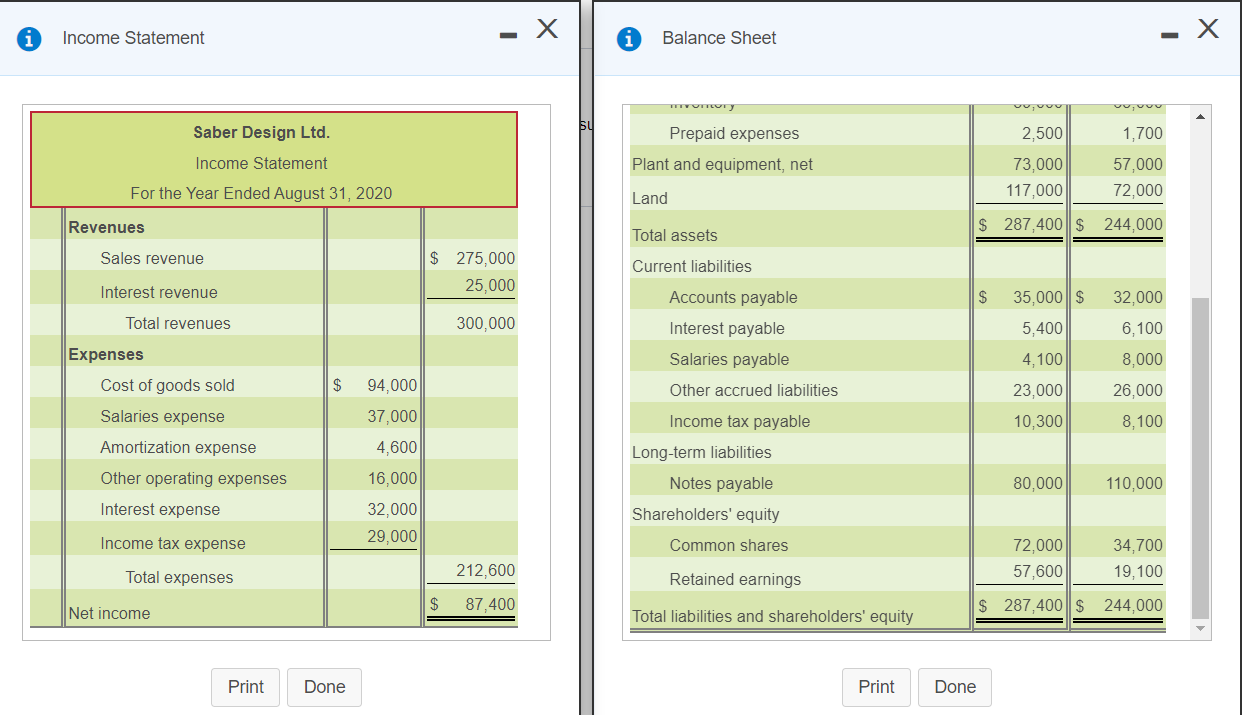

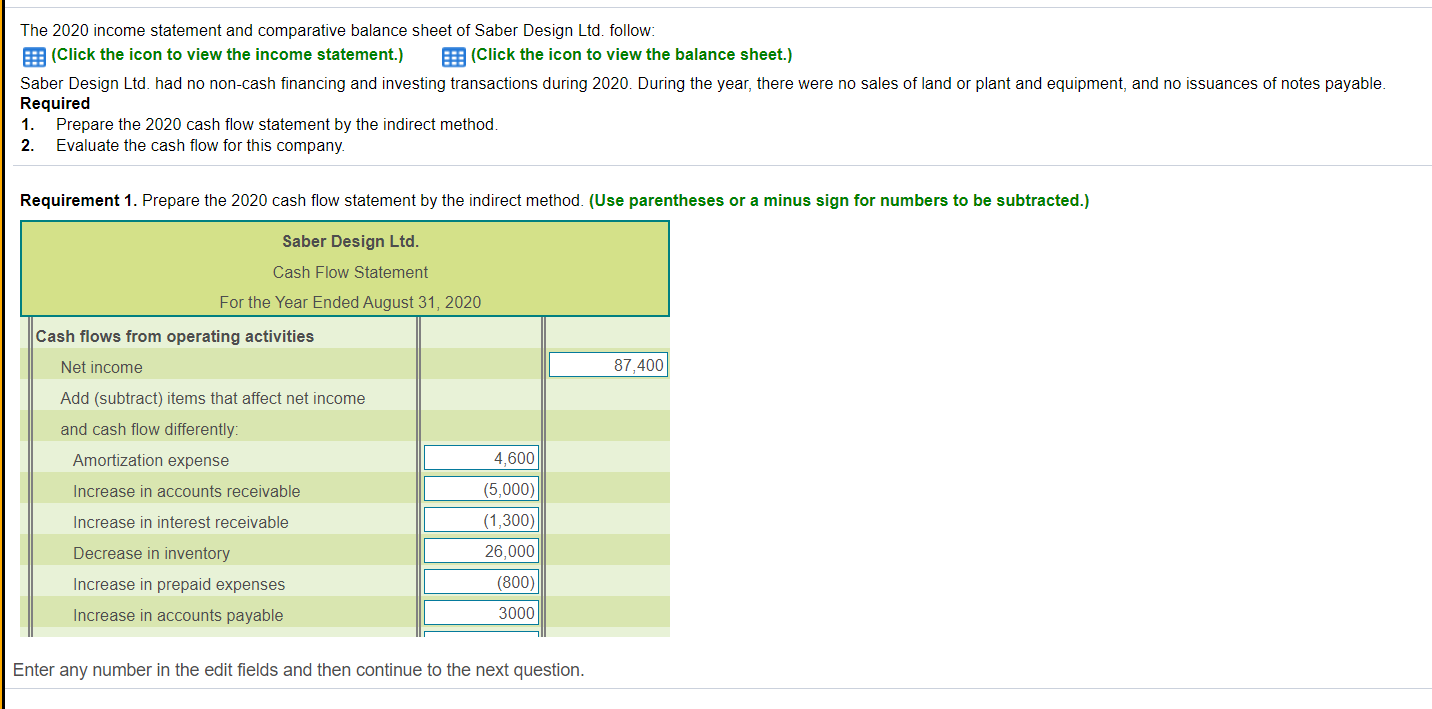

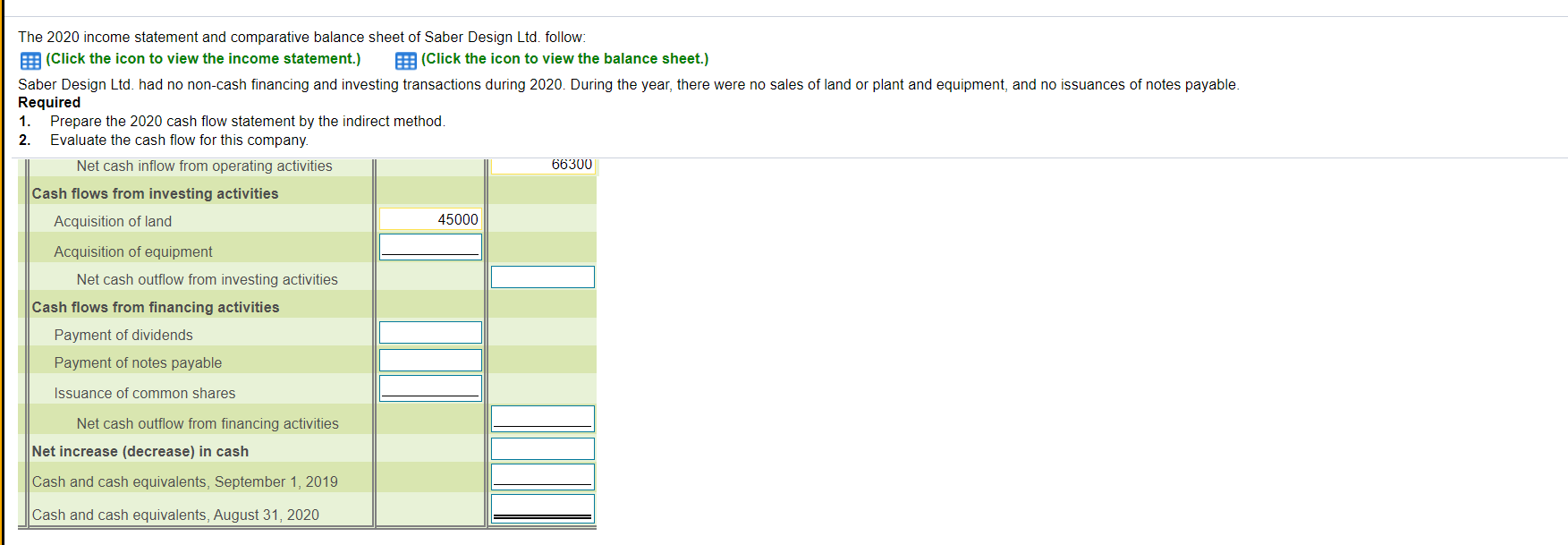

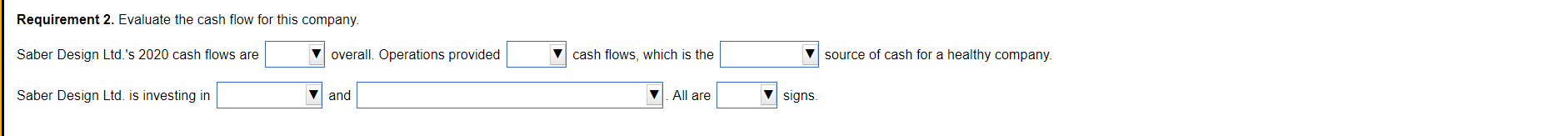

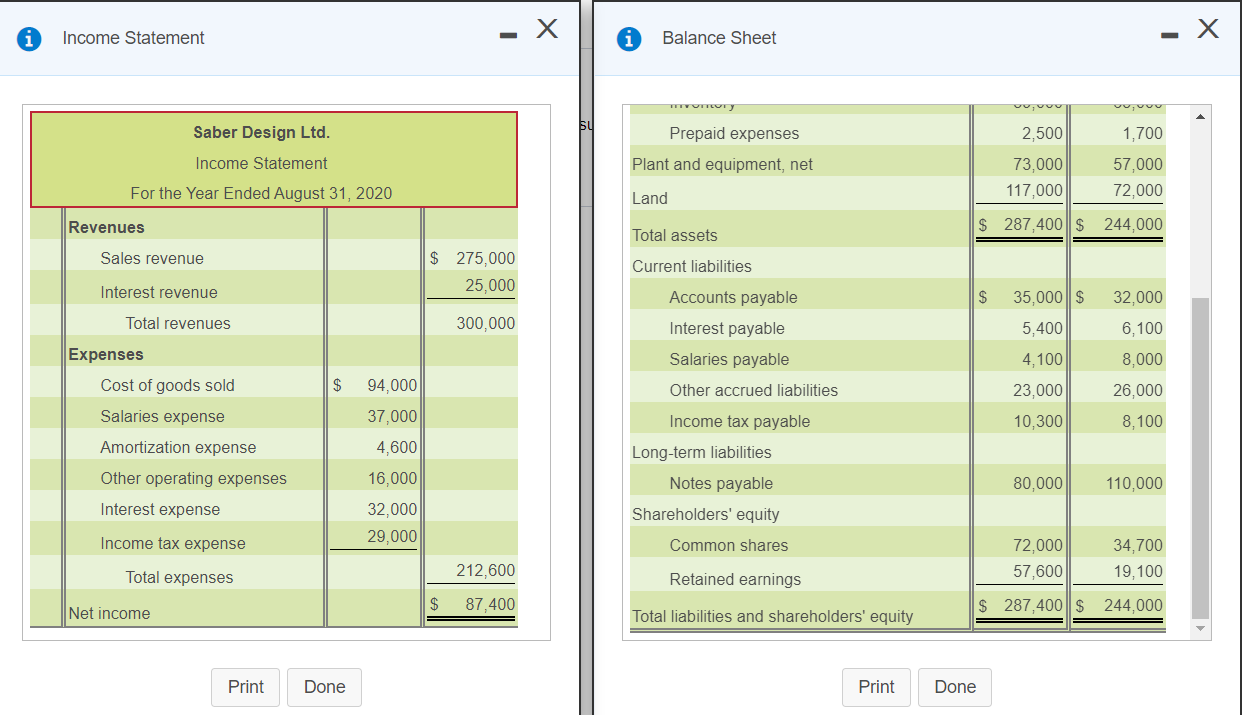

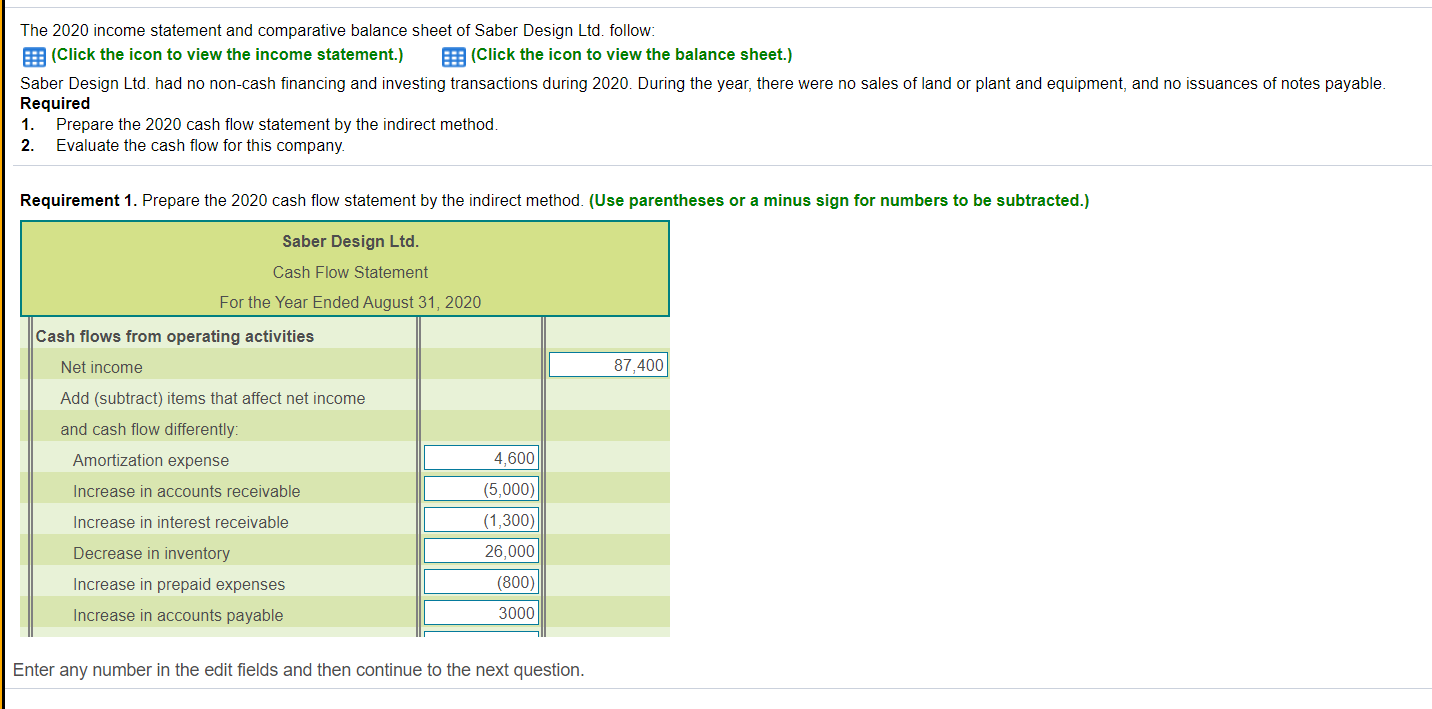

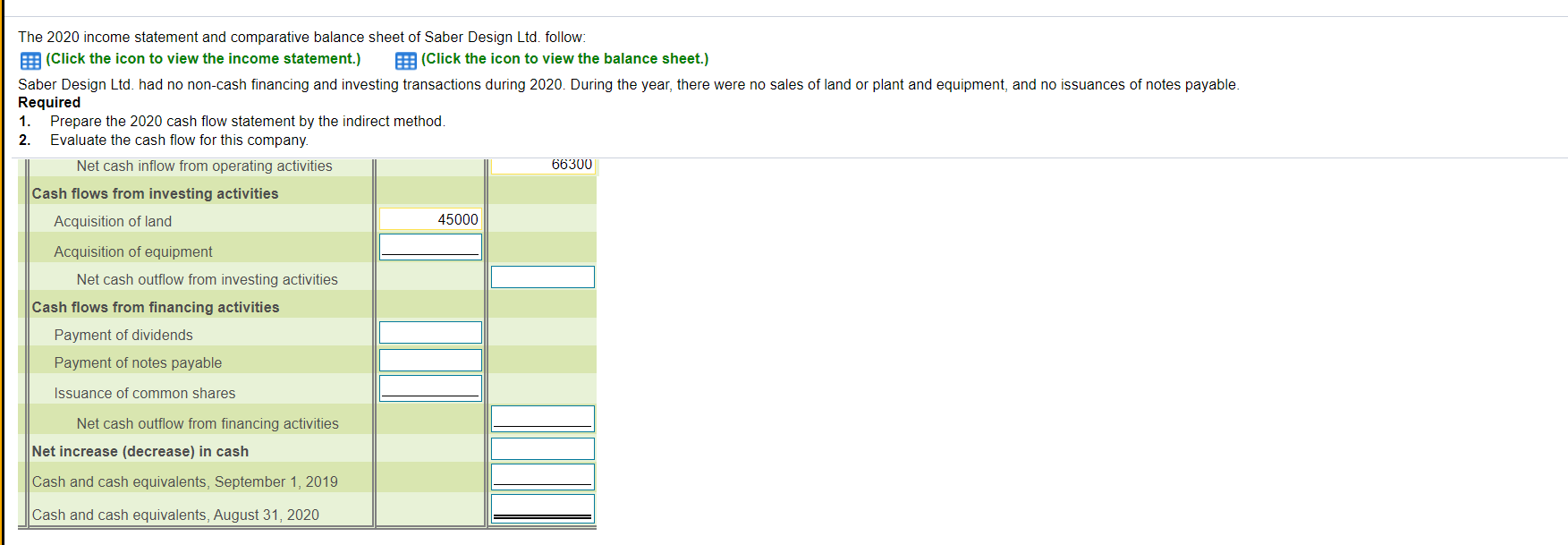

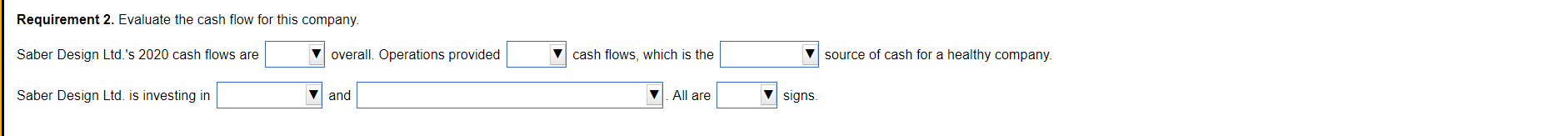

- X Income Statement Balance Sheet - X 2,500 1,700 Saber Design Ltd. Income Statement For the Year Ended August 31, 2020 Prepaid expenses Plant and equipment, net 73,000 117,000 57,000 72,000 Land Revenues $ 287,400 $ 244,000 Total assets Sales revenue $ 275,000 25.000 Current liabilities Interest revenue Accounts payable $ 35,000 $ 5,400 Total revenues 300,000 Interest payable Salaries payable 32,000 6,100 8,000 4,100 Other accrued liabilities 23,000 26,000 94,000 37,000 4,600 10,300 Expenses Cost of goods sold Salaries expense Amortization expense Other operating expenses Interest expense 8,100 Income tax payable Long-term liabilities Notes payable Shareholders' equity 80,000 110,000 16,000 32,000 29,000 Income tax expense Common shares 72,000 57,600 34,700 19, 100 Total