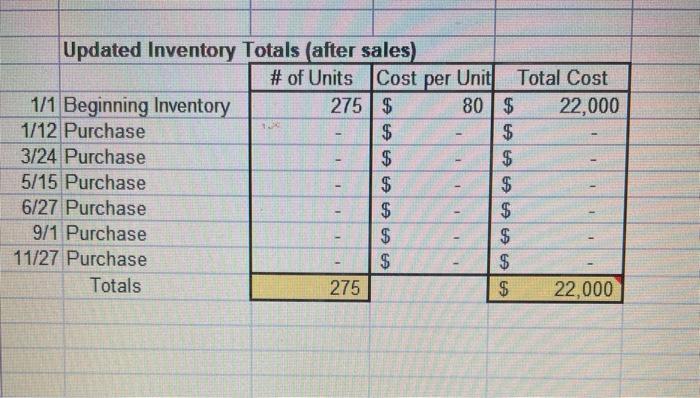

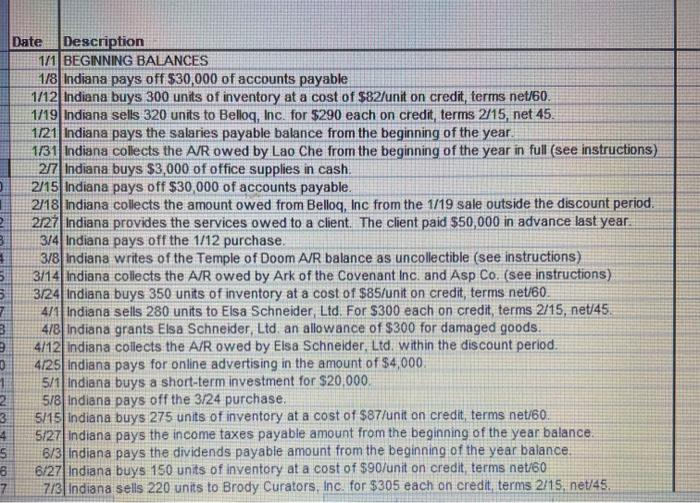

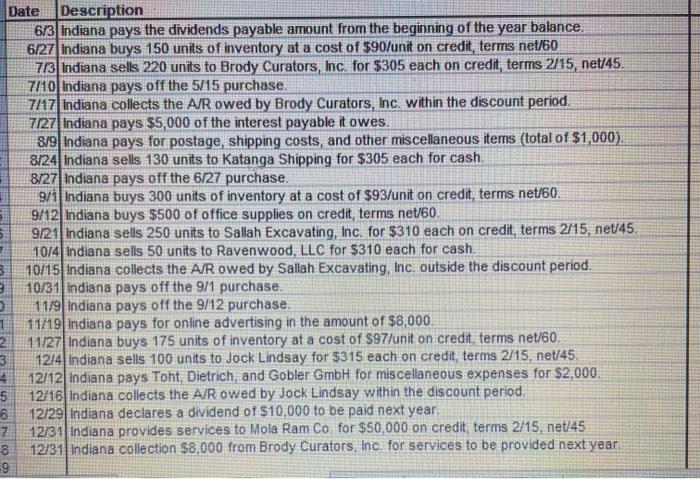

- - Updated Inventory Totals (after sales) # of Units Cost per Unit Total Cost 1/1 Beginning Inventory 275 $ 80 $ 22,000 1/12 Purchase $ $ 3/24 Purchase $ $ 5/15 Purchase $ $ 6/27 Purchase $ 9/1 Purchase $ $ 11/27 Purchase $ Totals 275 $ 22,000 - - - A A A A A A A A - - - - - - - Date Description 1/1 BEGINNING BALANCES 1/8 Indiana pays off $30,000 of accounts payable 1/12 Indiana buys 300 units of inventory at a cost of $82/unit on credit, terms net/60. 1/19 Indiana sells 320 units to Bellog, Inc. for $290 each on credit, terms 2/15, net 45. 1/21 Indiana pays the salaries payable balance from the beginning of the year. 1/31 Indiana collects the A/R owed by Lao Che from the beginning of the year in full (see instructions) 217 Indiana buys $3,000 of office supplies in cash. 2/15 Indiana pays off $30,000 of accounts payable. 2/18 Indiana collects the amount owed from Bellog, Inc from the 1/19 sale outside the discount period. 2/27 Indiana provides the services owed to a client. The client paid $50,000 in advance last year. B 3/4 Indiana pays off the 1/12 purchase. 3/8 Indiana writes of the Temple of Doom A/R balance as uncollectible (see instructions) 5 3/14 Indiana collects the A/R owed by Ark of the Covenant Inc. and Asp Co. (see instructions) 5 3/24 Indiana buys 350 units of inventory at a cost of $85/unit on credit, terms net/60. 471 Indiana sells 280 units to Elsa Schneider, Ltd. For $300 each on credit, terms 2/15, net/45 4/8 Indiana grants Elsa Schneider, Ltd an allowance of $300 for damaged goods. 2 4/12 indiana collects the A/R owed by Elsa Schneider, Ltd, within the discount period. 4/25 Indiana pays for online advertising in the amount of $4,000. 1 5/1 Indiana buys a short-term investment for $20,000. 2 5/8 Indiana pays off the 3/24 purchase, 5/15 Indiana buys 275 units of inventory at a cost of $87/unit on credit, terms net/60. 4 5727 Indiana pays the income taxes payable amount from the beginning of the year balance. 