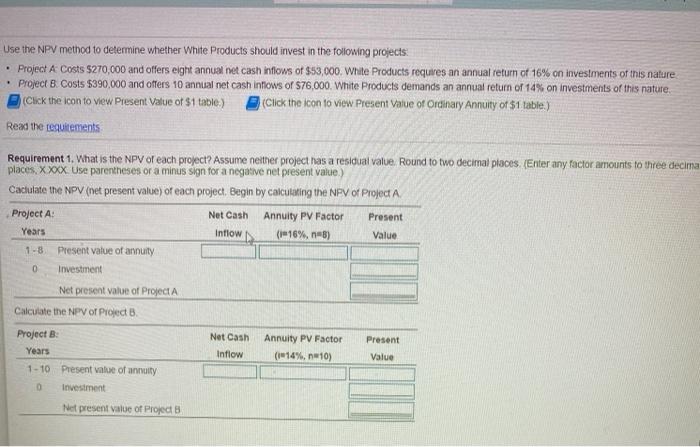

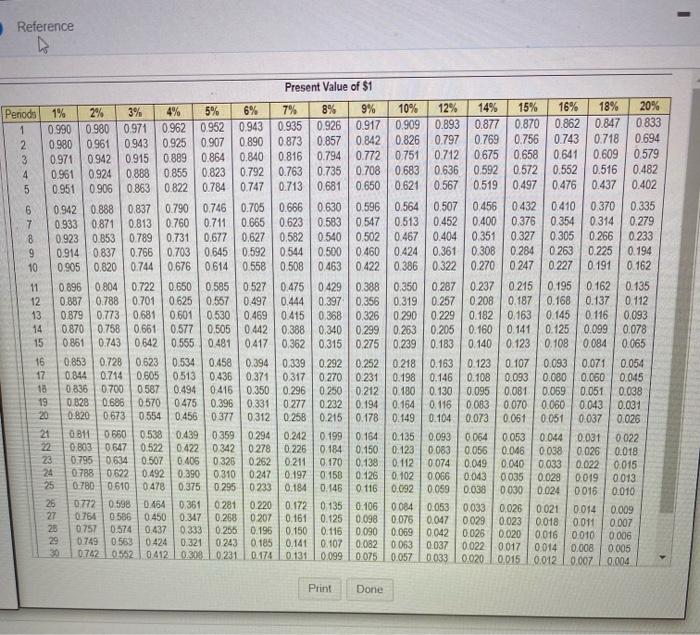

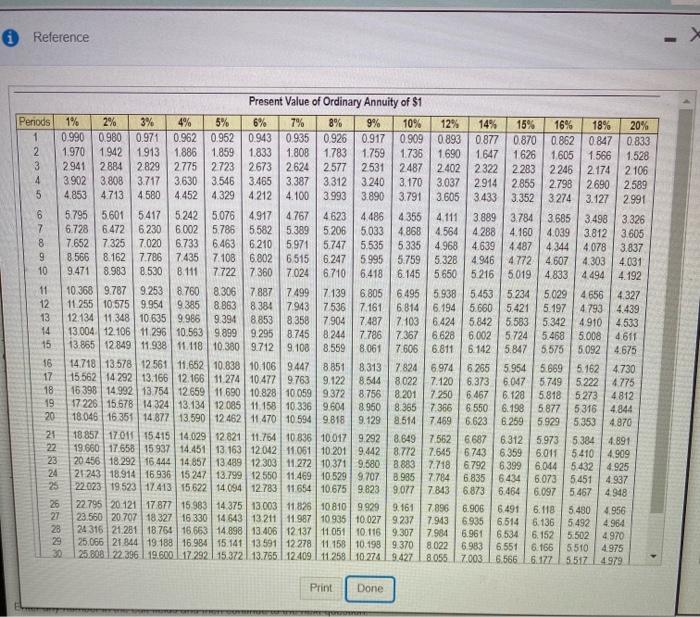

. Use the NPV method to determine whether White Products should invest in the following projects Project A Costs $270,000 and offers eight annual net cash inflows of $53,000, White Products requires an annual return of 16% on investments of this nature Project 8. Costs $390,000 and offers 10 annual net cash inflows or 576,000. White Products demands an annual return of 14% on investments of this nature (Click the icon to view Present Value of $1 table) Click the icon to view Present Value of Ordinary Annuity of $1 table.) Read the reguitements Requirement 1. What is the NPV of each project? Assume neither project has a residual value. Round to two decimal places. (Enter any factor amounts to three decima places, XXX Use parentheses or a minus sign for a negative net present value.) Caciulate the NPV (net present value) of each project. Begin by calculating the NPV of Project A Project A: Annuity PV Factor (16%, B) Present value of annuity Net Cash Years Present Value Inflow 1-8 0 Investment Net present value of Project A Calculate the NPV of Project B. Project B. Years 1 - 10 Present value of annuity 0 Investment Present Net Cash Inflow Annuity PV Factor (14%. 10) Value Net present value of Project - Reference Present Value of $1 1% Penods 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 14% 15% 16% 20% 18% 1 0.990 0.980 0.971 0.9620.952 0943 0.935 0.926 0.917 0.909 0.893 0.877 0.870 0.862 0.847 0.833 2 0980 0961 0.943 0.925 0.907 0.890 0873 0.8570.842 0.826 0.797 0.769 0.756 0.743 0.718 0.694 3 0.971 0942 0.915 0.889 0.864 0.840 0.816 0.794 0.772 0.751 0.712 0675 0.658 0.641 0.609 0.579 4 0.961 0924 0.888 0.855 0.8230.792 0.763 0.735 0.708 0.683 0.636 0592 0.572 0.552 0.516 0.482 5 0.951 0906 0.863 0.822 0.784 0.747 0.713 0.681 0.650 0.621 0.567 0.519 0.497 0.476 0.437 0.402 6 0.9420.888 0.837 0.790 0.746 0.705 0.666 0.630 0.596 0.564 0.507 0.456 0432 0.410 0.370 0.335 7 0.933 0.8710.813 0.760 0.711 0.665 0.623 0.583 0.547 0.513 0.452 0.400 0.376 0.354 0.314 0.279 8 0.923 0.853 0.789 0.731 0.677 0.627 0,582 0.540 0.502 0.467 0.4040.351 0.327 0.305 0.266 0233 9 0.914 0.837 0.766 0.703 0.6450.592 0.544 0.500 0.460 0.424 0.361 0.308 0.284 0.263 0.225 0.194 10 0.905 0.820 0.744 0.676 0.614 0.558 0 