expenses 212,600 Retained earnings $ Net income 87,400 $ 287,400 S 244,000 Total liabilities and shareholders' equity Print Done Print Done The 2020 income statement and comparative balance sheet of Saber Design Ltd. follow: (Click the icon to view the income statement.) E: (Click the icon to view the balance sheet.) Saber Design Ltd. had no non-cash financing and investing transactions during 2020. During the year, there were no sales of land or plant and equipment, and no issuances of notes payable. Required 1. Prepare the 2020 cash flow statement by the indirect method. 2. Evaluate the cash flow for this company Requirement 1. Prepare the 2020 cash flow statement by the indirect method. (Use parentheses or a minus sign for numbers to be subtracted.) Saber Design Ltd. Cash Flow Statement For the Year Ended August 31, 2020 Cash flows from operating activities Net income 87,400 Add (subtract) items that affect net income and cash flow differently Amortization expense 4,600 Increase in accounts receivable (5,000) Increase in interest receivable (1,300) Decrease in inventory Increase in prepaid expenses 26,000 (800) Increase in accounts payable 3000 Enter any number in the edit fields and then continue to the next question. The 2020 income statement and comparative balance sheet of Saber Design Ltd. follow: E: (Click the icon to view the income statement.) E: (Click the icon to view the balance sheet.) Saber Design Ltd. had no non-cash financing and investing transactions during 2020. During the year, there were no sales of land or plant and equipment, and no issuances of notes payable. Required 1. Prepare the 2020 cash flow statement by the indirect method 2. Evaluate the cash flow for this company. Net cash inflow from operating activities 66300 Cash flows from investing activities Acquisition of land 45000 Acquisition of equipment Net cash outflow from investing activities Cash flows from financing activities Payment of dividends Payment of notes payable Issuance of common shares Net cash outflow from financing activities Net increase (decrease) in cash Cash and cash equivalents, September 1, 2019 Cash and cash equivalents, August 31, 2020 Requirement 2. Evaluate the cash flow for this company. Saber Design Ltd.'s 