Answered step by step

Verified Expert Solution

Question

1 Approved Answer

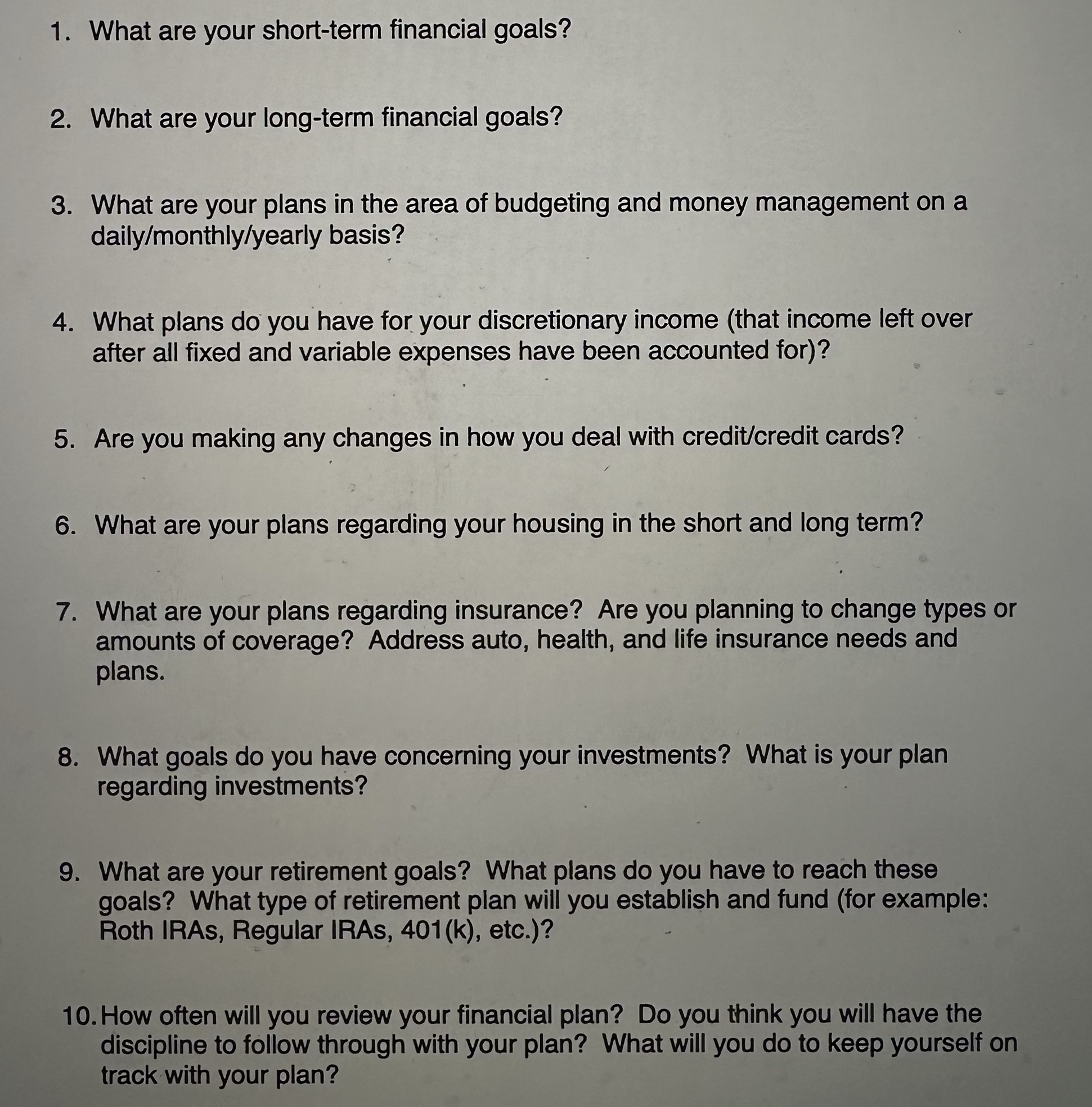

TranscribedText: 1. What are your short-term financial goals? 2. What are your long-term financial goals? 3. What are your plans in the area of budgeting

1. What are your short-term financial goals? 2. What are your long-term financial goals? 3. What are your plans in the area of budgeting and money management on a daily/monthly/yearly basis? 4. What plans do you have for your discretionary income (that income left over after all fixed and variable expenses have been accounted for)? 5. Are you making any changes in how you deal with credit/credit cards? 6. What are your plans regarding your housing in the short and long term? 7. What are your plans regarding insurance? Are you planning to change types or amounts of coverage? Address auto, health, and life insurance needs and plans. 8. What goals do you have concerning your investments? What is your plan regarding investments? 9. What are your retirement goals? What plans do you have to reach these goals? What type of retirement plan will you establish and fund (for example: Roth IRAs, Regular IRAs, 401(k), etc.)? 10. How often will you review your financial plan? Do you think you will have the discipline to follow through with your plan? What will you do to keep yourself on track with your plan?

Step by Step Solution

★★★★★

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 My shortterm financial goals include building an emergency fund equivalent to at least three to six months worth of living expenses paying of...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started