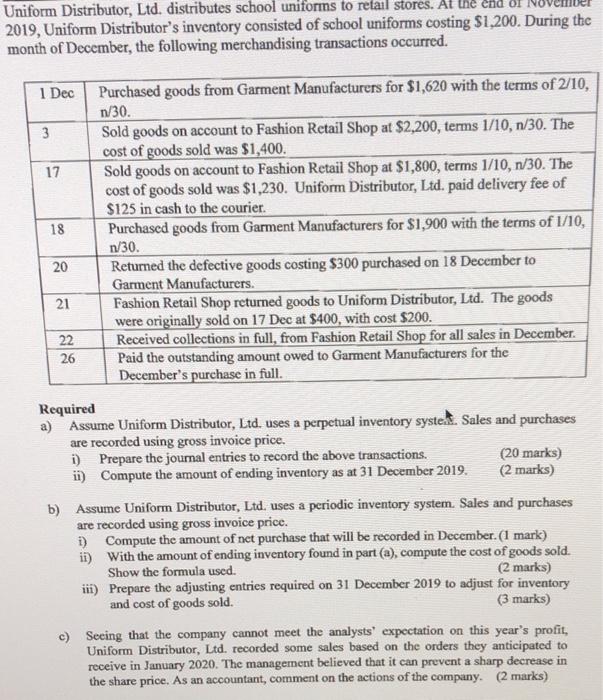

Uniform Distributor, Ltd. distributes school uniforms to retail stores. 2019, Uniform Distributor's inventory consisted of school uniforms costing $1,200. During the month of December, the following merchandising transactions occurred. 1 Dec 3 17 18 Purchased goods from Garment Manufacturers for $1,620 with the terms of 2/10, n/30. Sold goods on account to Fashion Retail Shop at $2,200, terms 1/10, n/30. The cost of goods sold was $1,400. Sold goods on account to Fashion Retail Shop at $1,800, terms 1/10, 1/30. The cost of goods sold was $1,230. Uniform Distributor, Ltd. paid delivery fee of $125 in cash to the courier. Purchased goods from Garment Manufacturers for $1,900 with the terms of 1/10, n/30. Returned the defective goods costing $300 purchased on 18 December to Garment Manufacturers. Fashion Retail Shop returned goods to Uniform Distributor, Ltd. The goods were originally sold on 17 Dec at $400, with cost $200. Received collections in full, from Fashion Retail Shop for all sales in December. Paid the outstanding amount owed to Garment Manufacturers for the December's purchase in full. 20 21 22 26 Required a) Assume Uniform Distributor, Ltd. uses a perpetual inventory syster. Sales and purchases are recorded using gross invoice price. i) Prepare the journal entries to record the above transactions (20 marks) ii) Compute the amount of ending inventory as at 31 December 2019. (2 marks) b) Assume Uniform Distributor, Ltd, uses a periodic inventory system. Sales and purchases are recorded using gross invoice price. 1) Compute the amount of net purchase that will be recorded in December. (1 mark) ii) With the amount of ending inventory found in part (a), compute the cost of goods sold. Show the formula used. (2 marks) iii) Prepare the adjusting entries required on 31 December 2019 to adjust for inventory and cost of goods sold. (3 marks) c) Seeing that the company cannot meet the analysts' expectation on this year's profit, Uniform Distributor, Ltd. recorded some sales based on the orders they anticipated to receive in January 2020. The management believed that it can prevent a sharp decrease in the share price. As an accountant, comment on the actions of the company. (2 marks)