2020 cash flows are v overall. Operations provided cash flows, which is the source of cash for a healthy company. Saber Design Ltd. is investing in and All are signs. - X Income Statement Balance Sheet - X 2,500 1,700 Saber Design Ltd. Income Statement For the Year Ended August 31, 2020 Prepaid expenses Plant and equipment, net 73,000 117,000 57,000 72,000 Land Revenues $ 287,400 $ 244,000 Total assets Sales revenue $ 275,000 25.000 Current liabilities Interest revenue Accounts payable $ 35,000 $ 5,400 Total revenues 300,000 Interest payable Salaries payable 32,000 6,100 8,000 4,100 Other accrued liabilities 23,000 26,000 94,000 37,000 4,600 10,300 Expenses Cost of goods sold Salaries expense Amortization expense Other operating expenses Interest expense 8,100 Income tax payable Long-term liabilities Notes payable Shareholders' equity 80,000 110,000 16,000 32,000 29,000 Income tax expense Common shares 72,000 57,600 34,700 19, 100 Total expenses 212,600 Retained earnings $ Net income 87,400 $ 287,400 S 244,000 Total liabilities and shareholders' equity Print Done Print Done The 2020 income statement and comparative balance sheet of Saber Design Ltd. follow: (Click the icon to view the income statement.) E: (Click the icon to view the balance sheet.) Saber Design Ltd. had no non-cash financing and investing transactions during 2020. During the year, there were no sales of land or plant and equipment, and no issuances of notes payable. Required 1. Prepare the 2020 cash flow statement by the indirect method. 2. Evaluate the cash flow for this company Requirement 1. Prepare the 2020 cash flow statement by the indirect method. (Use parentheses or a minus sign for numbers to be subtracted.) Saber Design Ltd. Cash Flow Statement For the Year Ended August 31, 2020 Cash flows from operating activities Net income 87,400 Add (subtract) items that affect net income and cash flow differently Amortization expense 4,600 Increase in accounts receivable (5,000) Increase in interest receivable (1,300) Decrease in inventory Increase in prepaid expenses 26,000 (800) Increase in accounts payable 3000 Enter any number in the edit fields and then continue to the next question. The 2020 income statement and comparative balance sheet of Saber Design Ltd. follow: E: (Click the icon to view the income statement.) E: (Click the icon to view the balance sheet.) Saber Design Ltd. had no non-cash financing and investing transactions during 2020. During the year, there were no sales of land or plant and equipment, and no issuances of notes payable. Required 1. Prepare the 2020 cash flow statement by the indirect method 2. Evaluate the cash flow for this company. Net cash inflow from operating activities 66300 Cash flows from investing activities Acquisition of land 45000 Acquisition of equipment Net cash outflow from investing activities Cash flows from financing activities Payment of dividends Payment of notes payable Issuance of common shares Net cash outflow from financing activities Net increase (decrease) in cash Cash and cash equivalents, September 1, 2019 Cash and cash equivalents, August 31, 2020 Requirement 2. Evaluate the cash flow for this company. Saber Design Ltd.'s 2020 cash flows are v overall. Operations provided cash flows, which is the source of cash for a healthy company. Saber Design Ltd. is investing in and All are signs