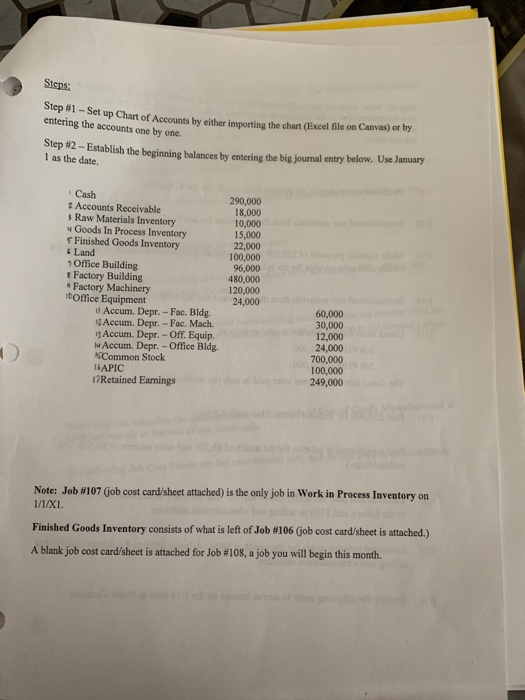

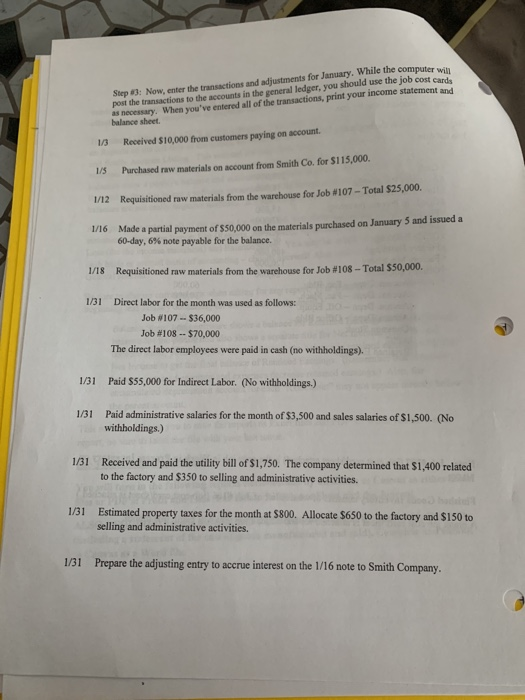

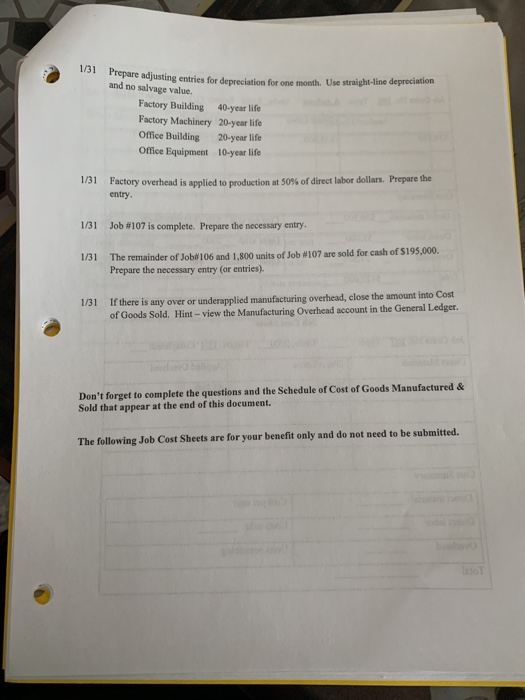

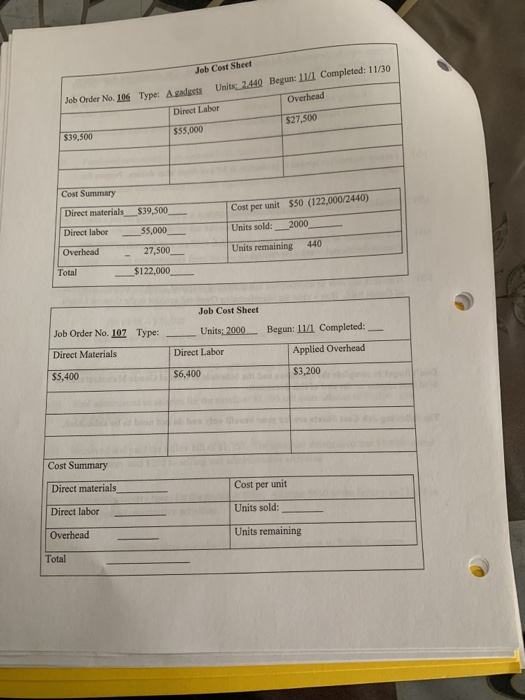

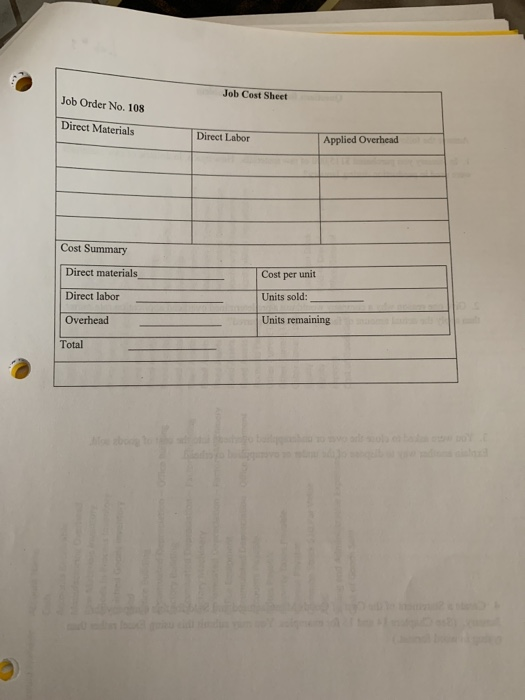

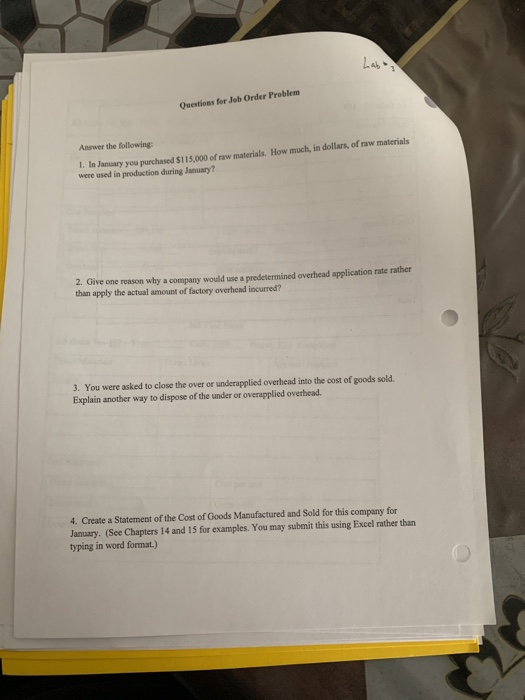

Sicps: Step #1 - Set up Chart of Accounts by either importing up Chart of Accounts by either importing the chart Excel file on Canvas) or by entering the accounts one by one. Step 12 - Establish the beginning balanses by entering the big journal entry below. Use January 1 as the date. Cash Accounts Receivable Raw Materials Inventory 4 Goods In Process Inventory 5 Finished Goods Inventory Land 1 Office Building Factory Building * Factory Machinery 10 Office Equipment u Accum. Depr. Fac. Bldg. 18 Accum. Depr.-Fac. Mach. Accum. Depr.-Off. Equip. Accum. Depr. - Office Bldg. Common Stock ISAPIC 17Retained Earnings 290,000 18,000 10,000 15,000 22,000 100,000 96,000 480,000 120.000 24,000 60,000 30,000 12,000 24,000 700.000 100,000 249,000 Note: Job W107 (job cost card/sheet attached) is the only job in Work in Process Inventory on 1/1/XI. Finished Goods Inventory consists of what is left of Job #106 (job cost card/sheet is attached.) A blank job cost cardsheet is attached for Job #108, a job you will begin this month. Step 3: Now, enter the transactions and adjustments for January. While the computer post the transactions to the accounts in the general ledger, you should use the job cost and as necessary. When you've entered all of the transactions, print your income statement and balance sheet 1/3 Received $10,000 from customers paying on account. 1/5 Purchased raw materials on account from Smith Co. for $115,000. 1/12 Requisitioned raw materials from the warehouse for Job #107 - Total $25,000. 1/16 Made a partial payment of $50,000 on the materials purchased on January 5 and issued a 60-day, 6% note payable for the balance. 1/18 Requisitioned raw materials from the warehouse for Job #108 - Total $50,000. 1/31 Direct labor for the month was used as follows: Job #107 -- $36,000 Job #108 -- $70,000 The direct labor employees were paid in cash (no withholdings). 1/31 Paid $55,000 for Indirect Labor. (No withholdings.) 1/31 Paid administrative salaries for the month of $3,500 and sales salaries of $1,500. (No withholdings.) 1/31 Received and paid the utility bill of $1,750. The company determined that $1.400 related to the factory and $350 to selling and administrative activities. 