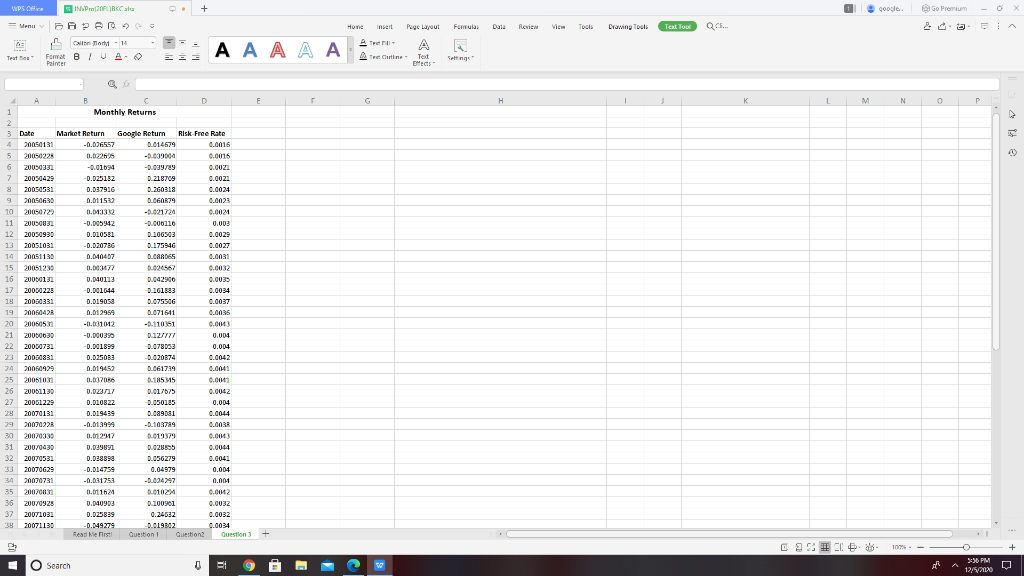

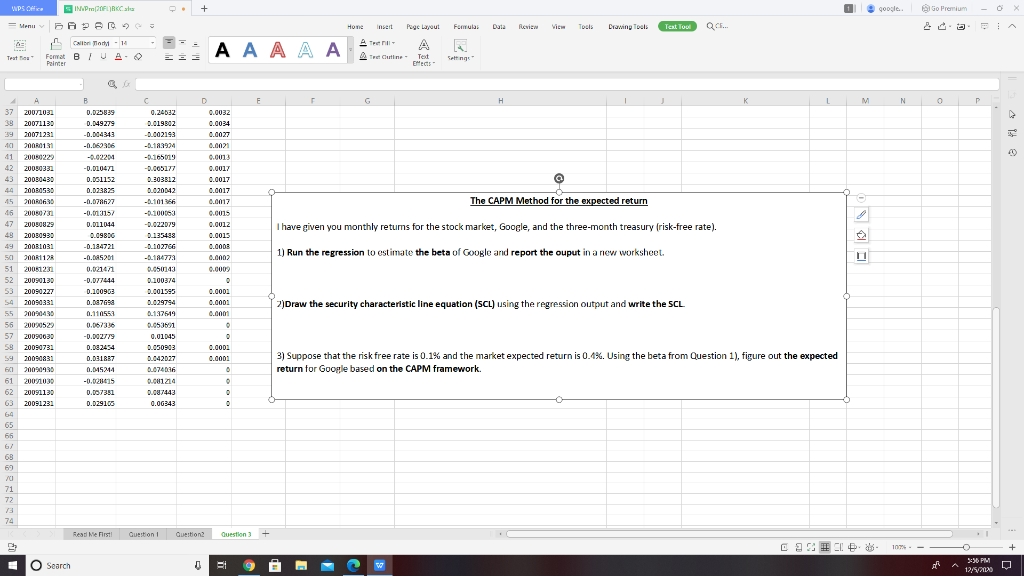

WPS Office INPL) BKC a + google AG Premium X = Menu 6 A Hone insert Page Layout Formulas Duta Duta Review Vice Tools Drawing Tools Teat. Tool A Teen librio - 14 Format BIUA O Painter A A A A A A Text Mecs - Teuta === Setting F H 1 K M N E 1 Monthly Returns 2. 3 Date Market Return Goorle Return Risk Free Rate 20050131 -0.006557 0.014579 0.0016 5 20059924 -DC39004 0.0016 6 20050332 -0.010 -0.039789 0.0021 7 20030429 -0.025132 0.218709 0.002) 8 2005051 D.087916 0.260318 0.0024 9 20050630 0.011513 0.060679 0.0023 10 20050723 0.013332 -0.021724 0.0021 11 20050831 -0.005942 -0.000120 0.003 12 20030930 0.010331 0.106503 0.0029 13 20051031 -0.020786 0.175946 0.0027 14 70051130 0.040407 D.CARD65 0.0031 1520051230 0.00077 0.020567 0.0032 16 2000013 0.040123 0.042900 0.0035 17 20000223 D.001044 D1618.3 0.0034 19 20060331 D.D190.58 0.07550G 0.0037 19 2005042R 0.012954 0.071611 20 2005053 -0.001012 -0.110361 0.0043 21 20000039 -0.000390 0.127777 0.004 22 20060732 -0.001899 0.07853 0.004 23 20000831 0.025083 -0.020574 0.0042 24 20050429 0.0194.53 0.061739 0.0041 25 200510 0.007056 0.185 MS 0.0001 26 20001130 0.023717 0.017575 0.0042 27 20001229 D.DL0322 0.050185 0.004 28 20070131 0.019439 0.089081 0.0044 39 2007022 -0.01.99 -0.103749 0.003 30 20070330 0.01.2017 0.019379 0.0043 31 20070430 0.02855 0.0044 32 20070532 D.028898 0.650279 0.0042 33 20070629 -0.014759 0.04979 0.004 34 20070731 -0.0.31751 -0.024297 0.001 20070831 0.011621 0.0102 0.0012 36 20070928 0.040903 0.10091 0.0032 37 20071033 0.625839 0.24632 0.0032 39 20071139 -0.049279 -0.019802 0.003 Read Me First Question ! Question Question 3 + D 2 I 107. - + Search 0 Ei 5:56 PM 12/2013 WPS Office INPL) BKC a + google AG Premium Go X Hone Insert Page Layout Formulas Duta Review Tools Drawing Tools Test Tool = Menu 6 A Com librio - 14 Teattes Format BTUA Painter A Teen Tutine === A Text Mecs - Setting E F H 1 K M N B 0.025039 0.049279 -0.004343 -0.001 -0.02204 -0.020471 D.DS1152 0.023825 D 0.0032 0.0034 0.0027 0.0021 0.0013 0.0017 0.0017 0.0017 0.0017 0.0015 0.0012 0.0015 0.0003 -0.078627 The CAPM Method for the expected return I have given you monthly retums for the stock market, Google, and the three-month treasury (risk-free rate). -0.013157 0.011044 0.09806 -0.184721 -0.DA5201 O 1) Run the regression to estimate the beta of Google and report the ouput in a new worksheet. 