5 6/3 Indiana pays the dividends payable amount from the beginning of the year balance. 6/27 Indiana buys 150 units of inventory at a cost of $90/unit on credit, terms net/60 7 7/3 Indiana sells 220 units to Brody Curators, Inc. for $305 each on credit, terms 2/15, net/45, 0 3 8 Date Description 6/3 Indiana pays the dividends payable amount from the beginning of the year balance. 6/27 Indiana buys 150 units of inventory at a cost of $90/unit on credit, terms net/60 7/13 Indiana sells 220 units to Brody Curators, Inc. for $305 each on credit, terms 2/15, net/45. 7/10 Indiana pays off the 5/15 purchase. 7/17 Indiana collects the A/R owed by Brody Curators, Inc. within the discount period. 7/27 Indiana pays $5,000 of the interest payable it owes. 8/9 Indiana pays for postage, shipping costs, and other miscellaneous items (total of $1,000). 8/24 Indiana sells 130 units to Katanga Shipping for $305 each for cash. 8/27 Indiana pays off the 6/27 purchase. 9/1 Indiana buys 300 units of inventory at a cost of $93/unit on credit, terms net/60. 9/12 Indiana buys $500 of office supplies on credit, terms net/60 9/21 Indiana sells 250 units to Sallah Excavating, Inc. for $310 each on credit, terms 2/15, net/45. 10/4 Indiana sells 50 units to Ravenwood, LLC for $310 each for cash. 3 10/15 Indiana collects the A/R owed by Sallah Excavating, Inc. outside the discount period. 3 10/31 Indiana pays off the 9/1 purchase. 11/9 Indiana pays off the 9/12 purchase. 1 11/19 Indiana pays for online advertising in the amount of $8,000. 2 11/27 Indiana buys 175 units of inventory at a cost of $97/unit on credit, terms net/60. 3 12/4 Indiana sells 100 units to Jock Lindsay for $315 each on credit, terms 2/15, net/45 4 12/12 Indiana pays Toht, Dietrich, and Gobler GmbH for miscellaneous expenses for $2,000, 5 12/16 Indiana collects the A/Rowed by Jock Lindsay within the discount period, 6 12/29 Indiana declares a dividend of $10,000 to be paid next year. 7 12/31 Indiana provides services to Mola Ram Co for $50,000 on credit, terms 2/15, net/45 8 12/31 Indiana collection $8,000 from Brody Curators, Inc for services to be provided next year. -9