1/31 Estimated property taxes for the month at $800. Allocate $650 to the factory and $150 to selling and administrative activities. 1/31 Prepare the adjusting entry to accrue interest on the 1/16 note to Smith Company. 1 for one month. Use straight-lune Prepare adjusting entries for denne and no salvage value. Factory Building 40-year life Factory Machinery 20-year life Office Building 20-year life Office Equipment 10-year life 1/31 Factory overhead is applied to production at 50% of direct labor dollars. Prepare the entry 1/31 Job #107 is complete. Prepare the necessary entry. 1/31 The remainder of Job 106 and 1,800 units of Job W107 are sold for cash of $195,000. Prepare the necessary entry (or entries). 1/31 If there is any over or underapplied manufacturing overhead, close the amount into Cost of Goods Sold. Hint - view the Manufacturing Overhead account in the General Ledger Don't forget to complete the questions and the Schedule of Cost of Goods Manufactured & Sold that appear at the end of this document. The following Job Cost Sheets are for your benefit only and do not need to be submitted. Job Cost Sheet deus Units 2.440 Begun: 11/ Completed: 11/30 Job Onder No. 106 Type: A Overhead Direct Labor $27,500 $39,500 $55,000 Cost Summary Direct materials_$39,500. Direct labor 55,000___ Overhead - 27,500 Total $122,000 Cost per unit $50 (122,000/2440) Units sold: _ 2000_ Units remaining 440 Job Cost Sheet Job Order No. 107 Direct Materials $5,400 Type: Units: 2000_ Begun: 11/1 Completed: Direct Labor Applied Overhead $6,400 $3,200 Cost Summary Direct materials Cost per unit Direct labor Units sold: Overhead Units remaining Total Job Cost Sheet Job Order No. 108 Direct Materials Direct Labor Applied Overhead Cost Summary Direct materials Cost per unit Direct labor Units sold: Overhead Units remaining Total Questions for Job Order Problem Answer the following: 1. In January you purchased $115.000 of raw materials. How much, in dollars, of raw materials were used in production during January? 2. Give one reason why a company would use a predetermined overhead application rate rather than apply the actual amount of factory overhead incurred? 3. You were asked to close the over or underapplied overhead into the cost of goods sold. Explain another way to dispose of the under or overapplied overhead. 