508 0.463 0.422 0.386 0.322 0.270 0.247 0.227 0.191 0.162 11 0.896 0804 0.722 0.650 0.585 0527 0.475 0429 0.388 0.350 0,287 0.237 0.215 0 195 0.162 0.135 12 0.887 0.788 0.701 0.625 0557 0.4970.4440.397 0.356 0.319 0.257 0 208 0.187 0.168 0.137 0.112 13 0.679 0.773 0681 0.601 0530 0.469 0.4150.368 0.326 0 290 0.229 0.182 0.163 0.145 0.116 0.093 14 0.870 0.758 0.661 0.577 0.505 0442 0.388 0.340 0.299 0.263 0.205 0.1600.141 0.125 0.099 0.078 15 0861 0.743 0642 0.555 0.4810417 0.362 0.315 0.275 0.239 0.183 0.140 0.123 0.108 0.084 0.065 16 0.853 0.7280.623 0.5340.458 0.394 0.3390.292 0.252 0.218 0.163 0.123 0.107 0.093 0.071 0.054 17 0.844 0.714 0.605 0513 0.436 0.371 0.317 0 270 0.2310.198 0.146 0.108 0.093 0.080 0.060 0.045 18 0836 0.7000587 0.4940416 0.350 0.296 0 250 0.212 0.1800. 130 0.095 0.081 0.069 0.051 0.038 19 0.828 0.686 0.570 0.475 0.396 0.331 0277 0.232 0.194 0.164 0.116 0.083 0.070 0.060 0.043 0.031 20 0.820 0.673 0554 0.456 0377 0.312 0.258 0.215 0.178 0.149 0.104 0.073 0.061 0 051 0.037 0.026 21 08110650 0.538 0.439 0359 0.294 0.242 0.199 0.164 0.135 0.093 0.064 053 0.044 0.031 22 0.022 0.8030647 0.522 0.422 03420278 0.226 | 0.184 0.150 0.123 0.083 0.056 0.046 0038 0.026 23 0.018 0.795 06340.507 0.405 0326 0.252 0.211 0.170 0.138 0.1120074 0.049 24 0.040 0.033 0.022 0788 0.015 0.622 0.492 0.390 0 310 0247 0.197 0.158 0.126 0.1020.066 0.043 25 0.035 0.029 0 019 0.013 0.780 0.610 0478 0.375 0.2950 233 0.184 0.146 0 116 0.092 0.069 0.038 0.030 0.024 0016 0.010 26 07720598 0.464 0.361 0281 0.220 0.172 0.135 0.106 0084 0.053 0.033 0.0260021 27 0.014 0.764 0586 0.009 0.450 0.347 0.268 0207 0.161 0.125 0.098 0.075 0.047 0029 28 0.023 0.0180.011 0757 0.574 0.007 0.437 0.333 0.255 0.196 0.150 0.116 0090 0.0690042 29 0.026 0.020 0749 0.563 0.016 0.010 0.424 0.321 0.006 0 243 0185 0.141 0.107 0.0820063 0.037 0.022 0.017 0742 0.014 0.552 0.008 0.005 0412 0.30 0.231 0.174 0.131 0.099 1 0.075 0.057 0.033 0.020 0.015 0.012 0.007 0.004 Print Done O Reference Present Value of Ordinary Annuity of $1 Periods 178 26 49% 36 E8 7% 396 96 106) 12% 149 15% 16% 18% 20% 1 090 0980 1070962 952 10943 093509260917 0909 0893 0870870 | 0 862 1047 0833 1970 |1942 1913 1886 1.859 183 1308 11783 1758 1735 1680 1647 165 165 16 1.528 3 2941 288.4 223 2775 273267312624 2577 2531 24872402 2322 12283 2245 2.174 2106 4 3902 13.88 3.717 | 3630 | 354534655 