37 20071031 38 20071130 39 20071231 401 20020131 41 20060222 42 20030331 43 20030439 44 20080539 200R0630 46 2005071 47 20080829 43 2003093 49 20081031 50 200112 51 200512 52 20090130 53 20090227 54 20090331 55 20090430 56 20020522 57 20090030 58 20099731 59 20090831 60 2002010 61 200710 62 20091112 63 20091231 64 65 65 0.24632 0.019302 -0.002193 -0.18.3924 -0.165019 -0.005177 0.303812 020142 -1.1016 -0.100063 -0.022079 139498 -0.102766 -0.184773 0.050143 0.100374 0.001593 0.629794 0.137619 0.053591 0.01045 0.050903 0.042027 0.07416 0.001214 D.087443 0.0G343 11 -0.077444 0.100903 D.08769 0.110551 0 0.0001 0.000 2)Draw the security characteristic line equation (SCL) using the regression output and write the SCL 0.0001 0.0002 0.0001 -0.002779 D.082454 0.031817 0.01524 -0.028035 0.007351 0.029106 3) Suppose that the risk free rate is 0.1% and the market expected return is 0.4%. Using the beta from Question 1), figure out the expected return for Google based on the CAPM framework. 68 69 71 72 74 Read Me First! Question! Guestion Questions + + DI 107. - + O Search 0 5:56 PM 12/2013 D WPS Office INPL) BKC a + google AG Premium X = Menu 6 A Hone insert Page Layout Formulas Duta Duta Review Vice Tools Drawing Tools Teat. Tool A Teen librio - 14 Format BIUA O Painter A A A A A A Text Mecs - Teuta === Setting F H 1 K M N E 1 Monthly Returns 2. 3 Date Market Return Goorle Return Risk Free Rate 20050131 -0.006557 0.014579 0.0016 5 20059924 -DC39004 0.0016 6 20050332 -0.010 -0.039789 0.0021 7 20030429 -0.025132 0.218709 0.002) 8 2005051 D.087916 0.260318 0.0024 9 20050630 0.011513 0.060679 0.0023 10 20050723 0.013332 -0.021724 0.0021 11 20050831 -0.005942 -0.000120 0.003 12 20030930 0.010331 0.106503 0.0029 13 20051031 -0.020786 0.175946 0.0027 14 70051130 0.040407 D.CARD65 0.0031 1520051230 0.00077 0.020567 0.0032 16 2000013 0.040123 0.042900 0.0035 17 20000223 D.001044 D1618.3 0.0034 19 20060331 D.D190.58 0.07550G 0.0037 19 2005042R 0.012954 0.071611 20 2005053 -0.001012 -0.110361 0.0043 21 20000039 -0.000390 0.127777 0.004 22 20060732 -0.001899 0.07853 0.004 23 20000831 0.025083 -0.020574 0.0042 24 20050429 0.0194.53 0.061739 0.0041 25 200510 0.007056 0.185 MS 0.0001 26 20001130 0.023717 