4. Create a Statement of the Cost of Goods Manufactured and sold for this company for January. (See Chapters 14 and 15 for examples. You may submit this using Excel rather than typing in word format.) Sicps: Step #1 - Set up Chart of Accounts by either importing up Chart of Accounts by either importing the chart Excel file on Canvas) or by entering the accounts one by one. Step 12 - Establish the beginning balanses by entering the big journal entry below. Use January 1 as the date. Cash Accounts Receivable Raw Materials Inventory 4 Goods In Process Inventory 5 Finished Goods Inventory Land 1 Office Building Factory Building * Factory Machinery 10 Office Equipment u Accum. Depr. Fac. Bldg. 18 Accum. Depr.-Fac. Mach. Accum. Depr.-Off. Equip. Accum. Depr. - Office Bldg. Common Stock ISAPIC 17Retained Earnings 290,000 18,000 10,000 15,000 22,000 100,000 96,000 480,000 120.000 24,000 60,000 30,000 12,000 24,000 700.000 100,000 249,000 Note: Job W107 (job cost card/sheet attached) is the only job in Work in Process Inventory on 1/1/XI. Finished Goods Inventory consists of what is left of Job #106 (job cost card/sheet is attached.) A blank job cost cardsheet is attached for Job #108, a job you will begin this month. Step 3: Now, enter the transactions and adjustments for January. While the computer post the transactions to the accounts in the general ledger, you should use the job cost and as necessary. When you've entered all of the transactions, print your income statement and balance sheet 1/3 Received $10,000 from customers paying on account. 1/5 Purchased raw materials on account from Smith Co. for $115,000. 1/12 Requisitioned raw materials from the warehouse for Job #107 - Total $25,000. 1/16 Made a partial payment of $50,000 on the materials purchased on January 5 and issued a 60-day, 6% note payable for the balance. 1/18 Requisitioned raw materials from the warehouse for Job #108 - Total $50,000. 1/31 Direct labor for the month was used as follows: Job #107 -- $36,000 Job #108 -- $70,000 The direct labor employees were paid in cash (no withholdings). 1/31 Paid $55,000 for Indirect Labor. (No withholdings.) 1/31 Paid administrative salaries for the month of $3,500 and sales salaries of $1,500. (No withholdings.) 1/31 Received and paid the utility bill of $1,750. The company determined that $1.400 related to the factory and $350 to selling and administrative activities. 1/31 Estimated property taxes for the month at $800. Allocate $650 to the factory and $150 to selling and administrative activities. 