 02 Record entry Clear entry View general Journal Saved Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare a petty cash payments report for February with these categories: delivery expense, mileage expense, postage expense, merchandise inventory (for transportation-in), and office supplies expense. Sort the payments into the appropriate categories and total the expenditures in each category. (Round your answers to 2 decimal places) NAKASHIMA GALLERY Petty Cash Payments Report (for February) Delivery expense Mileage expenso Postage expense Merchandise inventory (transportation in) Office supplies expense Total Record the reimbursement of the petty cash fund. Note: Enter debits before credits Date General Journal Dobit Credit Feb 28 Record entry Clear entry View.general Journal Required 2 Required 1 Required 3 Prepare the journal entries for required 2 to both (a) reimburse and (b) Increase the fund amount. (Round your answers to 2 decimal places.) View transaction list Journal entry worksheet 1 2 Record the increase of the petty cash fund. Note: Enter debits before credits General Journal Debit Credit Date Feb 28 Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started