0.017575 0.0042 27 20001229 D.DL0322 0.050185 0.004 28 20070131 0.019439 0.089081 0.0044 39 2007022 -0.01.99 -0.103749 0.003 30 20070330 0.01.2017 0.019379 0.0043 31 20070430 0.02855 0.0044 32 20070532 D.028898 0.650279 0.0042 33 20070629 -0.014759 0.04979 0.004 34 20070731 -0.0.31751 -0.024297 0.001 20070831 0.011621 0.0102 0.0012 36 20070928 0.040903 0.10091 0.0032 37 20071033 0.625839 0.24632 0.0032 39 20071139 -0.049279 -0.019802 0.003 Read Me First Question ! Question Question 3 + D 2 I 107. - + Search 0 Ei 5:56 PM 12/2013 WPS Office INPL) BKC a + google AG Premium Go X Hone Insert Page Layout Formulas Duta Review Tools Drawing Tools Test Tool = Menu 6 A Com librio - 14 Teattes Format BTUA Painter A Teen Tutine === A Text Mecs - Setting E F H 1 K M N B 0.025039 0.049279 -0.004343 -0.001 -0.02204 -0.020471 D.DS1152 0.023825 D 0.0032 0.0034 0.0027 0.0021 0.0013 0.0017 0.0017 0.0017 0.0017 0.0015 0.0012 0.0015 0.0003 -0.078627 The CAPM Method for the expected return I have given you monthly retums for the stock market, Google, and the three-month treasury (risk-free rate). -0.013157 0.011044 0.09806 -0.184721 -0.DA5201 O 1) Run the regression to estimate the beta of Google and report the ouput in a new worksheet. 37 20071031 38 20071130 39 20071231 401 20020131 41 20060222 42 20030331 43 20030439 44 20080539 200R0630 46 2005071 47 20080829 43 2003093 49 20081031 50 200112 51 200512 52 20090130 53 20090227 54 20090331 55 20090430 56 20020522 57 20090030 58 20099731 59 20090831 60 2002010 61 200710 62 20091112 63 20091231 64 65 65 0.24632 0.019302 -0.002193 -0.18.3924 -0.165019 -0.005177 0.303812 020142 -1.1016 -0.100063 -0.022079 139498 -0.102766 -0.184773 0.050143 0.100374 0.001593 0.629794 0.137619 0.053591 0.01045 0.050903 0.042027 0.07416 0.001214 D.087443 0.0G343 11 -0.077444 0.100903 D.08769 0.110551 0 0.0001 0.000 2)Draw the security characteristic line equation (SCL) using the regression output and write the SCL 0.0001 0.0002 0.0001 -0.002779 D.082454 0.031817 0.01524 -0.028035 0.007351 0.029106 3) Suppose that the risk free rate is 0.1% and the market expected return is 0.4%. Using the beta from Question 1), figure out the expected return for Google based on the CAPM framework. 68 69 71 72 74 Read Me First! Question! Guestion Questions + + DI 107. - + O Search 0 5:56 PM 12/2013 D