1/31 Prepare the adjusting entry to accrue interest on the 1/16 note to Smith Company. 1 for one month. Use straight-lune Prepare adjusting entries for denne and no salvage value. Factory Building 40-year life Factory Machinery 20-year life Office Building 20-year life Office Equipment 10-year life 1/31 Factory overhead is applied to production at 50% of direct labor dollars. Prepare the entry 1/31 Job #107 is complete. Prepare the necessary entry. 1/31 The remainder of Job 106 and 1,800 units of Job W107 are sold for cash of $195,000. Prepare the necessary entry (or entries). 1/31 If there is any over or underapplied manufacturing overhead, close the amount into Cost of Goods Sold. Hint - view the Manufacturing Overhead account in the General Ledger Don't forget to complete the questions and the Schedule of Cost of Goods Manufactured & Sold that appear at the end of this document. The following Job Cost Sheets are for your benefit only and do not need to be submitted. Job Cost Sheet deus Units 2.440 Begun: 11/ Completed: 11/30 Job Onder No. 106 Type: A Overhead Direct Labor $27,500 $39,500 $55,000 Cost Summary Direct materials_$39,500. Direct labor 55,000___ Overhead - 27,500 Total $122,000 Cost per unit $50 (122,000/2440) Units sold: _ 2000_ Units remaining 440 Job Cost Sheet Job Order No. 107 Direct Materials $5,400 Type: Units: 2000_ Begun: 11/1 Completed: Direct Labor Applied Overhead $6,400 $3,200 Cost Summary Direct materials Cost per unit Direct labor Units sold: Overhead Units remaining Total Job Cost Sheet Job Order No. 108 Direct Materials Direct Labor Applied Overhead Cost Summary Direct materials Cost per unit Direct labor Units sold: Overhead Units remaining Total Questions for Job Order Problem Answer the following: 1. In January you purchased $115.000 of raw materials. How much, in dollars, of raw materials were used in production during January? 2. Give one reason why a company would use a predetermined overhead application rate rather than apply the actual amount of factory overhead incurred? 3. You were asked to close the over or underapplied overhead into the cost of goods sold. Explain another way to dispose of the under or overapplied overhead. 4. Create a Statement of the Cost of Goods Manufactured and sold for this company for January. (See Chapters 14 and 15 for examples. You may submit this using Excel rather than typing in word format.)