3387 3312 3240 370303729142885 27982690 2.589 5 4.85 4743 4 560 4452 4 329 4 212 14. ICO 393 3.96 391 365 343333523274 a127 29 5795 5661 5417 15242 5.075 4917 4767 A623 4. ABS 4355 411 3989 13784 36653490 3.326 67786472 6230 6002 57155825389 5206 5003 496 42884 160 4.02012 3605 8 7652 73257020 6733 6463 6210 5991 5747 5535 5335 14.968 4639 4487 14 344 4076 13.837 8.566 862 77% 7435 76862 65156.247 5995 5.79 5.326 4946 4 TT2 4607 4.2303 AQ1 10 9474 893 2.520 8 1 77227366 17024 15710 5.418 E145 1565052165019 4.333 4 94, 4. 192 10.368| 9787 9253 8760 8366 7887 7 199 130 605 6495 5.538 15.453 | 52345029 | 4656 | 4.327 2550575 | 94 9866383847943 | 7536 17 161 6.84 16 194 5 660 15421 5 197 40.439 12.134 | 11 348 | 10635996533648853 18358|7904 787 |7 103 | 6424 15.042585242 4916 10 3004 12 106 1960.5539999 925 8746 8244 67067166226 062 5 724548 5. OCS 4671 15 13.85 | 12 49 | 1998 | 11 118 | 0 300 4712 9 106 | 8558 8.6 76066611 6.142 15847 5575 | 5092.75 16 14718 | 13578 2561 11.652 10.00 10 106 9447 | 8851 8313 | 7824 16974 555 554 59 5.1624730 5 562 | 14 292 13.166 |2 166 | 1274 10 4779763 9 122 844 80227.120 6.33 5.07 5749 522478 18 | 16 396 | 14992 | 754 259 690 10828 | 10 (659 193 8768 2017.250 6 467 620 15819,5273 4812 7225 | 15.578 | 14 324 | 13 134 | 2 35 | || 1988 | 10 3351964 8 950 4367366 60 61858 5.34.944 20 16046 | 16 35 14377 13590 | 2 462 11.470 | 10 594 9616 9.129 450 469 623 6250 5920,5353 | 4370 24 10 85 17011 15.415 | 14.029 221 11.754 | 10 1038 | 10.01 9292 18 649 162 978325973538-4 1991 960 17 656 | 537 14.45|| 10 12042 | 1061 | 10 201 | 9442 BT2 7.6456743 6359 60|| 5410 4909 22 20 46 18 292 6.44 | 14 857 | 13489 2303 | 11 22 | 10.371 | 9.80 | 8| 7718 16792 6399 600 524925 21743 18944 | 16936 | 247 13.799 12.50 11.49 | 10.5299076995 6936 6424 6.0 15451 4837 22 CP31 19523 17413 156224.664 | 12783 | 11 664 | 1067519823 907 13 663 SAFA 16.097567 498 25 20 121 || 16 199 | 14.375 | 13 003 11820 | 10810 | 9999 261786 6906 6.49 | 6|5 4904955 23 0 0 0 18 27 16 330 | FAMO | 32 1967 0935 | 0 027 9237 1943 69.35 651 136 5492 96-4 36 21,281 187*4 1663 14 98 1.406 12 137 || 051 | TIE9.37 704 0961 6534 6. 152 5502 970 25 66 21 RAM 19 18 | 16 984 |5 11111 2270 || 18 | 18 19370 1022 698) 6551 5166 5510 | 475 5062151190_2921 15.32 13.755.12.409_1258 | 10274_9427 18 057002 65 ) G17 5 5174979 =ppub SHBF%832888% 17- Print Done